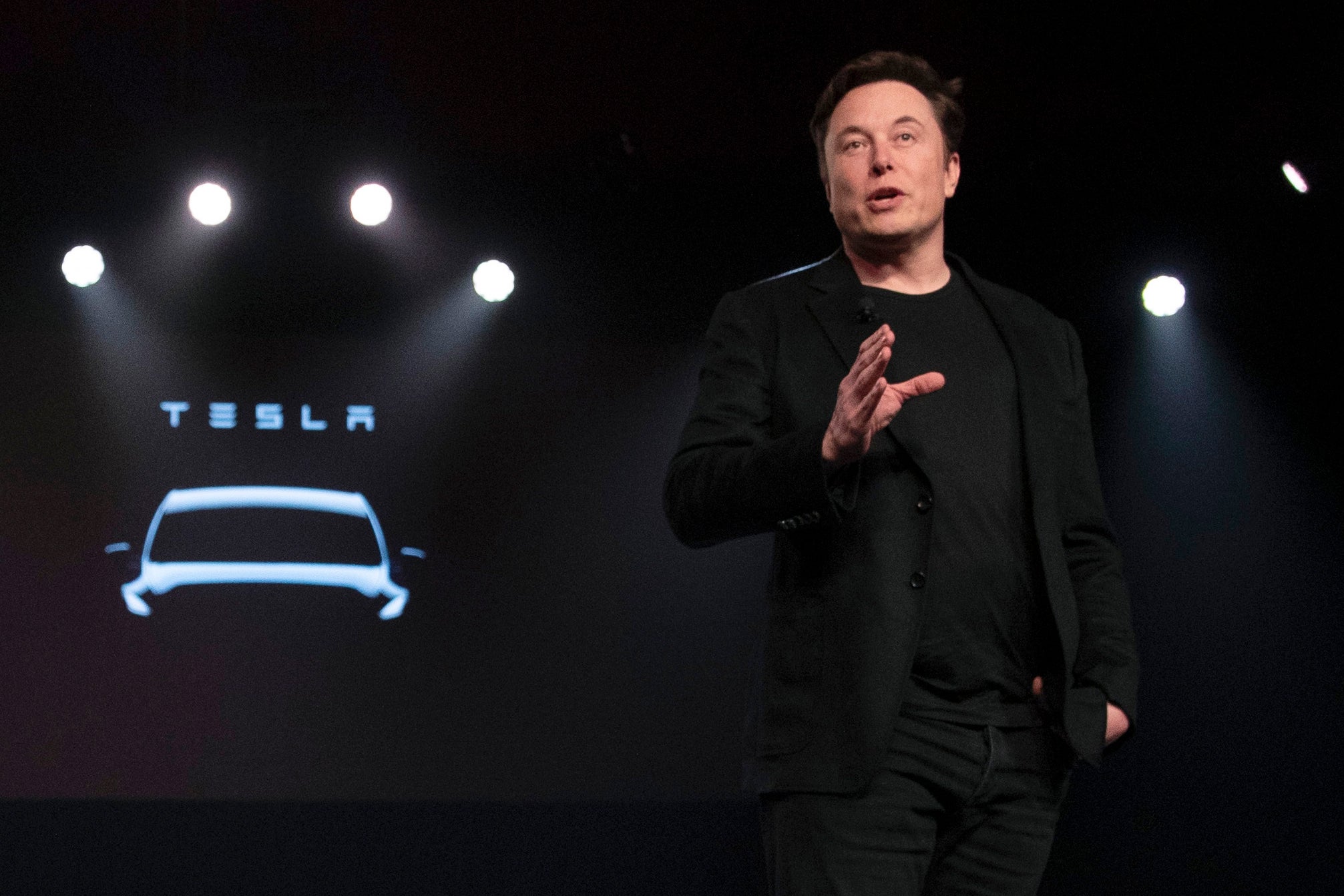

Elon Musk sells $7B in Tesla shares ahead of Twitter fight

Elon Musk has sold nearly $7 billion worth of shares in Tesla as the billionaire gets his finances in order ahead of his court battle with Twitter

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Elon Musk has sold nearly $7 billion worth of shares in Tesla as the billionaire gets his finances in order ahead of his court battle with Twitter.

Musk disclosed in series of regulatory filings that he unloaded about 8 million shares of his company Tesla Inc. in recent days.

“In the (hopefully unlikely) event that Twitter forces this deal to close and some equity partners don’t come through, it is important to avoid an emergency sale of Tesla stock," Musk tweeted late Tuesday.

Musk is by far the largest individual shareholder in both Tesla and Twitter.

Shares of Tesla rose almost 2% before the opening bell Wednesday. Shares of Twitter Inc., up 16% in the past month with most believing Musk faces long-shot odds of success in court, jumped another 3%.

Musk countersued Twitter last week, accusing the company of fraud over his aborted $44 billion acquisition. He claimed that Twitter held back critical information and misled his team about the size of its user base.

Musk alleges that Twitter committed fraud, breach of contract and violation of a securities law in Texas, where Musk lives.

Musk offered to buy Twitter earlier this year, then tried to back out of the deal claiming the social platform was infested with a larger numbers of “spam bots” and fake accounts than Twitter had disclosed.

Musk said in the spring that he planned no major sales of his stake in Tesla after lining up financing to acquire Twitter, but Dan Ives, an industry analysts with Wedbush, said Wednesday that “the situation has dramatically changed.”

Wedbush raised it's target price for shares of Twitter, “With the chances of a Twitter deal now more likely in our opinion and the Street seeing through this poker move by Musk,” Ives wrote to clients.

“We can also see Musk trying to resolve this powder keg situation before the Twitter deal officially heads to court in October,” Ives wrote. “At a minimum, we see Twitter getting a massive settlement from Musk in the $5 billion to $10 billion range that is starting to be factored into the stock.”