Nearly 20 million people who owe student loans not making payments as government tries to claw back $1.6tn

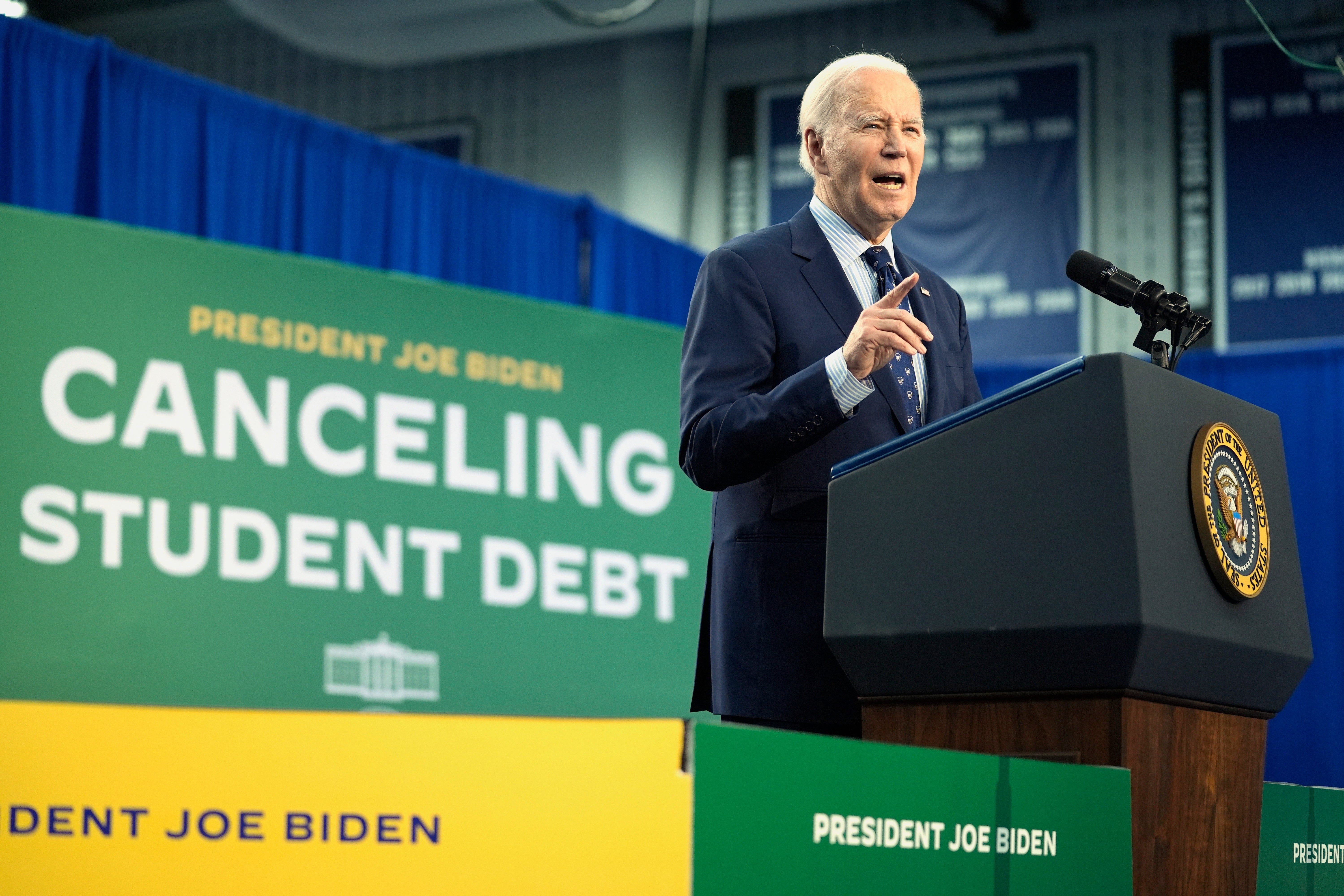

Throughout his presidency, Biden has sought out a way to eliminate student debt

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Nearly 20 million people who owe student loans are not making payments, according to the latest Department of Education data.

Following a three-year timeout on payments that began in 2020 during the pandemic, the government has restarted collecting the $1.6 trillion it is owed.

At the end of March, six months after the hiatus ended, nearly 20 million borrowers were making payments as scheduled. However, almost 19 million were not, leaving their accounts delinquent, in default, or still on pause.

Seven million people were at least 30 days overdue on payments at the end of 2023 - marking the highest delinquency rate since 2016.

Millions more had their accounts frozen through deferment or forbearance - meaning they did not have to pay their loans or they did not acquire interest - while nearly six million student loans were still in default from before the pandemic. For most federal student loans, you default if you have not made a payment in more than 270 days.

“The nonpayment rate really is emblematic of a system that’s not doing its job,” Persis Yu, managing counsel for the Student Borrower Protection Center, told the New York Times.

Throughout his presidency, Biden has sought to eliminate student debt, putting forward a major proposal to cancel as much as $400bn in loans. That proposal was struck down by the Supreme Court, which ruled that the move was unconstitutional.

President Biden also created the SAVE plan last year, which includes the cancellation of up to $10,000 in federal student loan debt for borrowers earning less than $125,000 annually.

The plan includes reforms to income-driven repayment plans, reducing the percentage of discretionary income that borrowers must pay each month from 10 percent to 5 percent. Additionally, the proposal aims to protect more income from being considered in repayment calculations, and to forgive loan balances after 10 years of payments for those with loan balances of $12,000 or less.

Two coalitions of Republicans filed lawsuits against SAVE, accusing the president of “unilaterally trying to impose an extraordinarily expensive and controversial policy that he could not get through Congress”.

Last week, federal judges in Kansas and Missouri temporarily blocked elements of the SAVE program, ruling in favor of states that contested the president’s authority to impose such generous terms without congressional approval.

In the Kansas suit, the states called the president’s debt relief maneuvers “a rushed product to evasively do what the Supreme Court already told defendants they cannot do.”

But on Sunday, the 10th Circuit Court of Appeals temporarily reversed the Kansas decision, paving the way for the Department of Education to proceed with planned payment reductions this month for millions of borrowers.

Following the ruling, Secretary of Education Miguel Cardona said the court “sided with student loan borrowers across the country who stand to benefit from the SAVE Plan – the most affordable repayment plan in history.”

The White House has said that more than 20 million borrowers could benefit from the SAVE Plan. The administration in May said 8 million are already enrolled, including 4.6 million whose monthly payments have been reduced to $0.

More than one in 10 Americans hold federal student debt.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments