JP Morgan Chase executives knew of Jeffrey Epstein sex abuse and obstructed justice, lawsuit claims

Red flags were raised about Jeffrey Epstein’s monthly cash withdrawals of up to $80,000 as far back as 2006, but JP Morgan kept him on as a client for another seven years, a lawsuit alleges.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.JP Morgan Chase executives knew of sex abuse and trafficking allegations against Jeffrey Epstein for at least seven years before cutting ties with him, a new court filing claims.

The new complaint, part of a lawsuit brought last year by the US Virgin Islands (USVI), further alleges that the financial giant obstructed federal law enforcement agencies from pursuing Epstein, who died in prison in 2019 while awaiting trial.

The filing contains details from a deposition last month with JP Morgan’s head of asset and wealth management Mary Erdoes, who admitted under oath that she knew in 2006 that Epstein was “accused of paying cash to have underage girls and young women brought to his home”.

A source familiar with the matter told The Independent that Ms Erdoes had read about the accusations in news reports.

The new filing shows how JP Morgan executives wrestled internally with whether to continue to work with Epstein after accusations of abuse and trafficking young girls first emerged.

It claims that JP Morgan’s Rapid Response Team raised red flags as early as 2006 that Epstein was making cash withdrawals of between $40,000 and $80,000 several times each month, totalling over $750,000 per year.

The risk management team decided that Epstein’s account “should be classified as high risk” and require special approval to make large cash withdrawals.

Epstein was convicted of procuring underage prostitutes in 2008 and sentenced to 18 months in prison.

It took another two years for the bank to flag Epstein’s status as a sex offender, and he remained as a JPMorgan client until 2013, the suit alleges.

Ms Erdoes testified that the bank dropped Epstein as a client when it realised that the large withdrawals were for “actual cash”.

The USVI and a group of Epstein victims brought separate lawsuits in a Manhattan court late last year accusing JP Morgan of facilitating his sex offences.

Epstein’s offending was so widely known within the bank, that executives joked about him attending an event with Miley Cyrus, the USVI suit claims.

Elsewhere, a senior compliance manager referred to Epstein as a “sugar daddy” while discussing his sponsorship of credit cards and accounts for two 18-year-olds.

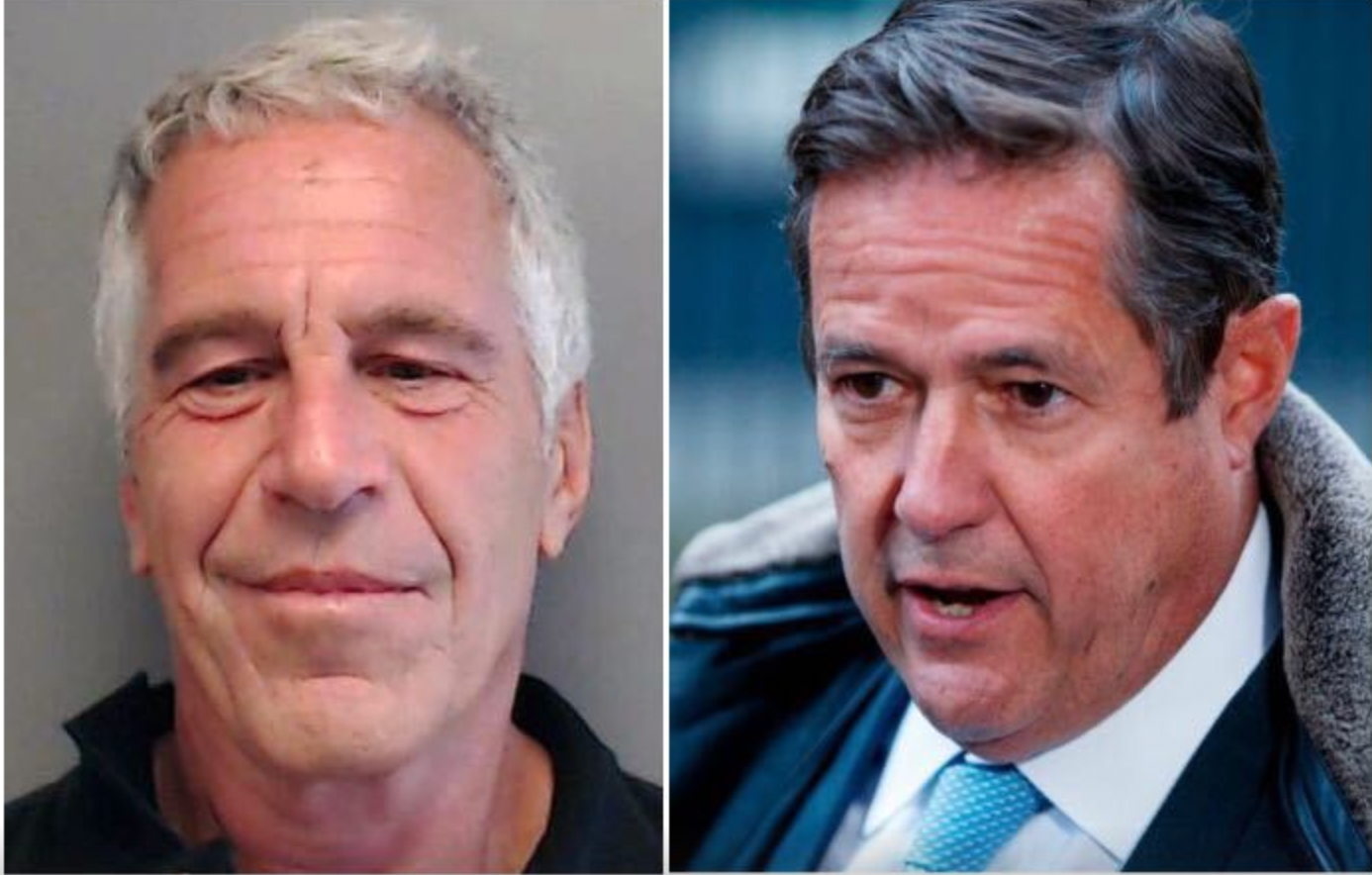

The bank initially defended its former investment banking chief Jes Staley, who also had a role as Epstein’s private banker.

Then in March, it sued Mr Staley claiming he had “repeatedly abandoned the interests of JP Morgan Chase and served his own and Epstein’s interests”.

JP Morgan has previously described the two lawsuits as “misplaced and without merit” in a statement. It did not provide a comment when contacted by The Independent.

The USVI lawsuit’s scope has broadened significantly in recent weeks with subpoenas being issued to Google co-founder Sergey Brin, Hyatt Hotels executive chairman Thomas Pritzker and real estate mogul Mortimer Zuckerman.

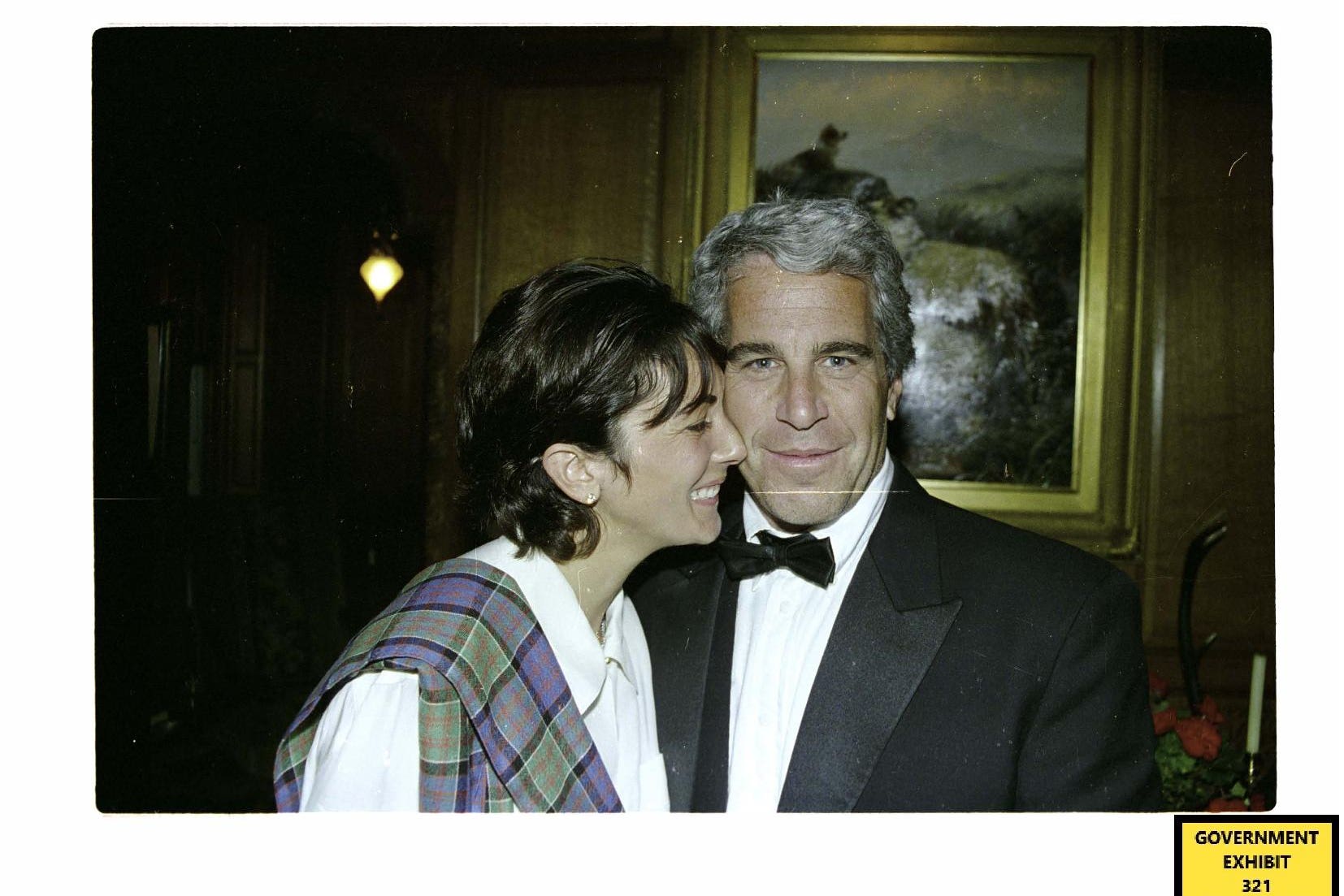

The suit states that Epstein’s former confidante Ghislaine Maxwell was flagged by the bank in 2011 after trying to open an account for a “personal recruitment consulting business.”

A medical examiner found Epstein died by suicide in August 2019 at the age of 66 while awaiting trial on federal sex trafficking charges.

In November, Epstein’s estate agreed to pay $105m to the US Virgin Islands government to settle a separate lawsuit that the late paedophile used his private island in the archipelago for sex-trafficking.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments