Democratic debate: How a 14-year feud between Joe Biden and Elizabeth Warren could steal the show

Ms Warren clashed with Mr Biden in 2005 while he was a powerful senator, and she a well regarded expert on bankruptcy law

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

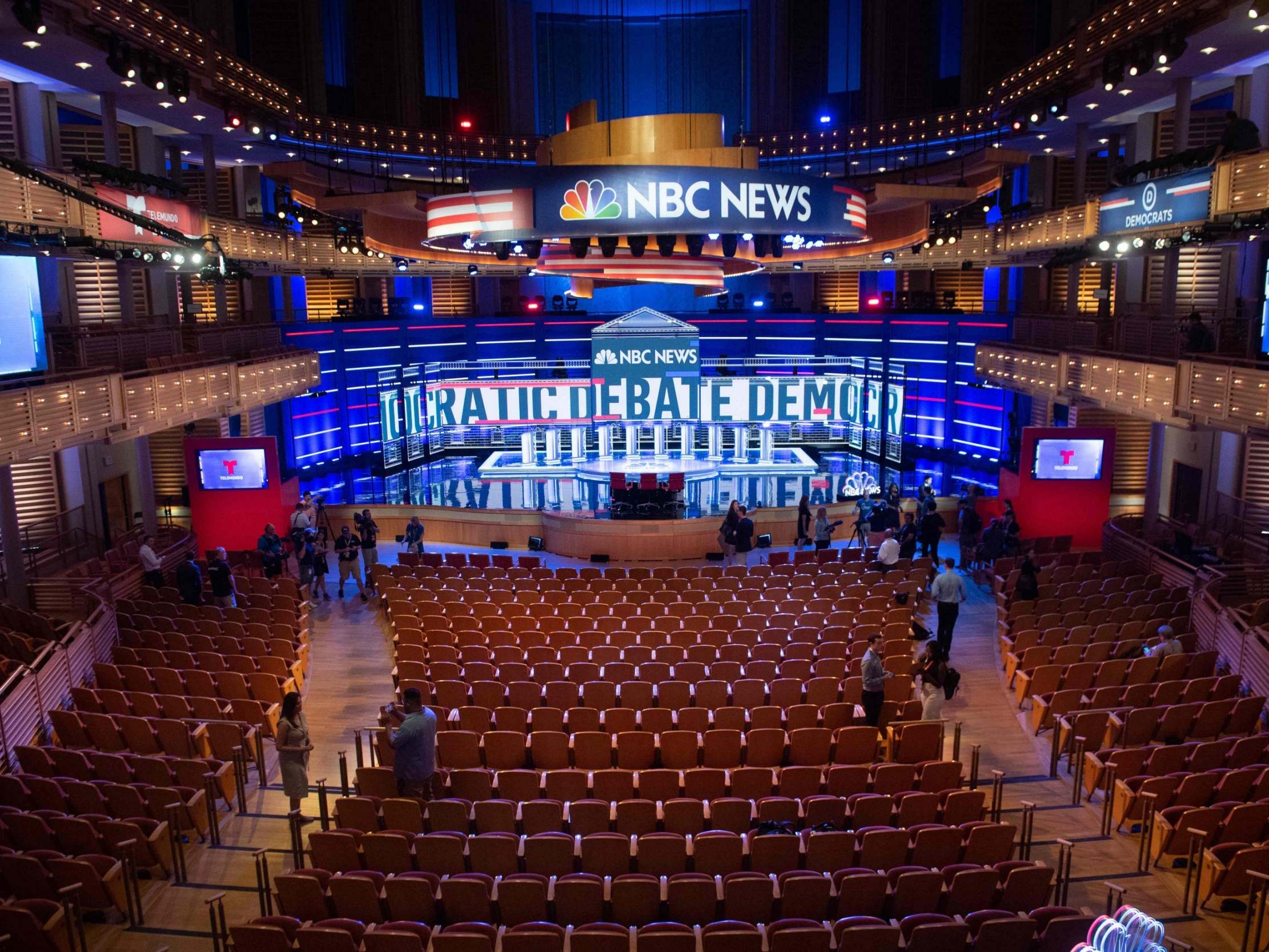

Your support makes all the difference.With Joe Biden and Elizabeth Warren meeting for the first time as 2020 presidential candidates during the third Democratic debate stage in Houston, the stage will be set for the two leading contenders to dredge up a nearly two-decade beef over bankruptcy, consumer protection, and the question of who the US economy should work for in the end.

The disagreement between the two candidates traces back at least to a 2005 encounter, when Mr Biden was a powerful US senator and Ms Warren was a highly regarded professor at Harvard Law School.

The showdown came as the Senate was considering the Bankruptcy Abuse Prevention Consumer Protection Act (BAPCPA), a measure that was first introduced in the 1990s amid an increase in US consumer bankruptcies.

The law, which was favoured by the financial sector and made it harder for Americans to seek bankruptcy relief, was originally enacted in Congress during the administration of Bill Clinton, who refused to sign the law in part because of Ms Warren’s lobbying of then-first lady Hillary Clinton.

The measure was re-introduced during the George Bush administration and eventually became law, but not before Mr Biden — who was then representing Delaware, a state with an economy that is known to thrive from a close relationship between corporations and its courts — and Ms Warren clashed. The financial industry, notably, was one of Mr Biden's top donor groups, according to the Center for Responsive Politics.

The backdrop of the exchange was the collapse of Enron, which was a Houston-based energy company that was going through bankruptcy. Ms Warren criticised BAPCPA during the hearing because it allowed Enron to conduct its bankruptcy proceedings in Delaware, far away from its employees in Texas, making it incredibly difficult for those employees to challenge decisions on the future of their pension funds.

Mr Biden took offence to Ms Warren claiming that the Delaware proceedings made the bankruptcy process inaccessible, before engaging in a lengthy critique of her views during the proceeding.

“Bankruptcy courts in Delaware are not open?” Mr Biden asked her.

“They are not open to employees of companies like Enron who cannot afford ...” Ms Warren started, before Mr Biden cut her off.

“In what sense do you mean open?” he said.

After a brief back and forth, she responded: “Employees of companies like Enron literally cannot go to Delaware and hire local counsel, which the Delaware bankruptcy court requires of them before they can make an appearance, and that effectively cuts thousands of small employees, pensioners, and local trade creditors out of the bankruptcy process. If they can’t afford it, they are not there.”

Mr Biden later complained: “We are going to ask the gas company, the drug store, the automobile dealer to pay for the broken system instead of having the nerve to come and say it is a moral obligation of a nation to pay for that broken system.”

Ms Warren countered: “Until we fix the broken healthcare finance system, those families have to turn somewhere and that means now they turn as a last-ditch effort to the bankruptcy courts.”

Finally, Mr Biden said that Ms Warren was actually concerned with high rates charged by credit card companies, not by bankruptcy laws themselves.

“But, senator, if you are not going to fix that problem, you can’t take away the last shred of protection from these families,” Ms Warren said.

“I got it, OK,” he said. “You are very good, professor.”

Ms Warren has said that that exchange, and the passage of the bankruptcy bill — which proponents say has led to a dip in bankruptcy filings, and which opponents say only means people are putting off financial crisis and borrowing more — was a wakeup call.

She penned an op-ed two years later calling for the creation of the federal Consumer Financial Protection Agency, which led her to become an adviser in the Obama White House. During that time, she clashed with the administration frequently, before being pressured to run for Senate in Massachusetts when Barack Obama made it clear that he would not be nominating her to run the agency.

And, just this year, after Mr Biden officially entered the 2020 race, Ms Warren did not shy away from their conflicts, and referenced the 2005 exchange itself.

“Our disagreement is a matter of public record,” Ms Warren said. “When the biggest financial institutions in this country were trying to put the squeeze on millions of hardworking families who were in bankruptcy because of medical problems, job losses, divorce and death in the family, there was nobody to stand up for them. I got in that fight because they just didn’t have anyone, and Joe Biden was on the side of credit-card companies.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments