Credit crunch claims life of billionaire who bet big

Germany's fifth-richest man throws himself under train after losing empire in VW share price squeeze

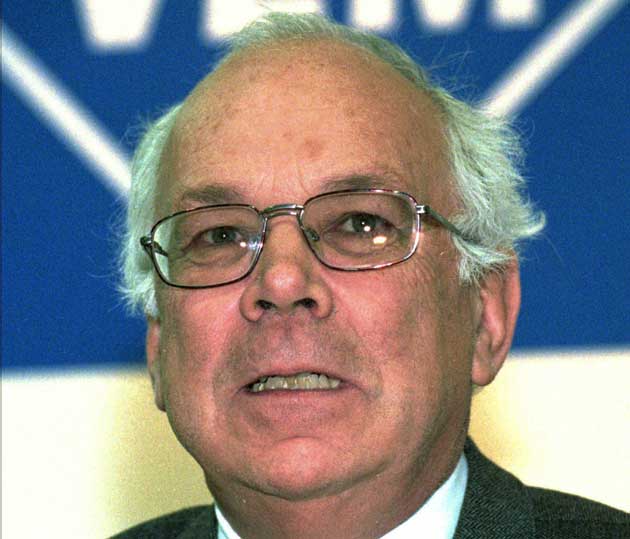

He seemed to be the epitome of the respectable German industrialist: a modest family man who strove to avoid publicity. But behind the scenes, the billionaire entrepreneur Adolf Merckle speculated and gambled away his fortune. On Monday, his body was pulled from under a train.

The 74-year-old pillar of Germany's business community and the country's fifth richest man committed suicide after losing millions in a high-risk stockmarket venture that backfired. Yesterday, his family blamed the credit crunch for his death.

His body was found on tracks 300 yards from his family's villa in Blaubeuren, near Ulm in south Germany. Police said he left a suicide note.

Mr Merckle became one of the most prominent victims of the financial crisis. In a statement, his family said he was broken by the struggle to salvage their business empire. The world's 94th-richest person in 2008, according to Forbes magazine, Mr Merckle spent his life building a business conglomerate with 100,000 employees.

His empire was poised to crash after his family made wrong-way bets on Volkswagen shares, which soared when rival Porsche moved to increase its stake in the company in October. The family has been under pressure to sell assets or seek bridging loans and has been in talks with banks for weeks.

"The desperate situation of his companies caused by the financial crisis, the uncertainties of the last few weeks and his powerlessness to act, have broken the passionate family entrepreneur and he took his own life," his family's statement said.

Prosecutors said Mr Merckle died when a train struck him late on Monday. He was thought to have been on his way home when he decided to throw himself across the tracks. Little was publicly known about the father of four. He enjoyed family life, skiing, cycling and mountain-climbing but avoided displaying his wealth. He did not own a yacht or fast cars and rarely threw parties.

While the Merckle family owned its own ski resort in the Kleinwalsertal tax haven on the borders of Germany and Austria, Mr Merckle is reputed to have enjoyed checking skiers' passes himself. On train journeys he refused to travel first class. "We prefer being among normal folk than shows offs," he was proud of saying.

He spent spent decades building up his multibillion-euro manufacturing empire from his grandfather's chemical company. His portfolio included the pharmaceutical giant Ratiopharm and Heidelberg cement company.

He received the German Federal Cross of Merit in 2005 for fostering economic growth in the state of Baden-Wuerttemberg, where he lived.

Market analysts said Mr Merckle liked to keep a low profile and had seemed like a conservative investor. In October, Volkswagen briefly became the world's most valuable company when its share price jumped in two trading sessions to just over €1000 (£907) from €210, after Porsche made a stakeholding announcement that sent short-sellers of VW shares, including Mr Merckle, running for cover.

"He had a reputation for being very, very prudent, very cautious – a typical entrepreneur who always remained down-to-earth. So it was a huge surprise," said an analyst who asked not to be named yesterday.

At the time, there was mostly speculation about banks and hedge funds that could have made losses on V as a result, but banking sources have put Merckle's losses at €400m.

Mr Merckle held talks on state guarantees with the regional government of Baden-Wuerttemberg but opted out of such backing and sought bridging loans from banks.

The prospect of a rich individual seeking state backing, with taxpayers' money, for losses caused by perceived reckless speculation sparked controversy in Germany. "The billionaire with empty pockets" read a headline at Suedeutsche newspaper. "Will Merckle, the gambler of billions, be saved by the state?" asked another newspaper.

The losses fuelled speculation that the industrialist could sell his generic drug company Ratiopharm or part of his stake in HeidelbergCement – both of which are based in Baden-Wuerttemberg. The firms are just two companies in the vast portfolio of the Merckle family, which also includes a maker of vehicles for ski slopes, a sugar refinery and one of Germany's oldest foundries. The portfolio generates about €30bn in annual sales.

Forbes listed Mr Merckle's fortune as $9.2bn and said he built it from his inheritance from his grandfather. He turned his grandfather's company into Germany's largest drugs wholesaler, Phoenix Pharmahandel, with annual sales of €21.6bn. He is survived by his wife, daughter and three sons.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments