Nobel prize-winner faces inquiry over aid money

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

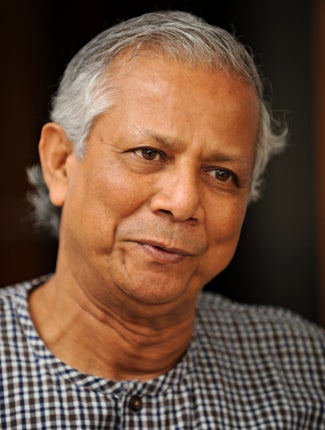

Your support makes all the difference.Nobel prize-winner Muhammad Yunus's Grameen Bank is being investigated in Bangladesh, as the "banker to the poor" and Prime Minister Sheikh Hasina clash yet again.

Last month, the bank, globally celebrated for revolutionising the world of microfinance and making credit available to millions of impoverished people, was accused in a Norwegian documentary film of getting tax benefits in the 1990s by moving around millions of dollars from Norway between different entities of the bank. After an inquiry by the authorities in Oslo, Grameen and its 70-year-old economist founder were cleared.

At the time, the Grameen Bank said the aid money was transferred for tax purposes to increase funds available to microborrowers and was loaned back to Grameen Bank the same day.

Norway's Minister for International Development, Erik Solheim, said: "There is no indication that Norwegian funds have been used for unintended purposes or corrupt practices."

The documentary's claims were based on letters that Danish filmmaker Tom Heinemann discovered in aid agency Norad's archives in Oslo.

But Sheikh Hasina's government has appointed a five-member panel to push ahead with its own investigation. The panel, headed by a professor of economics from Dhaka University, AKM Monowaruddin Ahmed, is to report back in three months. "The investigation is not to malign any individual or agency but to clarify the confusion and dig out the truth," a finance ministry official told reporters in Dhaka.

Some observers believe the inquiry may be the result of bad blood between the Prime Minister and Mr Yunus that dates back at least to 2007 when the economist made comments about the need to reform politics and considered launching his own party, Nagorik Shakti, or Citizens Power, a move he eventually decided not to pursue.

Last week, the Prime Minister, once a vocal supporter of the sort of credit schemes developed by Mr Yunus, accused him of pulling a "trick" to avoid paying taxes, adding: "[Micro-financiers are] sucking blood from the poor in the name of poverty alleviation." She has also accused Mr Yunus of running the bank like a private fiefdom.

Some reports suggest the authorities in Bangladesh would like to increase their stake in the Grameen Bank. According to Bangladeshi law, the government is supposed to hold a 25 per cent stake. But, because borrowers have been paying so much money in, the share of the government has fallen to less than 3.5 per cent. Claims that the government wants to change the law to ensure a larger stake in the bank were recently dismissed by the Finance Minister, Abul Maal Abdul Mhith.

Microfinance faces global controversy: many believe the scheme initially designed to benefit the poor has become a multibillion for-profit industry. In the Indian state of Andhra Pradesh, the industry has been accused of exploitation and illegal actions, and blamed for dozens of suicides of borrowers.

Mr Yunus, who was awarded the Nobel Prize in 2006, has insisted neither he nor the bank committed any offence. Nurjhan Begum, deputy chief of Grameen Bank, told the Agence France-Presse that the banker welcomed the investigation as a chance to clear his and the bank's name.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments