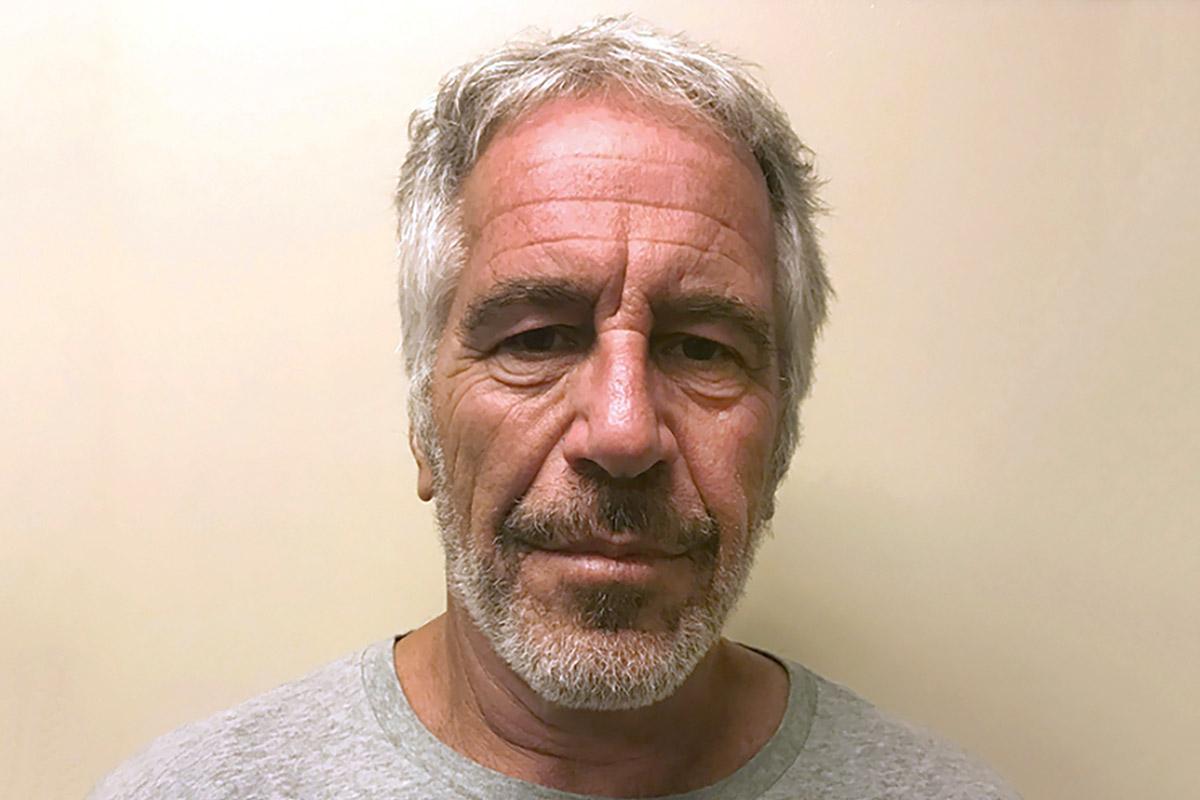

Jeffrey Epstein: The trail of ruined lives, misery and bankruptcy arch-swindler and paedophile left in his wake

After a history of hiding in shadows of influence, the story of how a billionaire paedophile escaped justice even when his alleged victims neared closure

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.At the beginning, middle and end of his career, Jeffrey Epstein faced a reckoning with his misdeeds. At every stage, he managed to avoid the efforts of prosecutors and victims to confront him with his financial chicanery and sexual abuses. On Saturday, he apparently chose to end his life rather than face what he had done.

Epstein’s death by hanging in his cell in a New York jail appears to be a macabre final escape in a long series of evasions by a fabulously wealthy financier and convicted sex offender who used his private jet and Palm Beach, Florida, parties to lure presidents and plutocrats into his orbit.

Equal parts charismatic and devious, he was a Wall Street washout with a knack for numbers and, according to those who worked with him, a mind set on deceit.

From his beginnings as a college dropout who scored a job as a math teacher at a Manhattan prep school to his career as a millionaire adviser to some of the nation’s top corporate executives and politicians, Epstein acted as if the rules of life did not apply to him.

A decade ago, he avoided a long prison sentence even after police and prosecutors amassed an enormous array of evidence showing that he regularly abused girls at his Palm Beach mansion and on a Caribbean island that he’d bought.

In that case, as at several pivotal points throughout his life, Epstein avoided the law by deploying some of the nation’s most famous lawyers and leaning on friendships with powerful figures in politics, business and academia.

Epstein’s ability to slip away even when those around him are held to account reaches back to well before he’d accumulated any fortune. Epstein, who died at 66, reported to federal authorities recently that he was worth $559 million, but some of his associates contend he had much more than that hidden overseas; others wonder whether he had anything close to that sum.

Whatever the truth, he worked to build the impression that he was wealthy and influential, helping him connect with powerful people who for many years defended his character when rumours emerged that he was abusing women and girls.

The story of Epstein’s first great escape is a tale of financial wizardry and brazen criminality, in which hundreds of thousands of Americans lost their retirement money, their life’s savings, on an investment intended to enrich only its creators.

“That money would have been my real retirement,” said Veriena Braune, a 91-year-old retired teacher in Granbury, Texas, who invested all of her savings – $112,000 – in bonds that a young Epstein sold for his partner, Steven Hoffenberg. She lost every penny of the money.

“Somebody should know: that Epstein did a number on a little teacher in Texas,” Ms Braune said.

Mr Hoffenberg, who headed up the investment scheme and spent 18 years in prison because of it, said in an interview with The Washington Post this week that Epstein was “the architect of the scam.” Federal prosecutors agreed. Yet Epstein was never charged. His name, initially included in prosecutors’ descriptions of the scheme, quickly vanished from the record.

“I thought Jeffrey was the best hustler on two feet,” Mr Hoffenberg said. “Talent, charisma, genius, criminal mastermind. We had a thing that could make a lot of money. We called it Ponzi.”

Mr Hoffenberg pleaded guilty in 1995 to mail fraud, obstruction of justice and tax evasion in two scams – one designed to misuse the assets of two Illinois insurance companies and the other fleecing more than $460 million from about 200,000 investors who bought notes and bonds from Mr Hoffenberg’s Towers Financial Corp.

“Last year, I got a call at home from no less than Steven Hoffenberg,” said Marvin Gerber, another victim of the scam and a tour operator on Long Island who lost about $250,000 that he’d invested in promissory notes that Epstein and Mr Hoffenberg were selling. “He said he sat in jail for years trying to figure out how he was going to get the money to give back to the people who lost it.

“He said he was going to try to get it from the guy who absconded with the money – Epstein. But of course, I got nothing. From the very start, I was screwed.”

Last year, two of the victims in the scam filed suit against Epstein seeking the return of their original investments. Two months later, they dropped their suit.

Epstein’s career in finance started at Bear Stearns, the investment banking firm that hired him away from his job teaching math at the Tony Dalton School. It may have helped that he came to Bear Stearns after having tutored the son of the firm’s chairman.

He quickly rose to become a limited partner but left the company suddenly in 1981. Epstein later testified in a Securities and Exchange Commission investigation that some people at the firm thought his departure had to do with “an illicit affair with a secretary,” but Epstein said he had been questioned by his bosses about an improper loan he’d made to a friend to buy stock.

He spent the next few years on his own, trying to build a money management practice known as J. Epstein & Co. In 1987, he met Mr Hoffenberg.

In the late ‘80s, Hoffenberg was, by his own account, a schemer. “I was always under investigation,” he said. From afar, he seemed successful – he briefly owned the New York Post, and he rented a floor in Trump Tower. “Donald’s crowd was my crowd,” Mr Hoffenberg said.

But much of Mr Hoffenberg’s career involved schemes to separate investors from their money. He figured Epstein had the smarts to help him do that on a much bigger scale.

Mr Hoffenberg said he was introduced to Epstein by Douglas Leese, a British arms dealer. “The guy’s a genius,” Mr Hoffenberg said Mr Leese told him. “He’s great at selling securities. And he has no moral compass.” Mr Leese did not respond to messages seeking comment.

Between about 1987 and 1993, Epstein worked for Mr Hoffenberg, who paid him $25,000 a month and gave him a $2 million loan in 1988 that Epstein would never have to pay back, according to court documents.

Mr Hoffenberg’s firm, Towers Financial, started out as a collection agency, buying bills that were owed to other firms and collecting as much of the unpaid debts as it could. In 1986, after adding business units in finance and leasing, Towers reported nearly 1,200 employees and nationwide sales of $95 million.

Mr Hoffenberg – like Epstein a Brooklyn native who never finished college – was on his way to acquiring many of the trappings of New York’s financial elite, including chauffeured luxury cars, speedboats and a 72-foot yacht.

But in 1987, Towers began constructing one of the largest frauds in history. The scheme began when Towers acquired the parent of two insurance companies, Associated Life Insurance and United Fire. Then, Towers launched a takeover attempt against Pan Am, the once-proud but then-struggling airline.

To boost its chances, Towers told the SEC that it had an expert on its team: Epstein. Towers called him “a financial advisor who has been familiar with Pan Am for approximately six years” and was now advising Towers.

What neither regulators nor Pan Am knew was that, as Mr Hoffenberg admitted later in court, Towers had begun devising a classic Ponzi scheme, named for a swindler who defrauded investors by moving money back and forth to create the false impression that profit was being made.

After acquiring the insurance companies, Towers began siphoning funds from them to make its bid for Pan Am look viable. Mr Hoffenberg and Epstein also began pulling out hundreds of thousands of dollars for themselves, court documents show.

Mr Hoffenberg issued more than 50 checks from the insurance companies to pay his stepdaughter’s tuition, expenses on his private plane and monthly $25,000 checks to Epstein.

“I advanced money to Epstein perpetually because I thought this thing could work,” Mr Hoffenberg said. “He could sell anything. People loved him.”

When the airline takeover failed, the insurance companies faltered. Then, in 1988, Towers took another $1.8 million from the insurers and used it to attempt another airline takeover, of Emery Air Freight. Towers filed fake financial information to accountants and investors to cover its tracks, according to court records.

That takeover also failed, leaving the insurance companies insolvent. The looting of the two insurers left 4,000 Illinois customers out $9 million that had been set aside to cover their medical bills. Another 2,200 Ohio customers lost about $1.8 million.

The Illinois Department of Insurance placed the companies in receivership. The state and the SEC sued Towers.

But Mr Hoffenberg and Epstein weren’t done. According to prosecutors, they expanded the fraud dramatically. Beginning in 1988, Towers began selling more than $270 million worth of promissory notes, offering returns of 12 to 16 percent and marketing them largely to people of modest means, among them widows, retirees and people with disabilities.

Mr Hoffenberg and his company used several million dollars from those investors to show Illinois regulators that they were putting sufficient capital into the insurance companies to guarantee that those insurers could cover claims. But that money actually wasn’t available to pay claims because it had been used in the efforts to take over the airlines.

“I call it a turnover,” Mr Hoffenberg said this week. “You raise a dollar here, you pay a dollar there. Epstein was brilliant at this.”

Sometimes, the machinations went very wrong. The money Towers used to try to buy control of Emery Air Freight was lost when Emery’s stock price plummeted.

By 1993, prosecutors in Illinois and New York who had spent years investigating Mr Hoffenberg’s companies were ready to spell out their findings.

In front of a grand jury in Chicago, federal prosecutor Edward Kohler walked Mr Hoffenberg, who had just agreed to cooperate with the government, through the design of the scam. In the narrative Mr Kohler laid out, Epstein was the technical wizard who kept the money moving around to support Mr Hoffenberg’s various schemes.

Over and over, Mr Kohler asked Mr Hoffenberg whether Epstein had designed Towers’ scams. Mr Hoffenberg affirmed the prosecutor’s story at every turn.

“Jeffrey Epstein was the person in charge of the transactions,” Mr Hoffenberg said.

“Epstein was trying to manipulate the price of the stock?” Mr Kohler asked.

“Yes,” Mr Hoffenberg replied.

“You didn’t object to that, sir?”

“No,” Mr Hoffenberg said.

That was in November 1993. Three months later, Epstein’s name disappeared from the case.

In court hearings, FBI reports and affidavits throughout 1994 and 1995, prosecutors and FBI agents referred to Hoffenberg’s “co-conspirators,” “confederates” and “others.”

A review of court files finds no further reference to Epstein as the case moved towards a conclusion that convicted Mr Hoffenberg and sent him to prison for 18 years.

Mr Kohler, still a prosecutor in the U.S. attorney’s office in Chicago, declined to comment on why Epstein was removed from the case.

“All I can tell you is it was 25 years ago,” Mr Kohler said this week. “I really haven’t thought about it since then.”

Other prosecutors who worked on the cases said that Mr Hoffenberg was always their primary target and that Epstein was removed from the government’s narrative because he cooperated with prosecutors.

“Epstein was not the focus of what we were doing,” said Barry Gross, who represented the Illinois Department of Insurance in the case against Mr Hoffenberg. “We were trying to take over these insurance companies and eliminate the Mr Hoffenberg management to protect the policyholders.

“Epstein was someone Mr Hoffenberg favoured, and he transferred substantial insurance company funds to Epstein. If you’re looking at Epstein’s mysterious accumulation of wealth, it sounds right that this is the place to start. But Epstein was never our focus.”

Mr Hoffenberg also cooperated with the government, beginning in March 1993. But his deal collapsed in early 1994, when, according to testimony by prosecutor Daniel Nardello, Mr Hoffenberg violated the agreement by starting three new collection agencies and lying about it to prosecutors – effectively continuing the scheme that got him in trouble in the first place. Through a spokesman, Nardello declined to comment.

One month after the government presented its version of the case with Epstein as a major player, Mr Hoffenberg admitted to prosecutors that “he had lied to the government in an effort to find a way to support his family,” Nardello wrote in an affidavit. Nardello moved to terminate the government’s deal with Mr Hoffenberg.

Amy Millard, a federal prosecutor in New York who handled the case during sentencing, said Mr Hoffenberg’s repeated lying made it difficult to rely on anything he said. She pushed to revoke his bail and move forward with the charges.

“I did not think he was a credible witness,” she said. Mr Hoffenberg was hospitalized with depression in 1970; a psychiatric exam when he was sentenced in 1996 concluded that although he was narcissistic, he was “well oriented” and not “disturbed or impaired.”

Why Mr Hoffenberg did not give prosecutors details of Epstein’s role in the scheme as part of his bid for a reduced sentence remains something of a mystery.

Gary Baise, a Washington lawyer who represented Mr Hoffenberg during his incarceration, said the judge in the case, Robert Sweet, told him years later that the purpose of the long sentence was to get Mr Hoffenberg to give up co-conspirators. Sweet died this year.

“Judge Sweet did not like the idea that he had sentenced Steven to 18 years, but he said, ‘By golly, I was trying to break him,’ “ Baise said. “He couldn’t figure out why Steve didn’t blow the whistle on Epstein or others.”

Baise said he also couldn’t figure it out. Clearly, any friendship between the two men had ended. After Mr Hoffenberg was released from prison in 2013, Baise and his wife met Mr Hoffenberg in New York, where the newly freed man unexpectedly offered to take them to Epstein’s townhouse.

Baise said a young woman greeted them at the door, took their names and disappeared inside. When she returned, Baise said, she slammed the door in their faces.

Four other Towers executives were convicted of roles in the fraud, generally serving little or no jail time.

Mr Hoffenberg said he had decided he could not rat out a partner. He said variously that he was under threat from Epstein to remain silent and that prosecutors faced similar pressure to drop Epstein from their case. Mr Hoffenberg offered no evidence for his allegation, which Nardello, the prosecutor at the time, called “desperate and ludicrous. . . . Hoffenberg’s insinuations reflect only on his apparent ability to project his corrupt view of the world onto others.”

Mr Hoffenberg said Epstein’s role in the scam eats at him. “He got away with it because I didn’t cooperate,” Mr Hoffenberg said. “How could you remove the architect of the crime from the story of the crime? I screwed myself, but I also got in bed with the wrong set of criminals. The whole thing blew up, but he wasn’t touched.”

Frail and in ill-health, Mr Hoffenberg says his last goal in life is to reimburse investors who lost money in the Towers scam. He intends to do that with Epstein’s money. “Every dollar Epstein has raised since leaving me has been tainted because everything came from the money he stole in Towers,” Mr Hoffenberg said.

In 2016, Mr Hoffenberg and some of his victims joined forces to file suit against Epstein, seeking restitution. But when a judge expressed skepticism that Mr Hoffenberg could legally be part of a class action with his own victims, Mr Hoffenberg withdrew the suit.

Some of the victims say they believe Mr Hoffenberg is truly remorseful. Others aren’t buying it.

“The concept of Hoffenberg being penitent is pure theatre,” said Gross, the lawyer who represented Illinois in the insurance case.

“I’m not looking to clear my name,” said Mr Hoffenberg, who was interviewed in his room at Stamford Hospital in Connecticut, where he was awaiting surgery. “I’m 74, I’m in a hospital bed, what do I have to gain? I owe people half a billion dollars. The only way they get paid is with the money that Epstein took, which originally comes from the Towers scam.”

But although Mr Hoffenberg claims to know where Epstein stashed his money overseas, he has not contacted law enforcement and doesn’t plan to. “They know my number,” he said.

The Washington Post

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments