Joe Biden’s next challenge: Ending the student debt crisis

Millions of Americans are on hook for nearly $2 trillion for higher education costs. After months of pandemic pauses on repayments, advocates ask Biden: Why not cancel it all? Alex Woodward reports

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.In five months, millions of Americans are scheduled to resume payments into their federal student loan debts, ending more than two years of dramatic financial relief for millions of Americans during the Covid-19 pandemic and its economic fallout.

On 22 December, weeks before it was set to expire at the end of January, President Joe Biden extended a pause on repayments for at least a few more months. It will now come to an end in May.

The CARES Act coronavirus relief package in March 2020 paused payments into federal student loans and kept interest rates at zero per cent. It was repeatedly extended over the following months.

In August, the Biden administration announced a “final” extension of the pause, with repayments to continue on 1 February.

The word “final” was used three times in that announcement and not at all in the administration’s latest extension – signalling the president’s potential readiness to finally confront America’s climbing student debt crisis.

Meanwhile, in the months between announcements – as lawmakers and debt elimination advocates pressured the White House to indefinitely extend the pause – borrowers received dozens of emails reminding them about their impending repayments.

Chasten Buttigieg – whose husband Pete Buttigieg is the secretary of the US Department of Transportation – shared one of those emails in his Instagram stories, with the caption “LOL no thank you Merry Christmas next”.

Two weeks before extending the pause, the federal government even created a new website to streamline loan repayments.

More than 40 million Americans hold roughly $1.75 trillion in student loan debt, most of which is wrapped up in federal loans.

Debt relief advocates argue the president can cancel nearly all of it with the stroke of a pen. Members of Congress have also repeatedly reminded the president that he campaigned on the promise of relieving at least some of that debt, which falls hardest on women and people of colour.

“Student debt is a national crisis,” US Rep Jamaal Bowman said from the floor of the House of Representatives last month. “It was a crisis before the Covid-19 pandemic, and it’s an even bigger one now. I can’t think of a better opportunity to cancel student loan debt.”

The state of the student debt crisis

Victoria took out $146,000 in private and federal loans, with interest rates as high as 11.75 per cent, for enrollment at the Savannah College of Art and Design, a prestigious private art school in Georgia, where she graduated in 2013.

She was supported by a combination of federal loans and loans through Wells Fargo, with an income-based repayment plan through the Department of Education. She has not been able to lower or consolidate payments because of a high debt-to-income ratio, and the debt was too high to re-finance through a third party.

Victoria first spoke with The Independent in December 2020, after nine months of the pause, which gave her some breathing room to catch up on the interest rates that outpaced her initial loan. In 2019, she paid more than $11,000 in interest alone, and now owes more than she did when she took out the loans more than a decade ago.

One year later, she told The Independent that the pause on interest had been a lifeline.

“Honestly, that’s the biggest thing for me,” she said. “Like, OK, I took out this loan, and I will pay it back, but I think the insanely high interest rates should be eliminated so people aren’t punished for the majority of their lives for getting an education.”

If the pause ends, she will try to refinance, again, so she can start saving to buy a house with her husband. But she hopes the administration “will come to their senses and cancel it all or at least the interest”.

Student loan debt – which is soon set to reach $2 trillion – ballooned within the last decade alongside private university enrollment and steep cuts from federal and state governments into higher education.

Over the last several decades, governments have stripped investments in higher education while tuition has spiked, putting the burden of costs on students. Meanwhile, federal policy changes effectively eliminated limits on borrowing, and predatory lending schemes and sky-high interest rates have trapped generations of borrowers into a lifetime of debt.

Borrowers who spoke with The Independent have said their debt has effectively trapped them into endless repayment plans that have defined all of their financial decisions, for the sake of higher education degrees – some earned more than 10 years earlier – that promised better career opportunities and the wages to pay down their debts.

Most loan debt issued today will never be paid off – borrowers are increasingly not making any progress toward paying off their loans, with balances growingly exceeding the original loan.

“That means for years, people have been doing all they can to make monthly payments, but can only afford to keep up with the interest that accrues,” said Rep Bowman, pointing to the thousands of Americans who have paid “hundreds of dollars every month for years without seeing the total amount they owed go down at all”.

The weight of that debt is compounded by financial insecurity, fears of bankruptcy or worse, and the pandemic that has magnified insecurities, threatened livelihoods and put millions of Americans out of work or at risk of illness that could have ripple effects at home and on the job.

Nine out of 10 borrowers would not be financially stable by 1 February to begin repayment, according to a survey of 33,000 borrowers conducted by the Student Debt Crisis Centre.

A quarter of borrowers said at least a third of their income would go towards repayments, if they were to begin on 1 February.

“The Omicron variant is a scary reminder that the pandemic is still a serious concern and Americans cannot be crushed by student debt as they shoulder this health and economic crisis,” said Student Debt Crisis Centre president Natalia Abrams, who has urged the president to “deliver on the promise to cancel student debt for everyone” as part of the administration’s pandemic response.

Debt Collective, a debtors union that advocates for widespread debt cancellation, had scheduled a rally outside the White House this month to demand that the president fulfill his campaign pledges on student loan debt relief.

Following the administration’s extension of the pause, the group canceled the event.

“This is a major win for the 45 million student debtors and their families,” the organisation said. “For at least a few more months, struggling families will be able to keep tens of billions of dollars in their pockets – costly student loan payments that the federal government continues to prove it doesn’t need to function.”

What Joe Biden can do – and what he promised

The Public Service Loan Forgiveness programme, created in 2007, aims to provide relief for teachers, healthcare workers and other public workers who make on-time payments while spending at least 10 years in service work.

But the programme has been dogged by reports of applicant rejections, unclear qualifications and other obstacles, including accusations that lenders have exploited the programme to mislead borrowers or failed to account for their repayments.

More than 17,000 public servants enrolled in the programme are celebrating, asking for help, or trying to figure out what went wrong on a Reddit channel dedicated to the programme.

“I seriously never thought today would come!” one user wrote announcing $170,000 in debt wiped off their balance. “I feel like I’ve won the lottery!”

“$250,000 GONE!” another announced. “I think my neighbors might have heard my scream.”

After announcing a series of changes to streamline the programme in October, the administration has canceled more than $2bn held by 30,000 borrowers, according to data from the Education Department shared with The Independent.

Before those changes, more than 1 million borrowers had applied to the programme, but only 20 per cent were on track to have their debt cancelled by 2026, a decade after they would first start to become eligible for relief, according to an analysis from the Student Borrower Protection Centre.

The administration has pointed to some successes with student debt relief within his first year in office by leveraging existing programmes to cancel more than $12.5bn held by roughly 640,000 borrowers by the end of 2021.

Beginning in September 2021, the administration began wiping out nearly $6bn in student loan debt held by more than 320,000 borrowers with disabilities through the Total and Permanent Disability discharge programme, which grants relief to borrowers who are unable to work due to physical or psychological disabilities.

That move followed years of pressure from advocates to grant relief to eligible borrowers as they are entitled under the law, without burdensome application processes and delays.

But the administration’s efforts thus far have fallen significantly shorter than Biden’s campaign pledges for more widespread debt relief.

During his campaign, Mr Biden proposed canceling up to $10,000 in student loan debt. In November 2020, weeks before he entered the White House, he even said that student debt relief should happen “immediately” when he entered office.

“[Student debt is] holding people up,” he said that month. “They’re in real trouble. They’re having to make choices between paying their student loan and paying the rent.”

As the administration gets closer to the end of the pandemic pause, officials have instead directed borrowers to enter into repayment plans to help whittle down their debt.

A report from the National Consumer Law Center found that only 32 people have ever qualified for loan cancellation through an income-based repayment plan that promises to cancel remaining debt after payments up to 25 years while enrolled.

More than 8 million people have enrolled in income-driven repayment plans, and roughly 2 million people have been in repayment for more than 20 years, still holding debt – with interest – tied to their undergraduate tuition.

White House officials have been mulling for months whether the president or Education Department Secretary Miguel Cardona have the legal authority to unilaterally cancel debt, but publicly, the administration has said only that the president is waiting for legislation from Congress.

A heavily redacted memo – titled “The Secretary’s Legal Authority for Broad-Based Debt Cancellation” – has circulated since April 2021, though its existence was not made public until late last year.

The White House and Education Department did not respond to requests for comment on the documents or confirm their existence.

“With the stroke of a pen, Biden can dramatically boost the economy, narrow the racial wealth gap, keep a key campaign promise and deliver a much-needed jubilee for the 99 per cent,” according to Debt Collective.

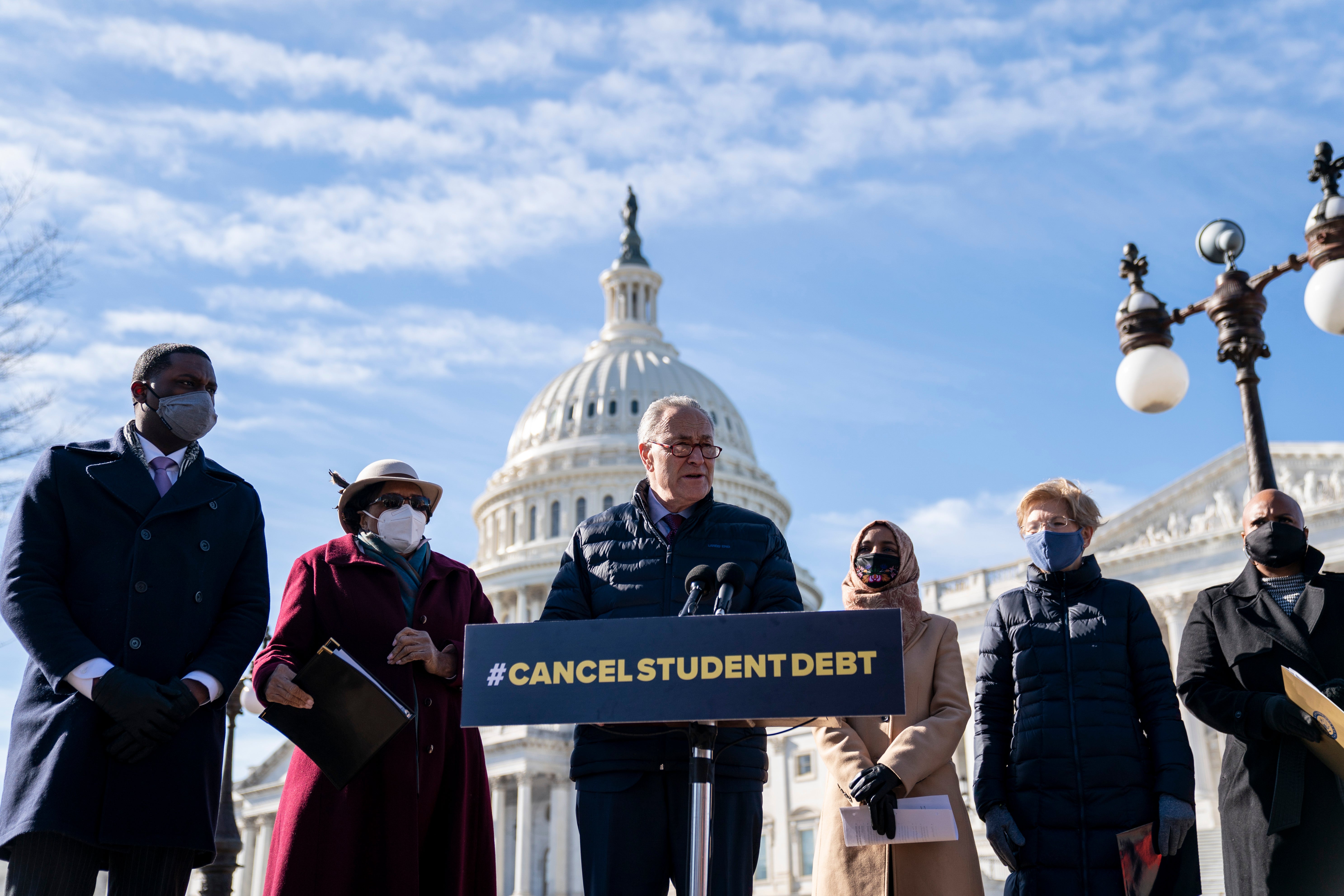

Senators Elizabeth Warren and Chuck Schumer and US Rep Ayanna Pressley have also called on the president to cancel up to $50,000 in federally held debt through executive action.

In a letter to the White House on 8 December, they pointed to a report from the Roosevelt Institute which found that if the payments resumed as scheduled on 1 February, $8bn a month and $85bn annually “will be stripped from over 18 million student loan borrowers’ budgets.”

“The pause on federal student loan payments, interest, and collections has improved borrowers’ economic security, allowing them to invest in their families, save for emergencies, and pay down other debt,” they said in a statement last month.

In a series of speeches on the floor of the House of Representatives last month, progressive lawmakers revived their demands to the Biden administration while standing next to a massive placard reading “CANCEL STUDENT LOAN DEBT.”

“This is getting ridiculous,” said US Rep Alexandria Ocasio-Cortez, who is among members of Congress still paying off outstanding debts from college. Her current loan balance is $17,000, she said.

“Growing up I was told since I was a child, ‘Your destiny is to go to college. That’s what’s gonna lift our family up and out. That is our future,’” she said.

“We still do that today,” she added.

“It’s teenagers signing up for what is often hundreds of thousands of dollars of debt, and we just do that. And our government allows that. We give 17-year-olds the ability to sign on for hundreds of thousands of dollars of debt, and we think that’s responsible policy.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments