Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

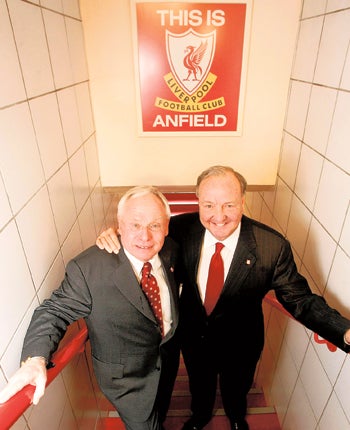

Your support makes all the difference.Liverpool co-owner Tom Hicks remains in control of his share of the club and has not sold out to Mill Financial, the Press Association Sport has been told.

Reports this morning suggested the hedge fund, a branch of Washington-based Springfield Financial, had acquired the Texan's 50% share having already taken ownership of his fellow co-owner George Gillett's half.

However, a UK-based spokesman for Tom Hicks told Press Association Sport Mill Financial had not acquired Hicks' shares.

That stance appears to be backed up by Royal Bank of Scotland, the club's major creditors whose deadline for the repayment of a £237million loan expires tomorrow, and the Premier League.

The bank has not had any recent contact with Mill Financial while no approach has been made to the Premier League to notify them of another potential change of ownership.

Doubts still remain over the ownership and it is not beyond the realms of possibility that Mill Financial could still make a move to acquire Hicks' share.

That would then put them in a position where, if they were able to repay RBS, any prospective sale to New England Sports Ventures - who have agreed a £300million deal - could be in jeopardy.

But there are numerous variables to the saga, the first of which will be decided at the Royal Courts of Justice this afternoon.

RBS and Liverpool are returning to the High Court to block a temporary restraining order taken out by Hicks and Gillett in Texas last night.

The injunction, which also included a claim for damages of more than £1billion, was imposed just minutes before a board meeting at which chairman Martin Broughton, managing director Christian Purslow and commercial director Ian Ayre out-voted Hicks and Gillett to complete the sale to NESV.

That was just hours after Mr Justice Floyd, who will hear the RBS/Liverpool application this afternoon, had ruled the American owners had no right to block a sale.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments