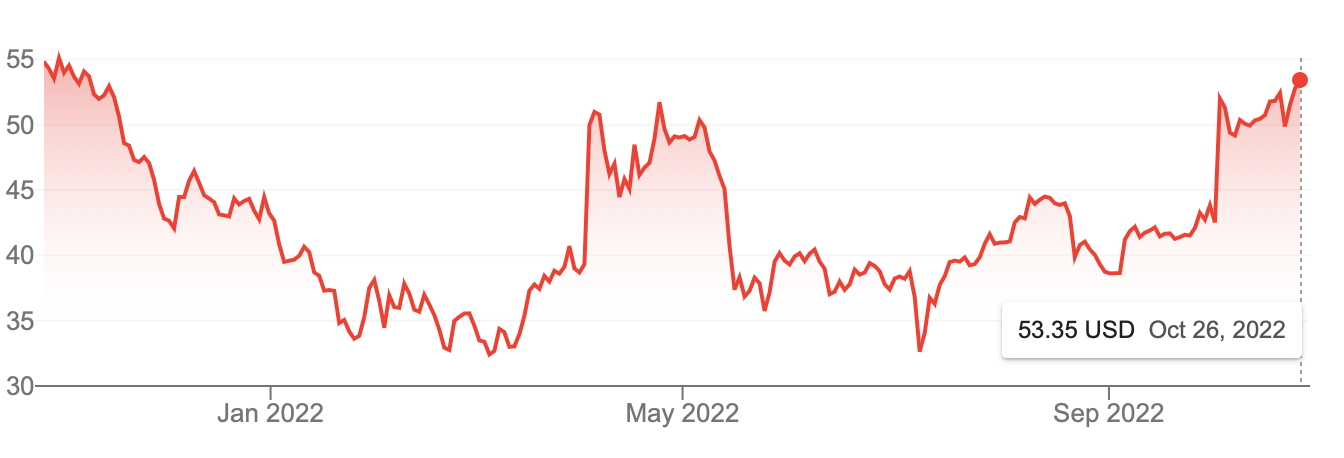

How Elon Musk’s Twitter takeover impacted its share price

Billionaire’s six month dalliance with purchasing social media platform has caused its stock price yo-yo

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.In March this year, Twitter’s share price was tanking.

A combination of inflation fears and increasing interest rates saw advertising spending on the social media platform plunge, causing Twitter’s stock price to fall from around $63 at the height of the bull market in November to under $33.

But unbeknownst to shareholders, one of Twitter’s most prominent and active users had been quietly buying up shares in the company for several months.

Elon Musk began accumulating Twitter stock in January, and by mid-March he had amassed a five per cent stake in the company.

He then began having conversations with Twitter CEO Parag Agrawal and his pal and company founder Jack Dorsey about joining the board.

On 4 April, Musk revealed in a regulatory filing that he had become the company’s largest shareholder after acquiring a 9 per cent stake worth about $3bn.

News of Musk’s investment in the company caused the share price to soar to nearly $50.

Musk then offered to buy the company for $54.20 per share, before saying he was placing the deal “temporarily on hold” and subsequently taking legal action to try to renege on the deal.

The share price has been yo-yoing ever since.

When Twitter sued to enforce the deal in July Musk counter-sued, causing the stock to plunge back to the mid-March depths of $33.

Every twist and turn in the legal drama playing out in the Delaware Chancery Court brought more price volatility.

Then in a sudden about-face on 4 October, Musk offered to go through with his original offer to buy Twitter for $44bn.

After a temporary trading halt, the share prices surged by more than 12 per cent. Twitter accepted the deal, allowing both parties to avoid a costly litigation process, and the share price has hovered above $50 ever since.

Shareholders readily accepted the offer, which was expected to be finalised as early as Thursday, a day before a court-imposed deadline to take Twitter into private ownership.

On Wednesday, Musk showed up to Twitter’s San Francisco headquarters carrying a porcelain sink.

“Entering Twitter HQ – let that sink in!” Musk tweeted with a video of him entering the Twitter lobby.

He also changed his Twitter bio to “Chief Twit”, signaling the takeover deal was imminent.

When the stockmarket open Thursday morning, Twitter stock rose to one per cent to $53.90, just short of the $54.20 sales price.

Musk will provide much of the $44bn, a significant chunk of his estimated $220bn fortune, which has largely been funded largely through sales of Tesla stock.

He has also leant on a consortium of investors including Larry Ellison, Saudi Arabian Prince Alwaleed bin Talal Al Saud, Qatar Holding, which is part of the Qatar Investment Authority, and Binance, the world’s largest cryptocurrency exchange, have all chipped in.

Major banks have committed to provide $12.5 billion in debt financing.

With other tech companies having seen hundreds of billions wiped from their share price since Musk initially made his offer, experts agree he is paying well above fair market value for the company.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments