Elon Musk's Tesla to raise $1.5bn to fund development of its cheapest electric car yet

Effort to bolster financial position as company focuses on mass-market model

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Tesla, the California-based maker of electric cars, has said it plans to raise $1.5bn in order to fund the production of its latest vehicle.

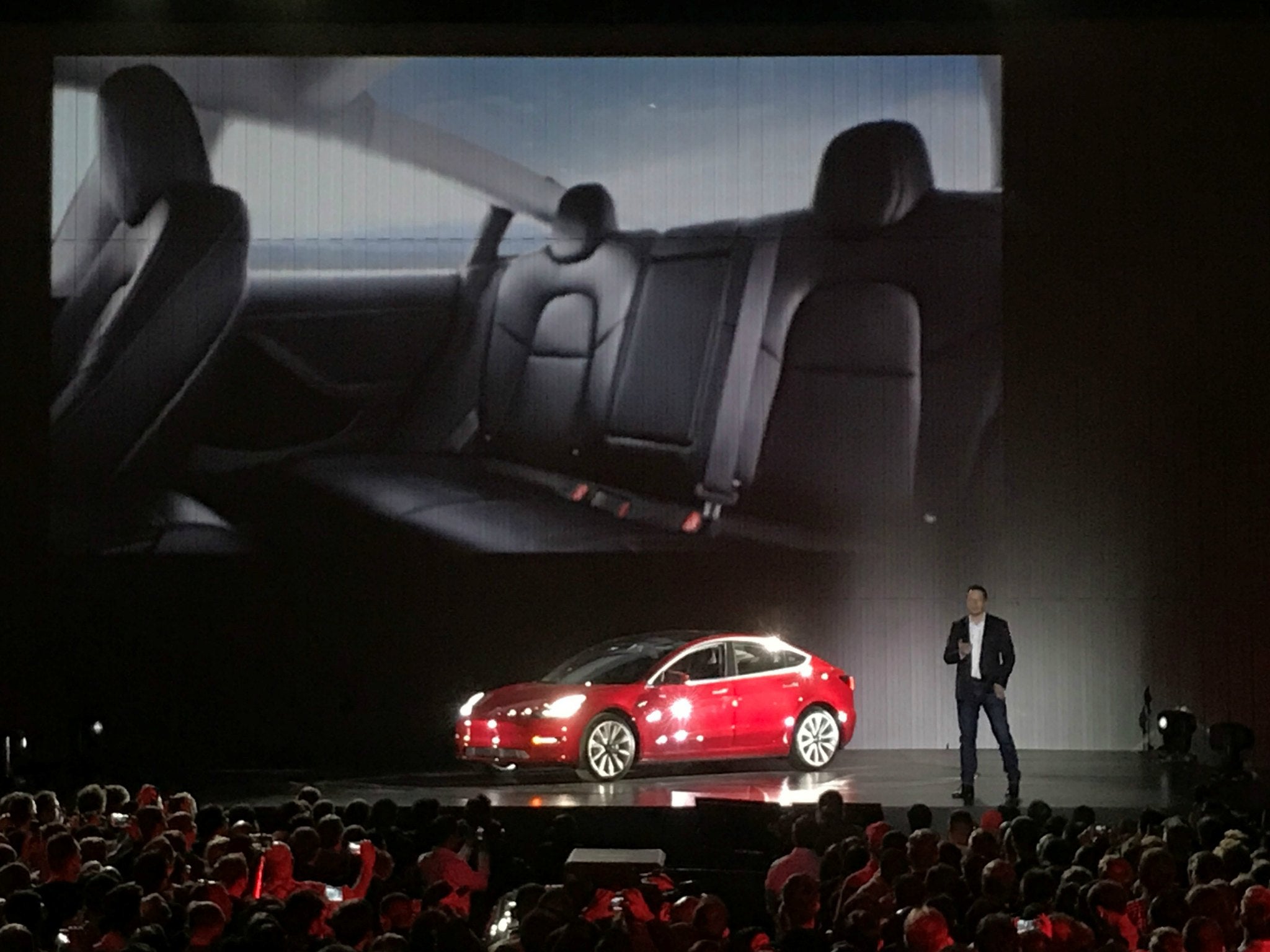

Seeking more capital after the launch of a much-anticipated new mass-market electric car, the Model 3, Tesla said it would offer $1.5 billion worth of bonds to professional investors.

“The notes will be senior unsecured debt obligations of Tesla,” the company said in a statement. “The interest rate, redemption prices and other terms of the notes are to be determined.”

The attempt to generate more cash via the debt markets comes roughly a week after Tesla officially announced its Model 3, a vehicle meant to broaden Tesla's appeal beyond a luxury car company.

The basic Model 3 will retail in the United States for $35,000 a year beginning in November, the company has said, giving consumers interested in reducing their carbon footprints or simply saving on gas a more affordable option. It claims to have already received 518,000 orders.

Selling debt will buoy Tesla's financials amid the Model 3's launch, the company said in a press release, noting that it “intends to use the net proceeds from this offering to further strengthen its balance sheet during this period of rapid scaling with the launch of Model 3.”

“We're not at this point considering an equity raise,” Tesla CEO Elon Musk said in a second quarter earnings call. “We are thinking about debt, but we're not thinking about an equity raise.”

According to a second quarter earnings report released last week, Tesla holds more than $3 billion cash on hand, a decrease of about $360 million from the end of 2016. Its total automotive sales more than doubled between the first half of 2016 and the first half of this year, from more than $1.9 billion to more than $4 billion.

A substantial chunk of Tesla's capital - about $2 billion - is expected to go toward spending on the Model 3, construction of a lithium-ion battery “gigafactory” in Nevada and fortifying electric car charging infrastructure over the rest of 2017.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments