How Trump vs Harris became the first ever bitcoin election

Cryptocurrency has become a significant issue in a major US election for the first time, with both candidates courting crypto holders, writes Anthony Cuthbertson

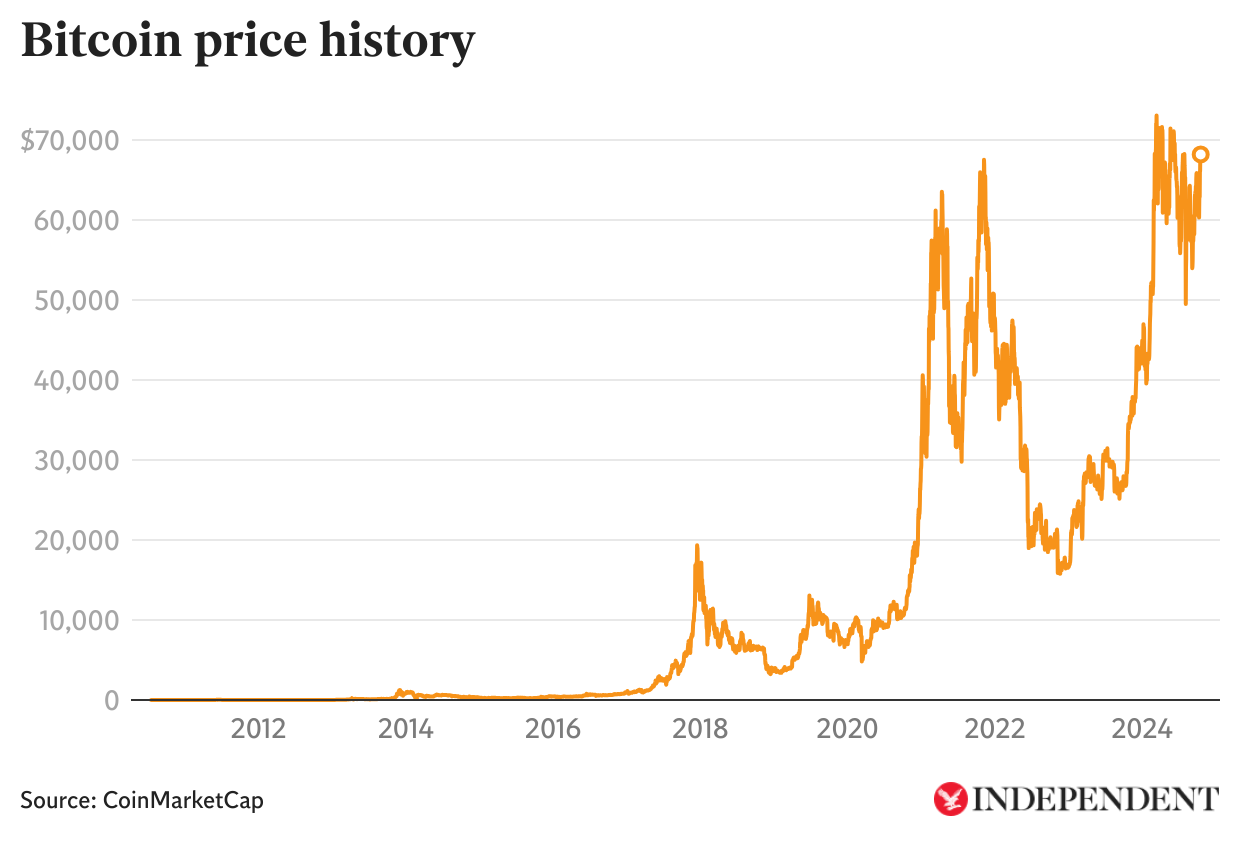

When Donald Trump was shot at a rally in Pennsylvania in July, the price of bitcoin spiked. The boost that it gave to the Republican candidate’s poll numbers was mirrored by the cryptocurrency market, as investors pegged their hopes on the self-proclaimed “crypto candidate”.

Two weeks after the assassination attempt, Trump was on stage in Nashville delivering a keynote address at the Bitcoin 2024 conference. In front of cheering crowds, he pledged to create a bitcoin strategic reserve and form a crypto advisory council. It was the first time a candidate from one of the leading parties had included cryptocurrency in their manifesto.

It marked a stark shift in sentiment from the former president, who had previously derided bitcoin as a scam and claimed that the value of cryptocurrencies was “based on thin air”. Now he promises that, if elected, he will make America the “bitcoin superpower of the world” – he has even launched his own crypto token, promising to take on the dominance of big banks (though so far it’s failed to take off).

Trump’s sudden switch fits with both his nationalistic rhetoric and his anti-bank stance – bitcoin, by its very design, is anti-bank, running on a decentralised network that can operate independently of banks and governments. But his latest pitch is also opportunistic. With roughly 50 million people in the US now owning cryptocurrency, the topic has become a significant issue in a major US election for the first time.

Earlier this year, a widely shared survey revealed that around a fifth of voters in crucial swing states consider cryptocurrency to be a deciding factor in how they vote. Both campaigns have opened up their coffers to crypto donors, and although Kamala Harris is yet to make any major proclamations, she has pledged to support a regulatory framework for cryptocurrencies.

“This year’s US presidential election promises to be a pivotal moment for the cryptocurrency industry, with crypto backers contributing nearly half of all corporate donations,” David Ben Kay, a member of the governing board of the Ethereum Foundation, told The Independent.

“While Democrats have traditionally been less favourable toward the crypto industry due to SEC crackdowns, Harris’s campaign is making efforts to build stronger ties with the sector, hosting fundraisers and meetings with crypto advocates. Donald Trump has embraced the crypto industry, positioning himself as the pro-crypto candidate… reflecting a broader Republican strategy to court crypto supporters and donors.”

The ploys by both candidates to attract crypto holders have led some analysts to predict that either outcome on 5 November will be positive for the space. This has helped push bitcoin to a three-month high, having risen by nearly a third since last month.

The world’s most valuable cryptocurrency is now just a few thousand dollars away from the all-time-high it experienced in March this year, with some market analysts predicting new record highs before the end of the year, no matter which way the election goes.

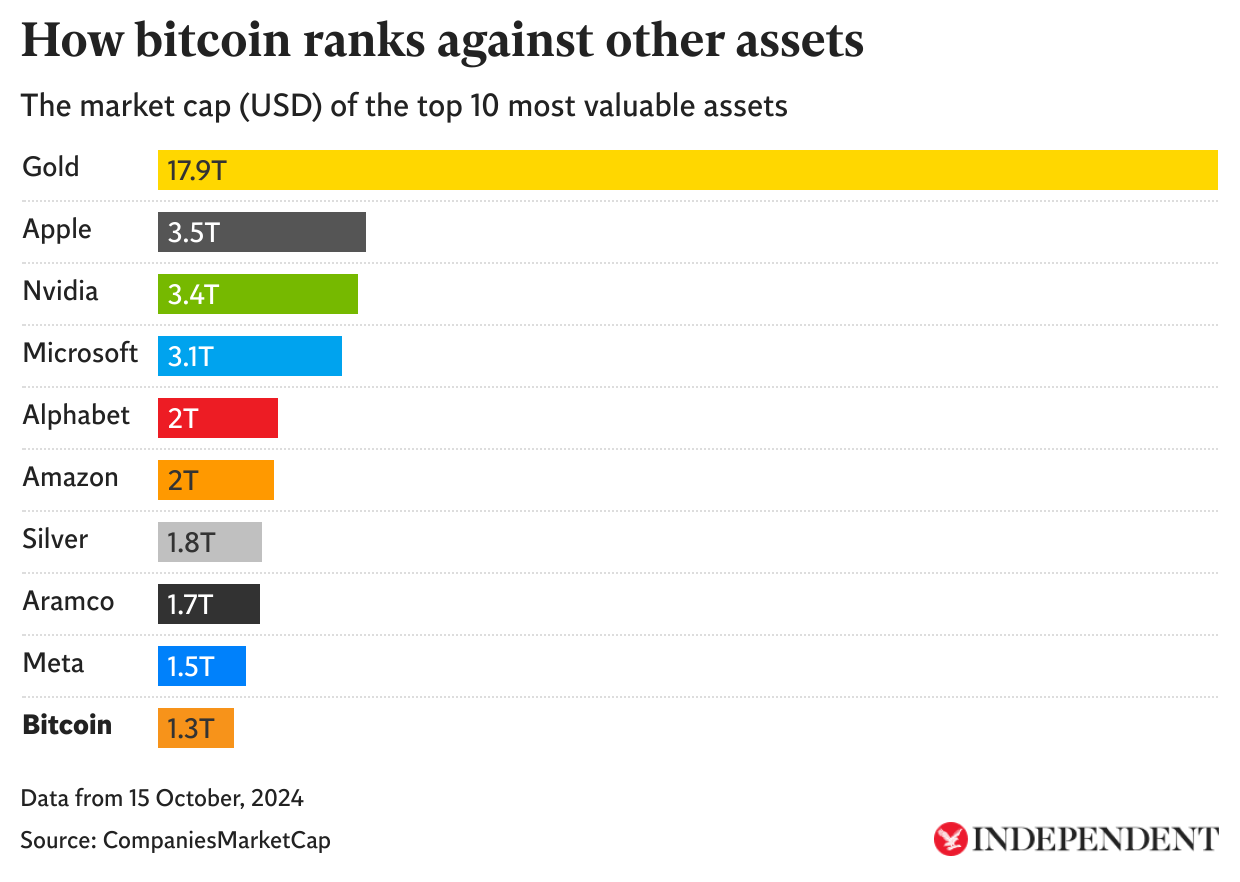

The rally has pushed bitcoin’s market cap above $1.3 trillion, ranking it in the top 10 most valuable assets in the world, just behind Facebook-owner Meta.

While the US elections are far from the only factor influencing the crypto market, the increased attention has helped to further legitimise the space, with bitcoin no longer considered a fringe asset class among some major figures within the traditional finance sector.

The chief executive of investment giant BlackRock, Larry Fink, recently compared the crypto market to the housing market, claiming that it could follow a similar trajectory.

“I’m not sure if either president would make a difference [to its trajectory],” he said during a third quarter earnings call last week. “I truly don’t believe it’s a function of regulation. It’s a function of liquidity [and] transparency... And I truly believe we will see a broadening of the market of these digital assets.”

So while courting the crypto vote may have an impact on the outcome of the election, the result of the election is unlikely to have any major impact on the crypto industry. It may, however, prove significant in the role that the US plays in shaping it.

Anthony Yeung, the global head of strategic development at the crypto platform Coincover, believes it will take time to actually understand either candidate’s stance towards cryptocurrency. But any delays in taking action could see other markets take the lead.

“The longer the US takes to craft a regulatory framework, the more likely it is that existing regulation like the European Union’s MiCA [Markets in Crypto-Assets Regulation] legislation will become the industry standard told The Independent. “This could affect the US’s ability to shape the crypto regulatory landscape over the coming years, so it’s in the country’s interest to move the dial sooner rather than later.”

Despite the promises of both candidates, there remains a degree of skepticism within the industry. While Trump’s bold proclamations and Harris’s quieter pledges have garnered attention, no policies are yet assured.

“Even if both presidential candidates promise the moon, let’s not forget that it’s politics,” says Tim Kravchunovsky, founder and CEO of the decentralised telecommunications network Chirp. “There’s no guarantee either of them will truly deliver on their promises.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments