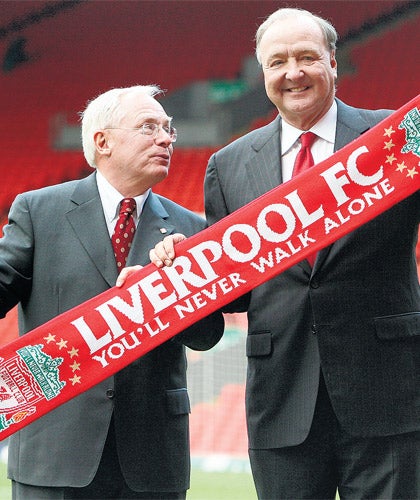

'Odd Couple' who agreed about everything. Except coach, finance, stadium...

Signs of disagreement between the Americans over how to run Liverpool were evident almost from the start

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.It became clear that Tom Hicks' and George Gillett's ownership of Liverpool was heading for serious trouble during a meeting in a Marseilles hotel room on the afternoon of Tuesday 11 December 2007.

Liverpool were playing a Champions League match in the French city that evening, a match they needed to win handsomely to guarantee progression to the knockout stages. (They would go on to get a fine 4-0 victory thanks to goals from Steven Gerrard, Fernando Torres, Dirk Kuyt and Ryan Babel.)

Those present at the meeting included Gillett as well as the former Liverpool chairman, David Moores, and the former chief executive, Rick Parry. Gillett asked Moores and Parry to sign up to a "whitewash", The Independent can reveal.

At the time, a "whitewash procedure", which is no longer allowed in law, would have allowed Hicks and Gillett to move their acquisition debt – run up when buying Liverpool – on to the football club's books, as long as serving directors gave written guarantees about debt repayments among other things.

Hicks and Gillett had borrowed money to buy Liverpool and ladened that debt on to a holding company. Now they wanted to shift it to the club itself, en masse. Moores and Parry felt Liverpool's income was already being used to fund the Americans' takeover, contrary to what they had promised. So they refused to sign up to the whitewash to put the debt directly on to Liverpool.

Hicks and Gillett, who even then were seeking to refinance the loans they took to buy the club, instead had to dip into their own wealth to smooth the refinancing. They also had to provide further personal guarantees on the loans. It was not so much a slippery slope as indicative of problems elsewhere.

Unbeknown to most, the credit crunch was threatening to bite both owners hard. They were already exploring the sale or part sale of the club, and they had wildly different views about how Liverpool should be managed and developed.

Those differences were at the heart of most of the problems that beset Liverpool from late 2007 until now. They fell out, bitterly, about the manager(s), the new stadium, the funding of the club, whether to sell a chunk of the club or not, and for what price.

These problems only really began to manifest themselves from late 2007 onwards, after that fateful meeting in Marseilles, and anyone who claims anything emphatically to the contrary is likely to be looking through revisionist specs.

That is not to say there were no concerns at all about Hicks and Gillett before they sealed their buyout on 6 February 2007, as part of a takeover billed as a £435m deal using £185m of RBS funding. This newspaper, for example, had a back-page story on 2 February 2007 about a $1bn bankruptcy on Gillett's CV, and on 3 February profiled Tom "Leverage Wizard" Hicks, the Texan Republican who had helped to make George "Dubya" Bush a multi-millionaire.

But in those early months, certainly into the summer of 2007 when Liverpool bought Torres, Babel and Yossi Benayoun, nobody really had grave doubts about the owners' ability to deliver. The vast majority of fans, including the most radical, were still on board. (Search "Tom Hicks mobbed by Liverpool fans 2007" on YouTube for evidence.)

But while Gillett always maintained to friends and colleagues – and still does – that he never intended to load the club with debt, Hicks' track record suggests it was always possible. And the credit crunch, which began to unfold in earnest in the US in the summer of 2007, had a "double whammy" effect on the owners.

Their American business assets' values declined, giving them a problem freeing up cash to put into Liverpool, then borrowing became nigh-on impossible, destroying the chances of good-value loans for the proposed new stadium.

In any case, Hicks and Gillett were at loggerheads over the Stanley Park project, Gillett inclined to push forward with the design on the table (if money could be found) and Hicks insistent on bringing in his own planners, architects, ideas – and ultimately costs. The stadium plans, palsied and without funding, festered, so the opportunity of a brand new ground with naming rights and other income drifted.

Hicks and Gillett fell out about managers too; Hicks began the courting of Jürgen Klinsmann in late 2007, something he revealed in January 2008 to the horror of many pro-Rafael Benitez fans. In what now looks like a PR-driven decision, Hicks then fell four-square behind everything Benitez did for two years, while Gillett, although supportive of the Spaniard, believed Benitez should not have an entirely free rein, and worked best under the supervision of a "moderating" executive, namely Parry.

Hicks was the driving force behind Benitez's extended five-year contract last year, and when Parry left at the end of the 2008-09 season (when Liverpool finished second in the Premier League), Gillett became increasingly bitter about what he perceived as Benitez's failings.

If the owners were at war over this, then they had always had major differences. Gillett realised as early as late 2007 that buying Liverpool had probably been an error. Hicks agreed only partially and thought the pair would still find a third investor to give them a lot of money for a bit of the club. Hicks ludicrously valued Liverpool at around £1bn and wanted the club's former suitors, Dubai International Capital, to pay around £150m for a 15 per cent stake.

DIC's representative Amanda Staveley met Hicks in Yorkshire as early as October 2007 to discuss that deal; DIC rejected it but returned with an offer of about £500m in early 2008 for the whole club. If Hicks and Gillett had accepted then, they would have walked away with an overall profit.

Instead, Hicks said no, and made it clear he did not approve of Gillett trying to sell his own stake separately. So 2008 passed too with no stadium and no investment, then Christian Purslow arrived as managing director in 2009 to seek solutions to both, as did – at the behest of a desperate RBS – Martin Broughton in April 2010. New ownership is the result.

Sporting tycoons: Henry joins the influx of US owners attracted by game's huge growth

America has finally woken up to the power of football, and that's the reason for the global expansion of sporting tycoons' interests. So says Professor Chris Brady, the dean of the BPP Business School in London, an expert in sports business. According to Brady, Liverpool fans should be delighted that the club's sale to New England Sports Ventures, headed by John W Henry of the Boston Red Sox, looks imminent, he says.

"I know someone close to Henry who knows what he's like personally and in business," Brady told The Independent. "The verdict was emphatic. If he buys Liverpool and it's not a huge success, then nobody in sports business is capable of making it a success."

Brady said the trend of American owners (the Glazers, Randy Lerner, Stan Kroenke) moving to the Premier League is hard evidence that football rules. "Look at wider business, see what's important in the economy, where the inward investment is within the City of London. Financial services is top, and after that its leisure, including sport.

"What these incomers have realised is that the biggest business opportunities in the next 100 years are going to revolve around what we do with our spare time. And these guys, who've been sitting on their investments in the NFL, albeit profitably, have actually realised that in global terms nobody actually gives a rat's arse about the NFL. They've realised football is the most popular sport in the world and the Premier League is its showcase product."

Of the six leading sports tycoons with global portfolios below, it is notable that all of them have at least one football club among their interests – or will have. Brady sees the Dietrich Mateschitz/Red Bull ownership model as a pure marketing tool, albeit an extremely successful one. Similarly, Vijay Mallya's spending on Formula One is a signal that India is a coming power in western markets. "He's a rich man and this is the trend of diversification at an international level in action," Brady said. "The next thing to watch for is genuine Chinese interest. There's been no one serious yet. There will be soon."

Six of the world's most influential sports tycoons:

Stan Kroenke American, 63 years old

Background Made his money in property and shopping centres.

Estimated fortune £1.85bn.

Sports interests Major shareholder in Arsenal (Premier League), owns Denver Nuggets (NBA), Colorado Avalanche (NHL), St Louis Rams (NFL) and Colorado Rapids (MLS).

Success/popularity Teams are decent but respected rather than popular.

Dietrich Mateschitz Austrian, 66 years old

Background A marketing man who hit upon a product – Red Bull – that made him wealthy.

Estimated fortune £2.6bn.

Sports interests Red Bull (F1), Scuderia Toro Rosso (F1), Red Bull Racing Team (NASCAR), NY Red Bulls (MLS), FC Red Bull Salzburg (Austria), Red Bull Brasil (Serie A2), RB Leipzig (Germany), ECRB Salzburg (Austrian Hockey League).

Success/popularity Winning teams, but alienated Salzburg football fans with name change.

Philip Anschutz American, 70 years old

Background Made fortune in oil then diversified.

Estimated fortune £4bn.

Sports interests LA Galaxy (MLS) and 50 per cent of Houston Dynamo (MLS), LA Kings (NHL), Eisbaren Berlin and Hamburg Freezers (both German ice hockey), Hammarby (Swedish football, 49 per cent), stake in LA Lakers (NBA), and venues.

Success/popularity Venues more successful than teams. Reclusive.

Vijay Mallya Indian, 54 years old

Background Son of an industrialist, heir to brewing dynasty. MP too. Moved into sport in the mid-Noughties.

Estimated fortune £650m.

Sports interests Force India (F1), Royal Challengers Bangalore (IPL), East Bengal and Mohun Bagan (both football teams in India's top-flight I-League).

Success/popularity Successful at projecting India, which fans like.

John W Henry American, 61 years old

Background Illinois farming family, college drop-out turned hedge fund trader. Estimated fortune £529m.

Sports interests Via NESV, owns the Boston Red Sox (MLB), a 50 per cent stake in Roush Fenway Racing (NASCAR), and a cable TV channel.

Success/popularity Revitalised the Red Sox. Popular.

Paul Allen American, 57 years old

Background Co-founder of Microsoft.

Estimated fortune £9.5bn.

Sports interests Seattle Seahawks (NFL), Portland Trail Blazers (NBA), minority stake in Seattle Sounders (MLS).

Success/popularity Sounders are a massive hit in MLS. Popular as a philanthropist and hands-off owner.

Timeline: How the Hicks and Gillett era unravelled

March 2007 Hicks and Gillett take over at Anfield. On the clubs proposed new stadium, Gillett says: "The spade has to be in the ground within 60 days."

May 2007 Liverpool lose the Champions League final, prompting a £49m spending spree, including the signing of striker Fernando Torres.

November 2007 In the first public falling out between Rafael Benitez and the owners, they tell him not to concern himself with transfer targets.

January 2008 Hicks admits that the club held talks with former Germany manager Jürgen Klinsmann with a view to his replacing Benitez.

February 2008 Dubai International Capital try to buy Gillett's stake for £200m, leading to a breakdown in the owners' relationship with each other.

June 2009 Christian Purslow made managing director in order to find £100m investment. Owners refinance their loans with Royal Bank of Scotland.

March 2010 A £118m offer from private equity firm the Rhône Group for a 40 per cent stake in the club is rejected by Hicks and Gillett.

April 2010 Hicks and Gillett put the club up for sale. British Airways chairman Martin Broughton is appointed to oversee the process.

September 2010 With deadlines looming from RBS, Hicks makes a last unsuccessful attempt to again refinance his loans and take control of the club.

October 2010 A £300m takeover bid is accepted from New England Sports Ventures. Hicks and Gillett attempt to remove board members so as to block the sale, but the High Court rules that the owners are in breach of their contract with RBS. This opens the door for Broughton to finalise NESV's purchase.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments