LOCALIZE IT: Biden announces student debt cancellation

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.EDITORS/NEWS DIRECTORS:

President Joe Biden on Wednesday announced his long-delayed plan for student loan forgiveness, granting $10,000 in relief to borrowers who earn less than $125,000 a year.

His action also grants an additional $10,000 in relief to recipients of Pell Grants and proposes more flexibility in loan repayment options.

It's a historic moment with huge stakes for many Americans.

More than 43 million Americans owe a combined $1.6 trillion in student debt to the federal government, according to the latest data from the Education Department. Almost a third of borrowers owe less than $10,000 and more than half owe less than $20,000.

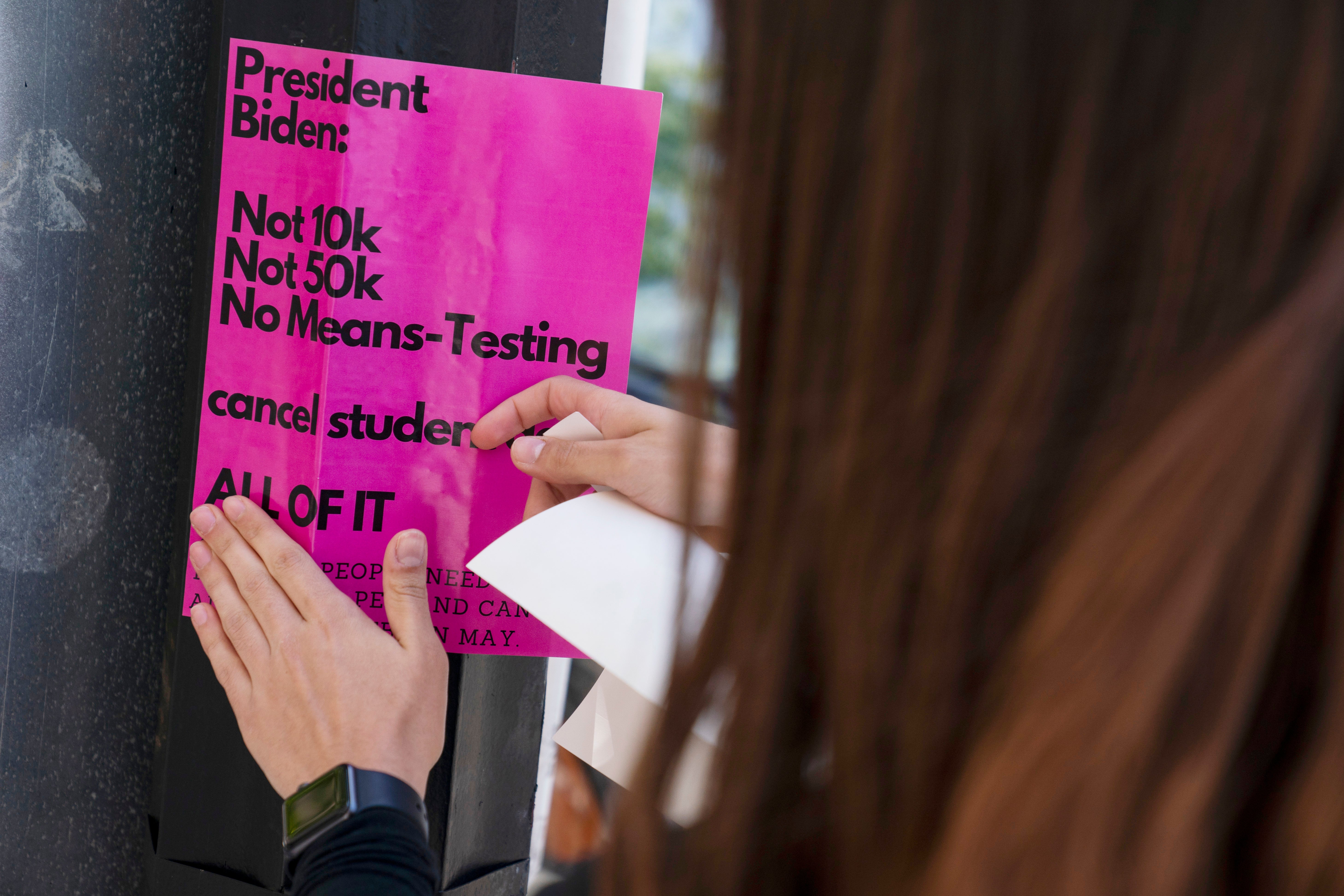

Supporters say debt cancellation will boost the economy and narrow the racial wealth gap. Progressive Democrats in Congress and the NAACP have been among the most ardent supporters, urging Biden to erase at least $50,000.

Opponents say it’s too costly and unfairly helps college graduates at the expense of taxpayers who didn’t go to college. Conservatives are likely to challenge forgiveness in court, and even some liberal think tanks question the value of broad cancellation.

Student loan borrowers are in every community, and audience interest in these stories is virtually limitless. With so much at stake, countless stories could be written even before the White House announces a decision. Here is a guide to help localize your coverage.

THE BACKGROUND

At a 2020 town hall, then-candidate Joe Biden vowed “to make sure everyone gets $10,000 knocked off of their student debt.” Swaths of young voters pointed to this promise as a key reason for electing him.

But once in office, the president expressed doubt about his authority to cancel student debt through executive action. He asked his administration to study the topic but also urged Congress to take up the issue through legislation.

He put off a decision for months, but ultimately promised a decision by the end of August.

LOCALIZING TIPS

—A key question to explore: Who would debt cancellation help in your area? Find people with student debt and ask what cancellation would mean for them.

—Think about the spectrum of people who would benefit from blanket forgiveness: It would help blue-collar workers who borrowed money to get associate degrees or who dropped out without finishing, but it could also help white-collar workers who have debt from advanced degrees. What impact would forgiveness have for each group?

—Some borrowers owe a few thousand dollars in student debt, while some owe more than $100,000. Think about exploring the impact of debt forgiveness across that spectrum. For the millions of borrowers who owe less than $10,000, what would it mean to have their debt erased entirely? How much would $10,000 in cancellation help borrowers with $50,000 or more? Finding local borrowers and telling their stories can help show the human impact at the heart of the debate.

—Supporters of debt forgiveness say it’s a matter of racial justice. Black Americans are more likely to have student debt, and in larger amounts, than white borrowers. A 2016 Brookings study found that, four years after graduation, the average Black borrower had $53,000 in student debt — almost twice as much as their white counterparts. Consider exploring the topic with Black borrowers and leaders in your community. The local NAACP, Black Lives Matter or Black Student Union chapter could help you get members’ perspectives and put you in touch with borrowers. If your newsroom has someone skilled with Census data, consider exploring whether neighborhoods with higher concentrations of Black residents are also more likely to have more households with student debt.

—The gridlock in Congress extends to the issue of student debt forgiveness. Some Democrats oppose cancellation and say the money would be better spent increasing money for federal Pell grants, for example. What positions have your senators and representatives in Congress taken?

—Experts say the student debt crisis is most troublesome for the millions of Americans who ended up with student debt but no degree. They can end up with large sums of debt but no credential to land a higher-paying job. Think about finding borrowers in your area who have debt but never graduated, and ask how cancellation would affect them.

HELPFUL RESOURCES

State-by-state statistics:

The Education Department releases regular reports on federal student loans. The data can be used to analyze the growth of student debt over time and how many borrowers have loans of various sizes. There are also geographic breakdowns with state-by-state statistics.

The Institute for College Access and Success publishes an annual report showing average debt loads for each state. The most recent report, for the class of 2020, found that the average student debt ranged from $18,350 in Utah to $39,950 in New Hampshire. TICAS also has experts who can talk about the impact of student debt.

What forgiveness could cost:

The Committee for a Responsible Budget, a group that advocates for lower deficits, argues that cancellation is too costly. Its estimates can provide a look at how much taxpayers might end up paying to cover debt forgiveness.

Who might benefit from forgiveness:

The Federal Reserve Bank of New York issued a report in April examining who would benefit from debt cancellation. It found, for instance, that if $10,000 was erased for all borrowers, 29% of the relief would go to high-income areas, while 25% would go to low-income areas

Help finding borrowers:

The Debt Collective is a national union of debtors that supports debt forgiveness and also purchases portfolios of debt and cancels them. The group can explain arguments in favor of cancellation, and it can connect you with local borrowers.

Young Invincibles is a student-founded nonprofit that advocates for debt cancellation. The group’s executive director, Kristin McGuire, has shared her story of taking out $20,000 in student debt that has now grown to $50,000.

The Student Debt Crisis Center is a national nonprofit that advocates for debt cancellation and can help find borrowers in your area.

More experts:

A number of scholars have studied debt forgiveness and come down on either side of the issue. Those who support it include Charlie Eaton at the University of California, Merced, and Adam Goldstein at Princeton University. Those who oppose the policy include Jason Furman at Harvard University and Miles Spencer Kimball at the University of Colorado, Boulder. Most universities are likely to have an economist or other scholar who can explore the potential impacts.

___

Localize It is an occasional feature produced by The Associated Press for its customers’ use. The Associated Press education team receives support from the Carnegie Corporation of New York. The AP is solely responsible for all content.