Private equity group scuppers Hicks' plan

Prospect of fire sale grows as co-owner's latest attempt to shore up control of Liverpool falls through

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Tom Hicks' eleventh-hour attempt to retain control of Liverpool in the teeth of bitter opposition from fans took another blow yesterday when it emerged that Blackstone Group, the private equity firm, has decided against providing loans to help him avert a sale.

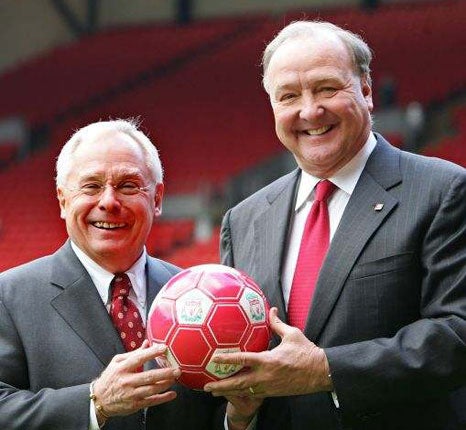

GSO Capital Partners, Blackstone's debt restructuring arm, is understood to have considered an involvement with Hicks but has now walked away. Blackstone, in which the Chinese Investment Corporation has a 20 per cent stake, appeared to represent Hicks' best hope of paying down a large chunk of the £237m debt with which he and co-owner George Gillett have saddled the club.

That could secure time to find a buyer willing to enable Hicks and Gillett to walk away from Anfield with a profit on the £218.9m they paid for the club in 2007.

The news of GSO's removal from the picture will not come as any disappointment to the club's executive chairman, Martin Broughton, who was appointed in April as one of Royal Bank of Scotland's conditions for extending its loan to the Americans for a further six months and who does not savour the idea of Hicks staying on at Liverpool under any circumstances.

It is unclear precisely when GSO indicated it was not interested, though there had been some optimism in the Hicks camp as recently as the weekend that a deal might be forthcoming, possibly through Blackstone taking a share in Liverpool in return for an investment of around £180m.

That route is now closed and Hicks and Gillett seem to be another step closer to being forced out, taking a major loss on their initial investment and living to regret their decisions both to demand unrealistic prices for the club and to refuse a degree of control to those, in the case of the US-based Rhône Group, who offered £110m for a 40 per cent share.

After GSO's decision, RBS seems to hold the cards in terms of the club's future. In 18 days, the terms of a £237m loan expire and if no alternative lending institution can be found, the bank's options are to foreclose on the loan, take control and seek a buyer itself – an option it has not favoured to date – or else to agree to yet another refinancing, which is not in the club's interests, though it could secure Broughton and his team more time to find a new buyer.

The endgame will bring a more modest price for the club, though that is no disaster for Broughton since a sale at a lower price may be more likely to bring a credible buyer, who will not line the Americans' pockets.

Rhône said when its £110m offer was initially tabled that it did not rule out returning with another bid, though it is an outright sale, removing Hicks and Gilllett from the scene, which Broughton is looking for. There are understood to be no new developments in the search for a buyer as the 6 October deadline to satisfy RBS looms.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments