Is Twitter really worth $3.7bn?

The microblogging site may have soared since it started four years ago, but it still doesn't make any money

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.On paper – and despite its ubiquity – Twitter is a tiny bird in a corporate world of soaring giants. The microblogging site, which started four years ago, has a staff of just 350 at its hip San Francisco HQ (its only office). Crucially, for a brand that has sprung from nowhere to dominate new media as well as the public consciousness, it doesn't make any money.

And yet this week we learned that Twitter now boasts 175 million accounts, helping it to attract a new round of funding worth $200m ($128m). The vast injection from a group of venture capitalists hoping they're on to a good thing has boosted the value of Twitter to $3.7bn (£2.4bn) To an eye not focused on the peculiar world of the technology start-up, these figures don't add up but the race to throw money into an apparent cash blackhole proves investors remain desperate to snap up Silicon Valley's hottest properties. And for them it's the potential to strike gold that brings up the dollar signs.

"People invest not on the value of the cash machine now," said Joshua March, chief executive of social media management firm Conversocial. "They are betting it will become the gorilla for the next cycle. But it is hugely risky."

Indeed there are as many disasters as there have been successes for tech investors. While YouTube has become the default website for video viewing after Google's acquisition, Yahoo's purchase and subsequent closure of GeoCities proved disastrous. In social networking, Aol was forced to sell Bebo, the site it bought for $850m in 2008, for a substantial loss this year. And, earlier this month it also emerged that Rupert Murdoch was considering selling the loss-making MySpace.

But increasingly Twitter, which has been embraced by celebrities from rappers to A-list actors, sportsmen and politicians – and journalists who were allowed to tweet the proceedings of the bail hearing of Wikileaks' Julian Assange this week – is being seen as a safer bet. Twitter boss Dick Costolo also revealed this week that his site had gained 100 million accounts in the past year alone. Crucial to the company's expansion (it has doubled its staff in the past year) has been a shift in mindset to making money.

Or at least that is the hope. One social networking professional said: "There is money to be made out of Twitter's audience. The company just doesn't seem to have found a way to do it yet."

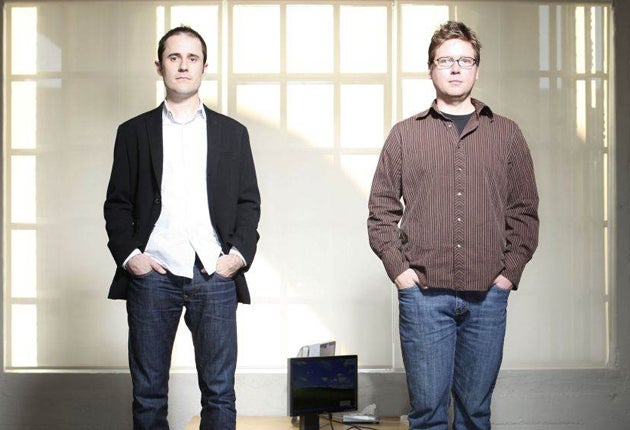

The problem for Twitter – one that also initially dogged Facebook – was how to keep the people joining up and part them from their cash without driving them away with intrusive advertising. "Growing big is not a success in itself," said Ev Williams, one of the site's three founders, who stepped down as chief executive in October. "Success to us means meeting our potential as a profitable company that can retain its culture and user focus while having a positive impact on the world. This is no small task."

Twitter shied away from banner adverts running across the top of the screen or promotions running down the side. Instead, in April it introduced the less obtrusive "promoted tweets" before adding "promoted trends" and "promoted accounts" of companies people might want to follow. Next year it will be able to offer country-specific advertising, tailoring products more specifically to users.

Professionals in the social media industry drew a clear line between Facebook and Twitter, suggesting the latter may be a harder sell. "Facebook has a lot of personal data on its users, on their friends and what they like to do," one said. "It's hard to see something like Twitter being able to sell on the same scale because of its business model."

After Mr Costolo's appointment two months ago, the group said it was to increase the amount of advertising on the home site and through third party applications that allow easy access for users checking updates on smartphone and tablet devices. Some in the industry expect the advertising model to develop "in a different direction" from traditional online advertising. One suggested it could look to sell advertising around the content of people's tweets.

Dan Cryan, senior analyst at Screen Digest, said: "Social networking has never been that easy to monetise properly. The current valuations are a reflection of a number of different things".

Yet, on Wednesday night Mr Costolo said: "2010 was one of the most meaningful years since Twitter was founded," adding "We're proud of what Twitter users have accomplished, we're proud of our work and we're very proud of our team". The investors may have to wait before they agree.

Mixed fortunes

Born in Mark Zuckerberg's Harvard dorm room in 2004 and still heavily sought after by investors. Recent secondary trading in its shares valued the company as high as $50bn. Forbes magazine estimates Zuckerberg's wealth at $6.9bn.

News Corporation bought the site for $580m in 2005 and it was valued as high as $12bn. After taking a beating from Facebook, Murdoch's group is looking at offloading it at a heavy loss.

Aol snapped up the social network in 2008, three years after it was set up by a husband and wife team in the UK. The $850m deal has since turned sour and it sold to Criterion Capital Partners in June in a deal believed to be less than $10m

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments