Bitcoin price crash causes bankruptcy and mass cryptocurrency mine closures

Tens of thousands of mining rigs have been shut down in China

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Bitcoin mining operations in the US and China are facing closures after the plummeting price of bitcoin means they may no longer be profitable.

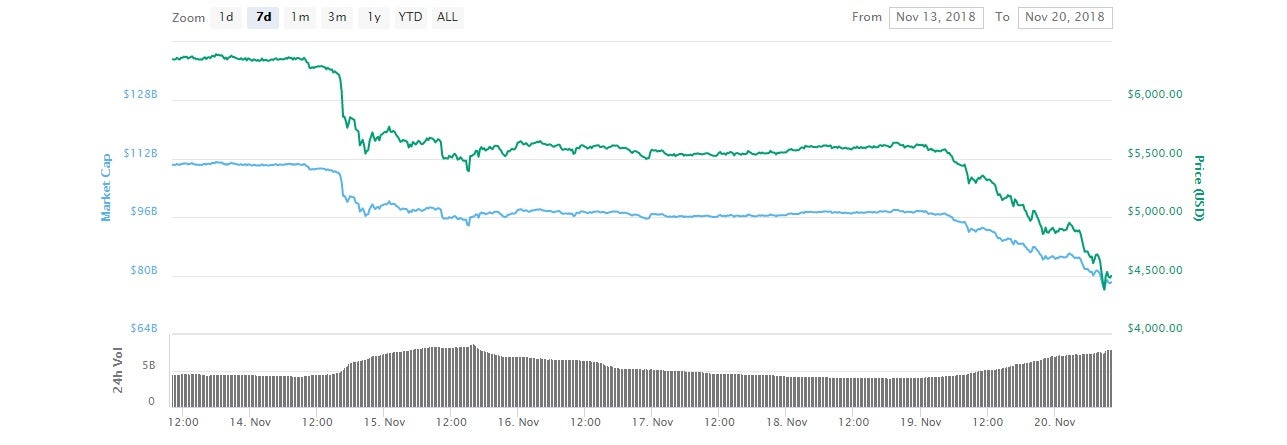

The world's most valuable cryptocurrency is currently trading at around $4,500, having lost almost a third of its value in the space of a week.

Bitcoin mining – the process of generating new units of the cryptocurrency by solving complex puzzles – requires vast amounts of electricity to power the computers performing the calculations.

This means that the profitability of mining falls when bitcoin's price drops, and if the price falls too far then operations may no longer be economically viable.

The biggest casualty so far may be the US-based mining firm Giga Watt, which was forced to file for Chapter 11 bankruptcy this week after it was unable to pay debts of around $7 million.

"The corporation is insolvent and unable to pay its debts when due," the filing stated, according to CoinDesk.

"The corporation and its creditors would best be served by reorganisation of the corporation under Chapter 11 of the Bankruptcy Code."

The majority of bitcoin mining operations are based in China, where electricity costs are some of the lowest in the world.

Yet despite the cheap electricity, images and videos of mining operations shutting down in the country have been spreading across social media.

Hon Kong-based mining platform Suanlitou announced this week that it was unable to cover electricity fees for a 10-day period in November, according to the South China Morning Post.

Another group of Chinese cryptocurrency miners also reportedly shut down 20,000 mining rigs due to the fall in profitability.

It is not clear what the future holds for the price of bitcoin, with some analysts predicting more falls, while others expect the market to turnaround before the end of the year.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments