Saudi investment will not be quick fix for Liverpool

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

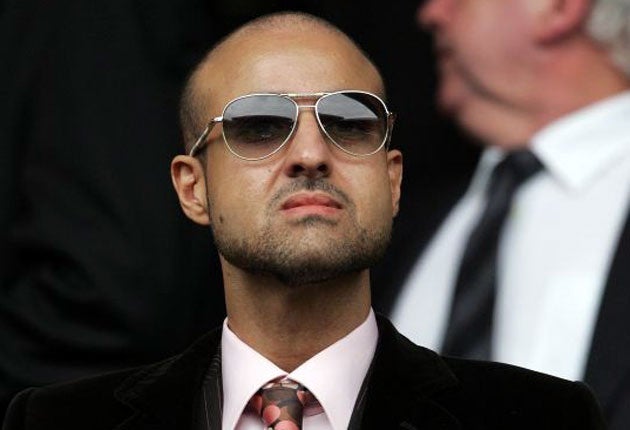

Your support makes all the difference.An associate of Saudi Arabia's Prince Faisal bin Fahd bin Abdullah al-Saud claimed yesterday that the prince could bid for a major stake in Liverpool, but has concerns about the club's debt and the relationship between its owners.

The Liverpool co-owner George Gillett is due in Saudi Arabia next week to hold talks with the Saudi Royal. "His Highness's shareholding could go from anything from nought to 100 per cent," said Barry Didato, director of strategic investments for the prince's company F6. "But he cannot be seen as a solution to the debt or problems in the existing relationship between the owners. His Highness would not want to get involved in the [problems between the pair.] He is not a marriage counsellor."

Didato added: "The debt has to be at a manageable level before Prince Faisal would invest and the current level is high. He cannot be looked to as someone who is going to clean up the balance sheet – Gillett has to deal with this."

Gillett and co-owner Tom Hicks last week issued a joint statement, stressing that any talks to bring in new investment were "at an early stage" but discussing publicly for the first time the search for new equity partners.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments