Rivals on brink of £100m Hammers deal

Former Birmingham City owners Gold and Sullivan face fight but sale will be 'wrapped up in seven to 10 days'

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.West Ham's Icelandic owners look likely to sell the club before the end of January, with at least two rival bidders "at an advanced stage of the due diligence process", according to a source familiar with the situation. The source added that "negotiations are ongoing with more than one group" but said "things could be wrapped up within seven to 10 days".

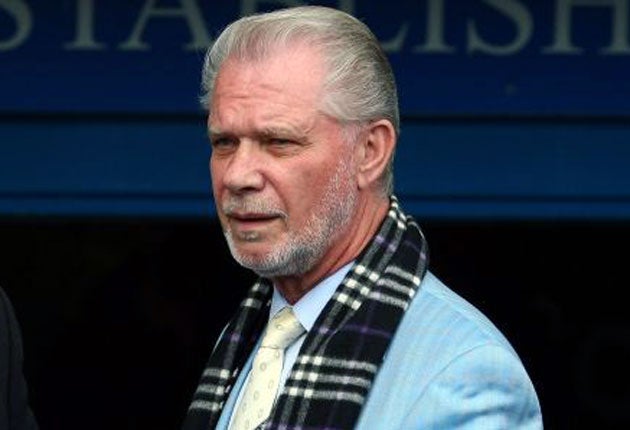

One bidding group comprises the former Birmingham City owners, David Sullivan and David Gold. A second bid is from a London finance company, Intermarket. It has also been suggested in banking circles that a third bid could yet emerge from Tony Fernandes, the Malaysian businessman behind Air Asia, former sponsors of Manchester United. Fernandes himself said last month that no bid is planned.

West Ham's chairman, Andrew Bernhardt, has consistently claimed that the company which owns the Hammers, CB Holding, does not need to sell, and there is a sustainable business plan if it doesn't sell.

Other sources say the dire financial situation could force the sales of players this month to balance the books unless the club is sold or fresh capital is otherwise injected.

It would make sense for CB Holding to get out now for business reasons if they think there is any possibility of the club being relegated. It is obvious the firm has no capital to invest, or no will to invest any, and if West Ham go down, an asset worth millions in the Premier League would become a liability in danger of administration, little better than a write-off.

Sullivan and Gold want 50 per cent of West Ham – and a guarantee of effective control – in exchange for around £50m investment, much of which they stipulate should be spent on buying some players and the most urgent football debts. They have increased an earlier offer.

CB Holding is owned by a bank, Straumur, which is owed a chunk of the club's £40m bank debts. On top of that, West Ham have £30m of other liabilities including £19m which is still owed to Sheffield United over the Carlos Tevez affair.

It is understood that Intermarket have tabled an offer of around £100m for the whole club, but the structure of their deal is not known. "There will be a deal with someone within a month," a source said.

Gold and Sullivan sold Birmingham last year for £82m, having bought it 16 years ago for £1 and transformed its fortunes; they laid the foundation for Blues' current progress. If the pair fail with their West Ham bid, they will target Charlton then Crystal Palace, in that order.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments