China launches app encouraging users to identify and report ‘deadbeat’ debtors

Radar-like programme encourages individuals to alert authorities to those suspected of shirking their debts

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.China has launched an app allowing users to identify nearby debtors and report those who appear to be shirking the responsibility of paying back what they owe.

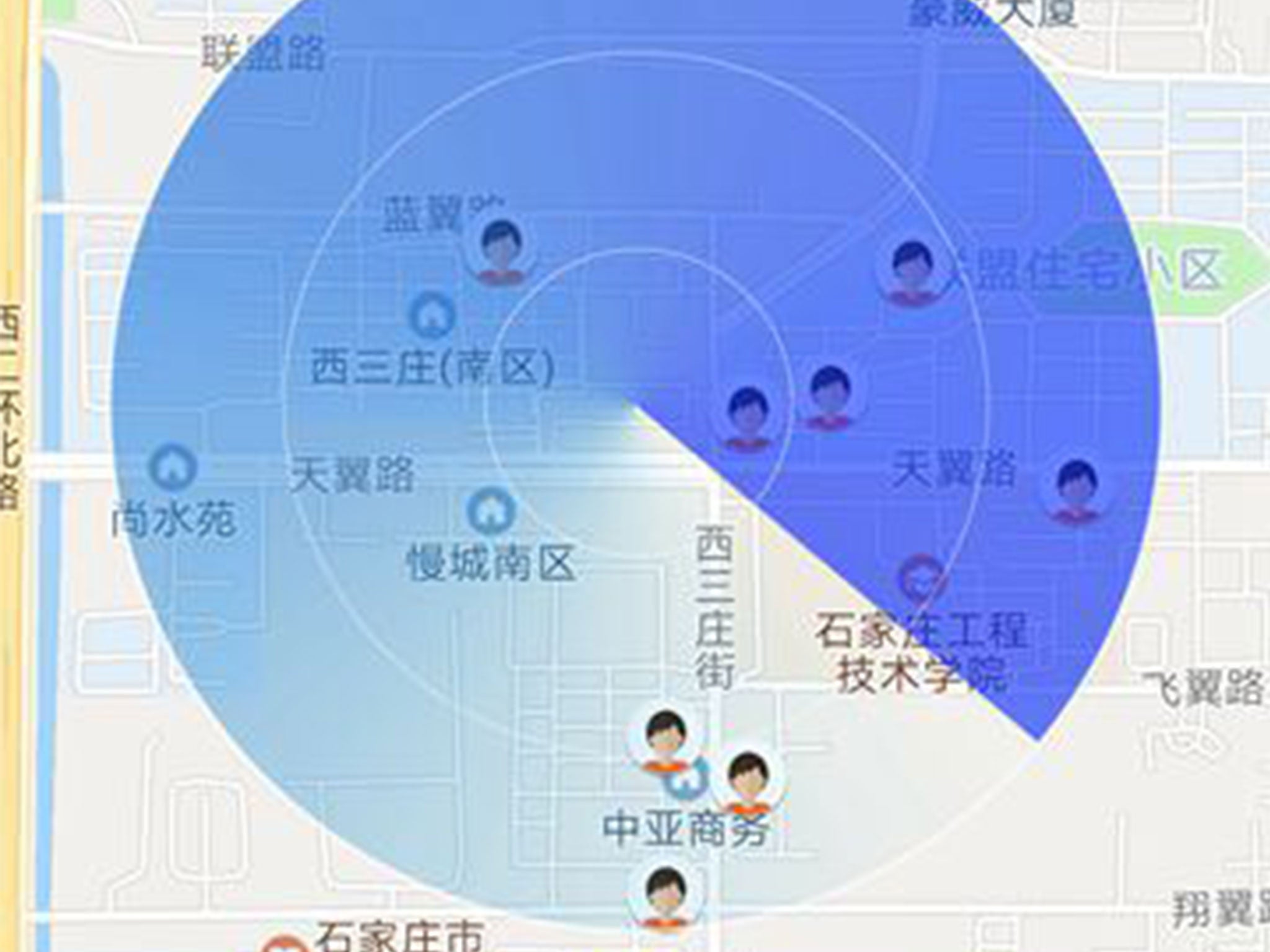

The Higher People’s Court of Herbei in northern China released the software, called “a map of deadbeat debtors”, last week as an add-on to the popular WeChat messaging service.

Users are given an on-screen radar, which allows them to discover if there is anyone who owes money within a 500 metre radius, according to the state-owned China Daily newspaper.

Debtors’ information is available to check through the app and individuals are encouraged to whistle-blow if they believe the person can afford to pay back what they owe but is refusing to do so.

“It's a part of our measures to enforce our rulings and create a socially credible environment,” a court spokesman said.

Chinese society generally frowns upon people in debt, with citizens who live a frugal existence viewed more favourably than those who live beyond their means.

Overall household debt as a percentage of GDP is lower in China than in most Western countries, although this is beginning to change.

Individual debt has risen rapidly over the last 15 years, partially aided by the government’s move in 2003 to allow citizens to take out a private bank loan for the first time.

Some economists have expressed concern rising personal debt could affect levels of consumer spending in China, exacerbating the current economic slowdown the country is experiencing.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments