Cyprus crisis Q&A: the logistics of withdrawal

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

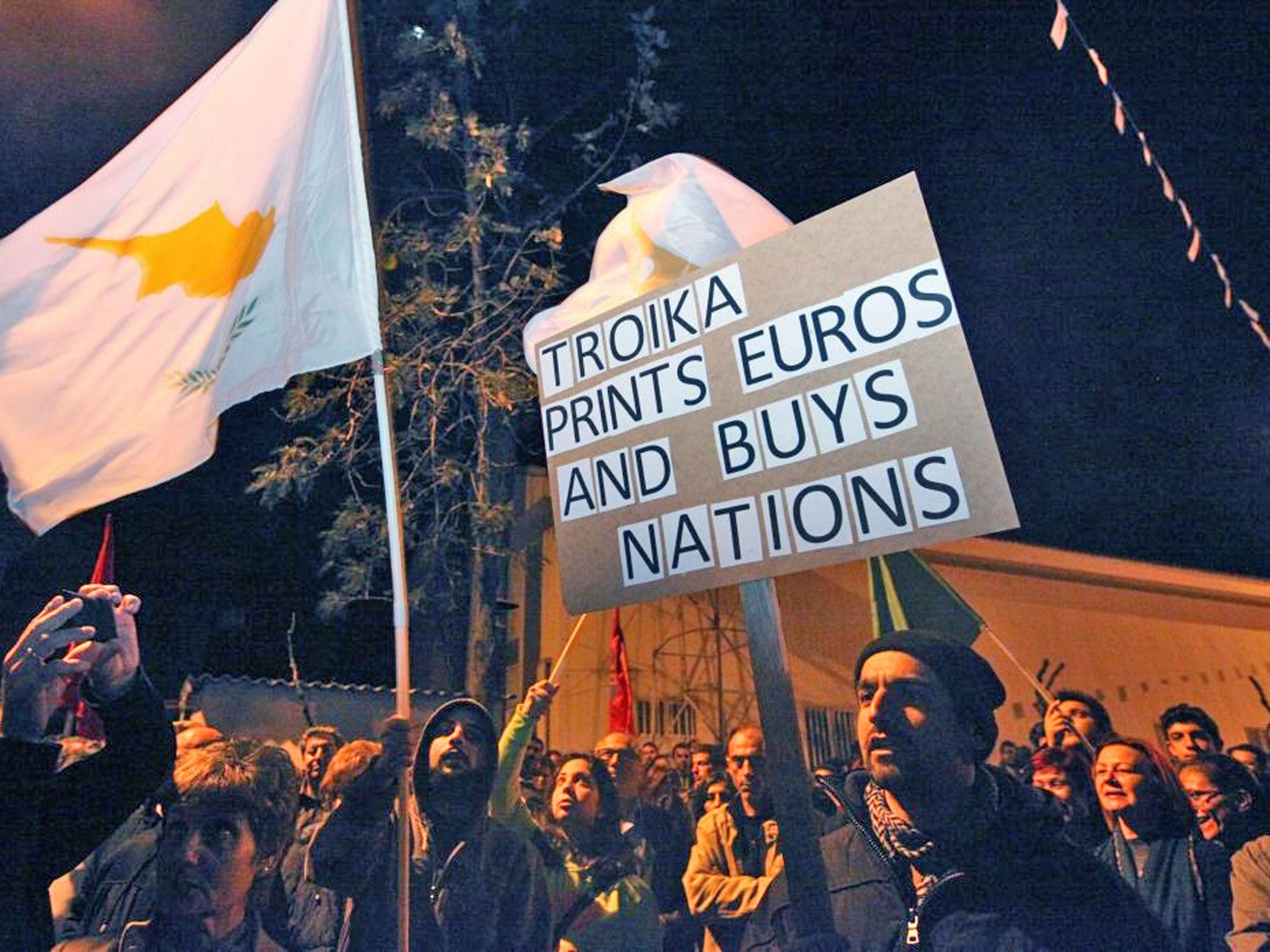

Your support makes all the difference.Q. Is an exit from the euro really a possibility?

A. Absolutely. If no deal is reached in Brussels and the ECB goes through with its threat today to pull the Exceptional Liquidity Assistance from the crippled banks, then the dominoes start to fall. First, the banks would go bust and everyone would lose their savings. That would lead to collapse of the entire banking system, as the government does not have the money to prop up the lenders. Without the €10bn bailout from the ECB and IMF, analysts say the government could survive for a couple of weeks before it runs out of funds.

Q. OK, so the government has no money and the banks have no money. What happens then?

A. First of all the state would no longer be able to pay for the basics, such as civil servants’ salaries, pensions, and welfare. The government would default on its debt, impacting on any creditors to the bankrupt nation and stopping any more investment in Cyprus. With the ECB also turning off the taps, there would be no more euros coming into the country. The government would need to get money back in the system, and one way of doing that would be to print currency. They can’t print euros, so it would most likely be a return to the pound for the Cypriots.

Q. Is there a process for this?

A. No. When the utopian dream of the single European currency became reality, no one thought any country would need to leave it. And although the question was raised when Greece was in crisis last year, it never got close enough to put any mechanisms in place.

Q. But would the eurozone really let them go?

A. That is the million euro question. Few really thought it was possible that the eurozone would let one of its members fall, but no one seems willing to blink. The Cypriots had until recently refused to toe the ECB/IMF line of imposing a high levy on large investments, fearful of scaring off the Russians who have poured billions into Cyprus. Something has to give: the Cypriot government is hoping that won’t be membership of the single currency.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments