Biden White House launches public push for child tax credit

The White House is working to raise awareness of the federal government's new expanded child tax credit

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The White House sought Monday to raise awareness of the federal government's new expanded child tax credit, which will start paying out monthly in July to families with children who are 17 years old and younger.

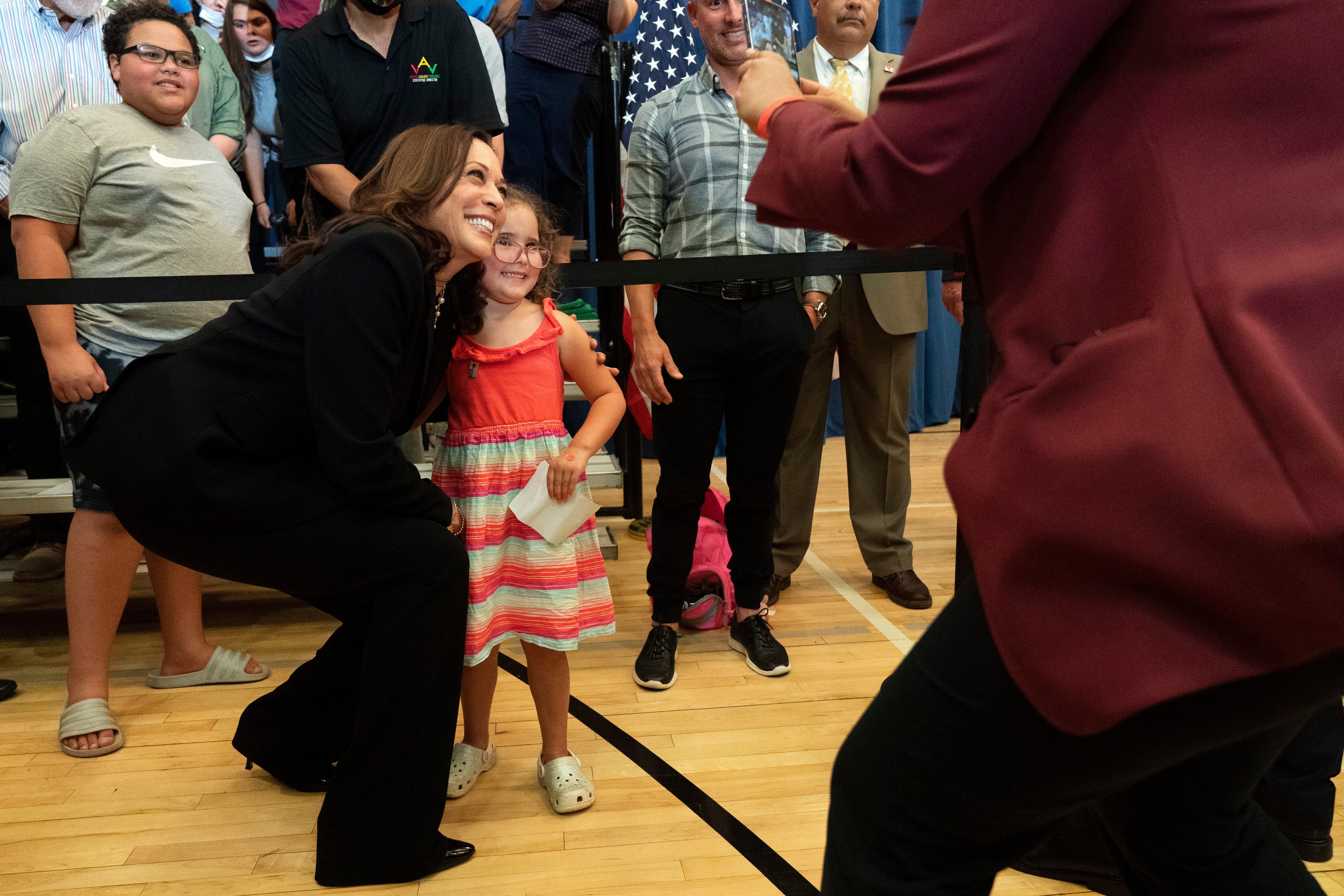

Vice President Kamala Harris spoke at a recreation center in Pittsburgh as part of a broader push to promote the program in partnership with churches, schools and other organizations.

“When more families know about how they can get the relief, that is how we will be able to lift our children out of poverty,” Harris said.

The administration has launched the website https://childtaxcredit.gov with details for potential recipients. As part of President Joe Biden s $1.9 trillion coronavirus relief package, eligible families can receive as much as $3,600 for each child under the age of 6. The tax credit will be $3,000 annually per child between the ages of 6 and 17.

The payments are to be made monthly, a first for the program. People can register for the program even if they did not fully file their taxes.

The program is slated to expire after one year, though Biden has proposed extending it through 2025 with the ultimate goal of making it permanent.