Turkey's Central Bank raises key interest rate in show of defiance against Erdogan

'The country is going into a very nasty recession,' says on analyst

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

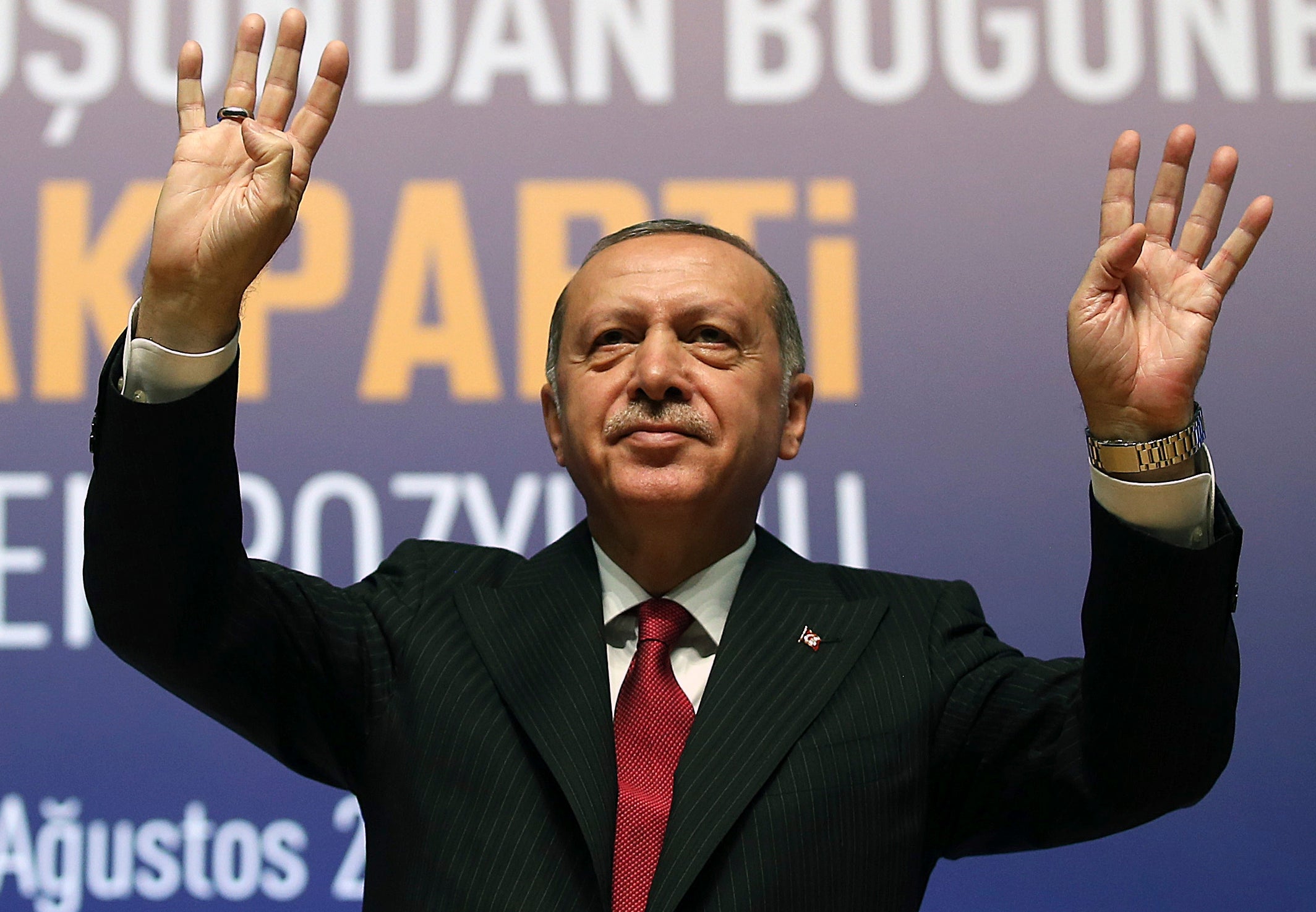

Your support makes all the difference.Turkey’s central bank has raised a key interest rate by a dramatic margin, just hours after coming under criticism by the country’s president, Recep Tayyip Erdogan. It is a show of independence by the institution that could reassure international investors.

The bank raised the rate on short-term loans to private banks to 24 per cent, from 17.75 per cent. The move effectively hampers Mr Erdogan’s vision of credit-fuelled growth for now. But it also but stabilises the currency, the lira, while calming Turkey’s creditors, and helping stave off worries about financial pressures spreading to banks in Europe.

Turkey holds $242bn in debt amid a currency crisis that has made it tougher for government institutions, banks, developers, and businesses to repay loans. Turkey’s lira has lost more than 40 per cent against the dollar this year, but rallied on the news of the hike.

“They’ve given themselves a chance of surviving, of getting through this,” Timothy Ash, an economist and emerging markets specialist at London-based Bluebay Asset Management, said. “It’s giving them a break. They needed to do this. They had no choice.”

The bank showed the independence and fiscal prudence coveted by international investors by hiking the rate even above the expected 350 or so basis points. Mr Ash speculated that Berat Albayrak, Turkey’s finance minister and Mr Erdogan’s son-in-law, managed to convince the president of the need to give the central bank leeway and heed the concerns of international financiers.

“Albarak was in London a couple weeks ago,” said Mr Ash. “It looks like he listened to investors. He probably went to his father-in-law and had some tough talking to do. He gave the central bank the cover to raise rates.”

However, economists warn that deeper problems could undermine any positive impact of the rate hike. Paul McNamara, investment director at GEM, a London asset management firm, said that Turkey suffers crisis of confidence that can’t be fixed with interest-rate adjustments. “The country is going into a very nasty recession,” he told The Independent. “I think a simple recognition of how bad things could get -- non-performing loans, people losing their jobs -- would be helpful here.”

Mr Erdogan also continues to insist on opposition to interest on moral grounds, and appears to hold the unorthodox belief that high interest rates spur inflation. Just hours before the central bank announced the rate hike, Mr Erdogan told an audience in Ankara that the country’s “high inflation was a result of wrong steps by the central bank,” and said he hoped rates would remain unchanged.

On Thursday, the government published a decree requiring all real estate transactions be conducted in Turkish lira, as opposed to dollars or euros, in what critics worry could be a precursor to controls on capital flows.

The previous day, Mr Erdogan named himself head of the country’s sovereign wealth fund, which owns chunks of the country’s national airline, railway system, telecommunications firm, postal service, state banks, energy firms, and the lottery. He named son-in-law Mr Albayrak to the fund’s board.

“If you just want to p*** off the market, and convince investors your country has a Third World approach to governance,” quipped Mr McNamara, “you name yourself head of the sovereign wealth fund”.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments