Biden and Europe waiting on one key sanction against Russia

U.S. and European officials are holding one key financial sanction against Russia in reserve

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.U.S. and European officials are holding one key financial sanction against Russia in reserve, choosing not to boot Russia off SWIFT, the dominant system for global financial transactions.

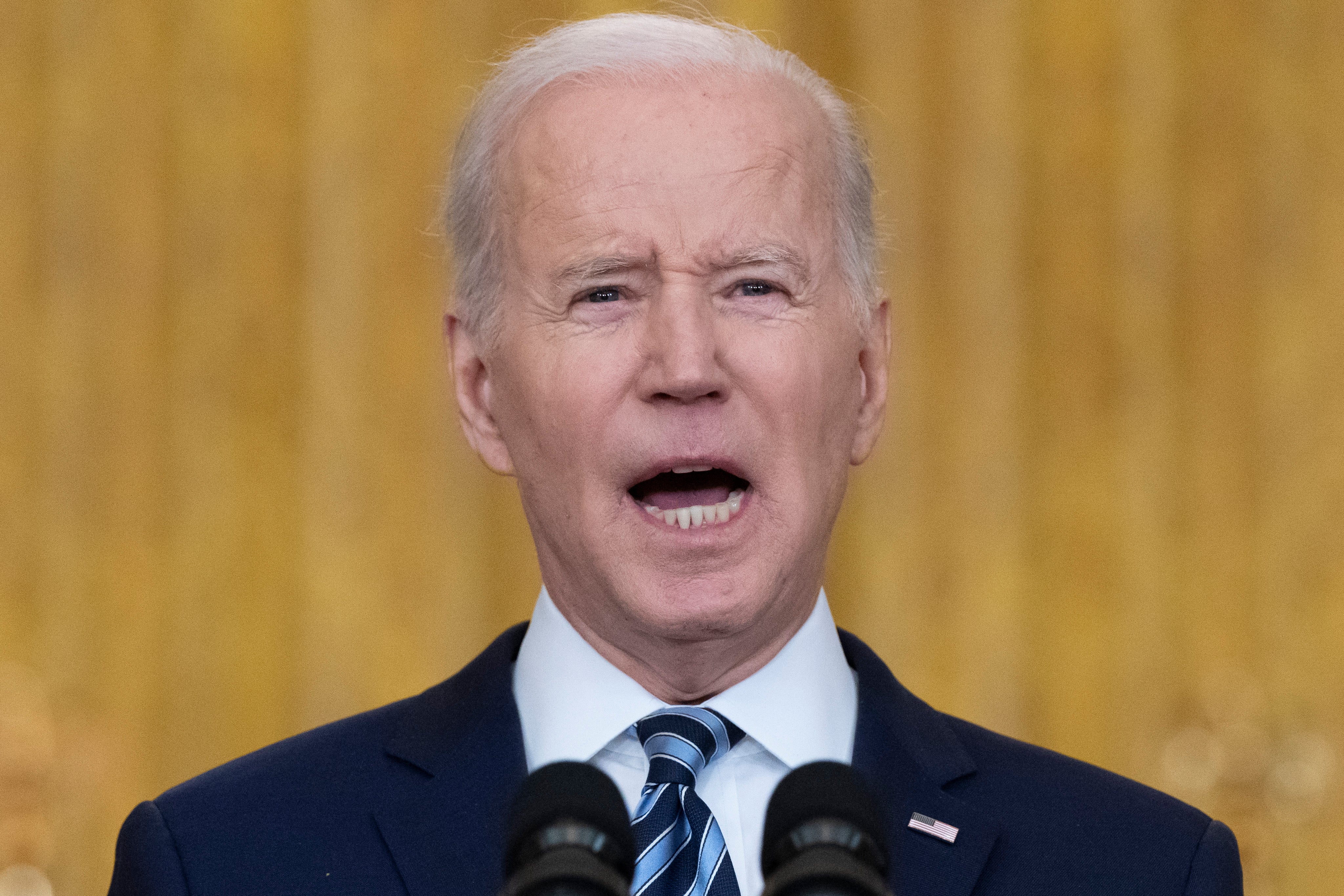

The Russian invasion of Ukraine caused a barrage of new financial sanctions Thursday. The sanctions are meant to isolate, punish and impoverish Russia in the long term. President Joe Biden announced restrictions on exports to Russia and sanctions against Russian banks and sate-controlled companies.

But Biden pointedly played down the need to block Russia from SWIFT, saying that while it's “always” still an option, “right now that's not the position that the rest of Europe wishes to take.” He also suggested the sanctions being put in place would have more teeth.

“The sanctions we’ve imposed exceed SWIFT,” Biden said in response to a question Thursday. “Let’s have a conversation in another month or so to see if they’re working.”

Still, some European leaders, including in the United Kingdom, favor taking the additional step of blocking Russia from SWIFT, the Belgium-headquartered consortium used by banks and other financial institutions that serves as a key communications line for commerce worldwide. The SWIFT system averaged 42 million messages daily last year to enable payments. The name is an acronym for the Society for Worldwide Interbank Financial Telecommunications, and about half of all high-value payments that cross national borders go through its platform.

Ukraine has sought for Russia to be excluded from SWIFT, but several European leaders would prefer to stay patient because a ban could make international trade more difficult and hurt their economies.

“A number of countries are hesitant since it has serious consequences for themselves,” said Dutch Prime Minister Mark Rutte, who believes a ban should be a last resort.

The British government says Prime Minister Boris Johnson pushed at a virtual meeting of the Group of Seven world leaders Thursday for Russia to be kicked out of SWIFT. It said there was “no pushback” but it was agreed that more discussion was needed. U.K. officials would not confirm Germany was resisting.

U.S. lawmakers have called on Biden to deploy every available financial sanction, with Senate Republican Leader Mitch McConnell saying Thursday that America should “ratchet the sanctions all the way up. Don’t hold any back. Every single available tough sanction should be employed, and should be employed now.”

But Sen. Jim Risch of Idaho, the top Republican on the Senate Foreign Relations Committee, said the SWIFT ban would be complicated and time-consuming in part because the U.S. doesn't have control over the decision.

The problem is that banning Russia from SWIFT might not cut it off from the global economy as cleanly as proponents think. Also, there could be blowback in the form of slower international growth. And rival messaging systems could gain users in ways that erode the power of the U.S. dollar — all of which has left SWIFT as a sanction waiting to be deployed.

“It’s a communications platform, not a financial payments system," said Adam Smith, a lawyer who worked in the Obama administration. "If you remove Russia from SWIFT, you’re removing them from a key artery of finance, but they can use pre-SWIFT tools like telephone, telex or email to engage in bank-to-bank transactions.”

The other risk is that countries could migrate their institutions to platforms other than SWIFT, such as a system developed by China. This would increase the friction in global commerce — hurting growth — and make it harder to monitor the finances of terrorist groups.

“By politicizing SWIFT you give incentive for others to develop alternatives,” said Brian O'Toole, a senior fellow at the Atlantic Council and former Treasury official. “SWIFT also is an important partner in U.S.-European counterterrorism efforts. It shares data with U.S. Treasury related to counterterrorism issues that has proven to be enormously valuable.”

The sanctions announced Thursday would still accomplish much of what would happen if Russia lost access to SWIFT, said Clay Lowery of the Institute of International Finance.

“Cutting off these financial institutions from utilizing the dollar, euro, pound sterling is still a pretty significant step," Lowery said. “You’re really having the same impact on certain subsections of the Russian economy through sanctions.”

Iran was blocked from the SWIFT system in 2014 because of its nuclear program. In 2019, then-Russian Prime Minister Dmitry Medvedev said losing access to SWIFT would be akin to a declaration of war against Russia. The statement by Medvedev is a sign that Russia viewed the platform as a vulnerability and developed workarounds to limit any economic damage.

"I think it will be harmful in the immediate term and psychological as well, but I’m not sure it’ll impact the economy in ways that make it worthwhile,” Smith said.

Russia has already prepared for ways to evade sanctions, including those imposed this week, experts say.

Ari Redbord, a former Treasury senior adviser, said he expects Russia’s leadership to bypass financial penalties that limit its ability to engage in the global financial system through the increased use of cryptocurrency.

He said this is a risk “especially when there are actors like Iran, China and North Korea” that will continue to trade with Russia outside of the formal financial system, Redbord said.

“If Russian banks are entirely cut off from the U.S. and European financial system, that will be very debilitating to those banks and the Russian economy,” he said. But the Russian government will use alternative means to trade with countries “even if there are debilitating" sanctions from the European Union and U.S.

__

Associated Press writers Jill Lawless in London and Lisa Mascaro in Washington contributed to this report.