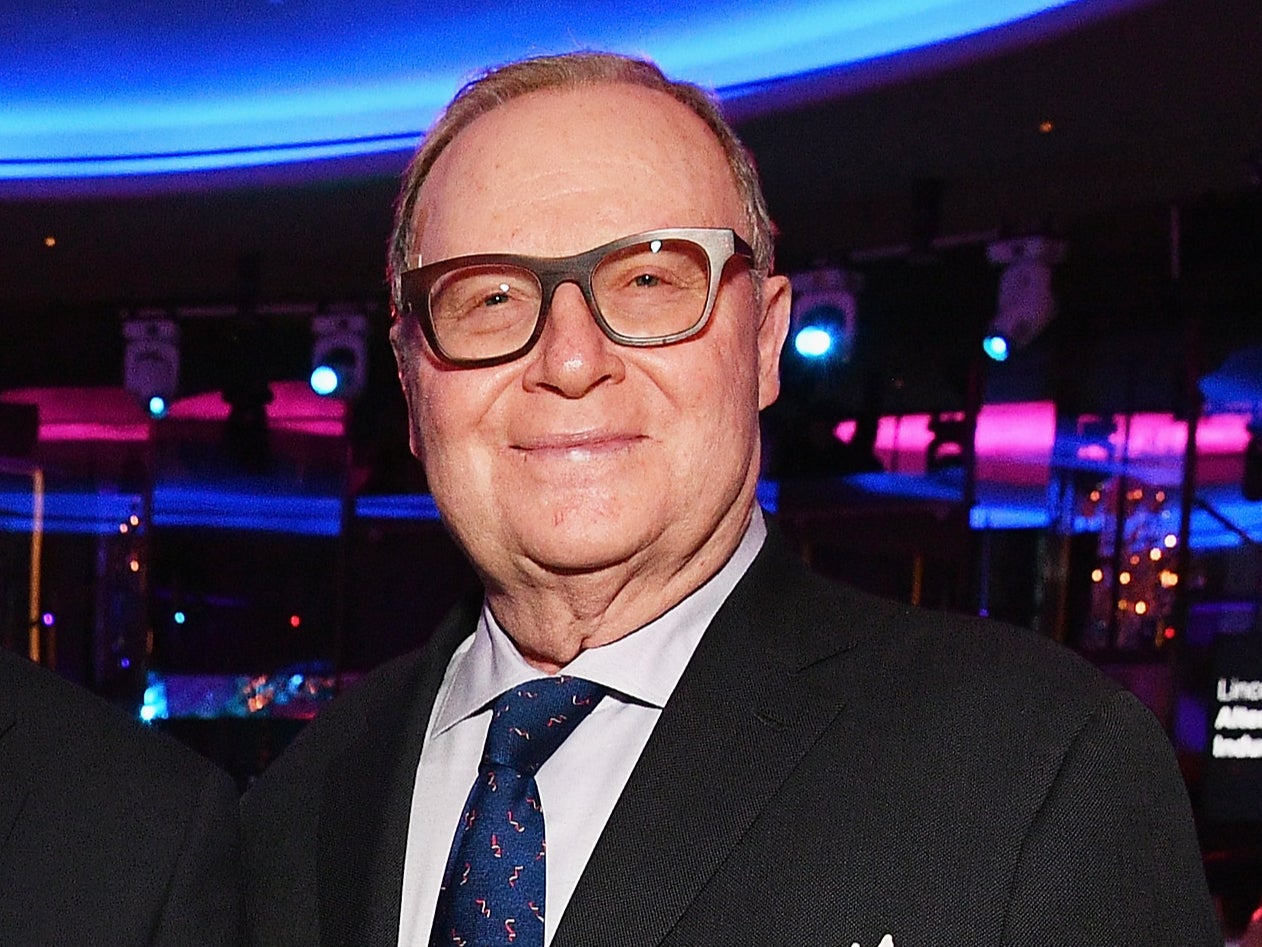

Billionaire New York financier found dead in Manhattan office

“We knew him as a devoted husband, father, grandfather, sibling, friend and philanthropist” the family says

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.American financier Thomas Lee, a pioneer in private equity, has died at the age of 78, his family has confirmed.

“The family is extremely saddened by Tom’s death,” family friend and spokesperson Michael Sitrick said in a statement. “While the world knew him as one of the pioneers in the private equity business and a successful businessman, we knew him as a devoted husband, father, grandfather, sibling, friend and philanthropist who always put others’ needs before his own. Our hearts are broken. We ask that our privacy be respected and that we be allowed to grieve.”

The NYPD told the BBC that an unidentified 78-year-old man had been found dead at 767 Fifth Avenue – the address listed for Thomas H Lee Capital LLC. A police spokesperson said the cause of death will be determined by a medical examiner.

Police added that they responded to a 911 call just after 11am on Thursday at the Fifth Avenue office.

“Upon arrival EMS responded and pronounced the male deceased at the scene,” the authorities said, according to the BBC.

When he died, Mr Lee was estimated to be worth $2bn, according to Forbes.

He pioneered the use of the leveraged buyout – when one company acquires another using large amounts of borrowed money – and became known for buying beverage firm Snapple in 1992 for $135m and selling it to Quaker Oats two years later for $1.7bn, which was 32 times the amount that he purchased the company for. Quaker Oats soon sold Snapple at a huge loss, getting $300m for the company.

His previous firm which still bears his name said in a statement that “we are profoundly saddened by the unexpected passing of our good friend and former partner, Thomas H. Lee”.

“Tom was an iconic figure in private equity. He helped pioneer an industry and mentored generations of young professionals who followed in his footsteps,” the firm added.

His firm didn’t get the reputation, as many other private equity firms have, of making massive cuts, such as by firing staff, after an acquisition to make it more valuable ahead of selling it, according to CNN.

When he acquired Snapple, he boosted its value before selling it to Quaker Oats by growing the business and increasing sales. The revenue is reported to have spiked from $95m to $750m.

“He’s that rare thing on Wall Street — a genuinely nice guy,” Forbes wrote in a 1997 profile.

After founding it in 1976, he left the firm in 2006 to start another one – Lee Equity Partners. The company’s site states that he has invested $15bn over the course of the last 46 years.

He began as an analyst at L.F. Rothschild & Company in its institutional research department before moving to First National Bank of Boston, becoming vice president and heading its high-tech lending group.

He served as a trustee of the Lincoln Center for the Performing Arts, the Museum of Modern Art, NYU Langone Medical Center, and the Whitney Museum of American Art, in addition to other organisations.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments