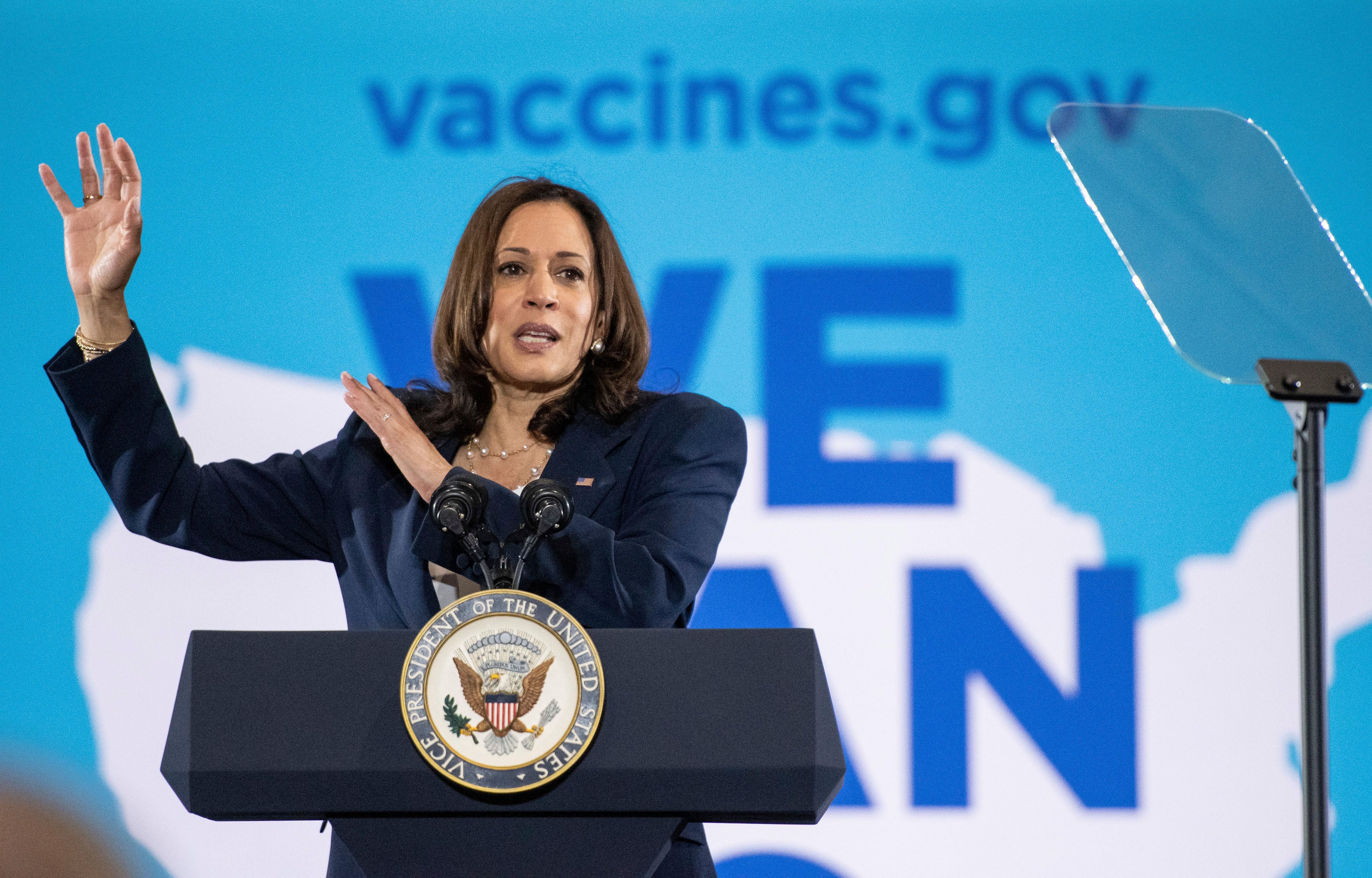

Harris announces $1.25 billion for community lenders

Vice President Kamala Harris has announced that the Biden administration is distributing $1.25 billion to hundreds of community lenders

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Vice President Kamala Harris announced Tuesday that the Biden administration is distributing $1.25 billion to hundreds of community lenders in an effort to help boost the economic recovery from the coronavirus for small businesses and disadvantaged business owners.

“President Joe Biden and I knew that more than repair, we must re-imagine our economy,” Harris said during an event at the White House “Small businesses, of course, are at the center of this re-imagining.”

The funds are going to more than 860 community development financial institutions, or CDFIs, around the country. CDFIs offer loans to small businesses and those who may be turned down for loans from major banks, a problem that studies have shown particularly plagues minority business owners.

Harris has focused on small businesses from the start of her vice presidency, and has emphasized in particular the need to support minority- and female-owned small businesses as key to a robust economic recovery.

On Tuesday, she lamented that “traditional banks have not always seen or understood the vision of women, small business owners, small business owners of color, small business owners who serve low income communities.” CDFIs, she said “add value to those communities, and by extension, to our entire nation.”

This fund in particular comes from work she did as a California senator. The funding for the program comes from $12 billion provided for community lenders in the 2020 stimulus that was signed into law by then-President Donald Trump last December. At the time, Harris pushed to include funding for CDFIs in the final package, along with Virginia Democratic Sen. Mark Warner, and House Financial Services Committee Chairwoman Maxine Waters a California Democrat, both of whom joined her at Tuesday’s event.

Harris praised their work, along with the support of a number of other senators, calling it a “full team effort” to get the funds into the final bill.

Treasury Secretary Janet Yellen also joined Harris at the event, and said that the CDFI fund delivered on Biden and Harris' campaign-trail promise to tackle systemic racism and build an economy “that works for everyone.”

CDFIs, she said, are “exactly the right place to focus our attention, because these questions — who can access credit and capital and who can’t — those questions are at the root of many long-term structural problems in our economy.”