Donald Trump’s deal to create 50,000 jobs in America looks a lot different on Day Two

Donald Trump boasted that without his election win, America would lose out on 50,000 more jobs. But that's far from the full story

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

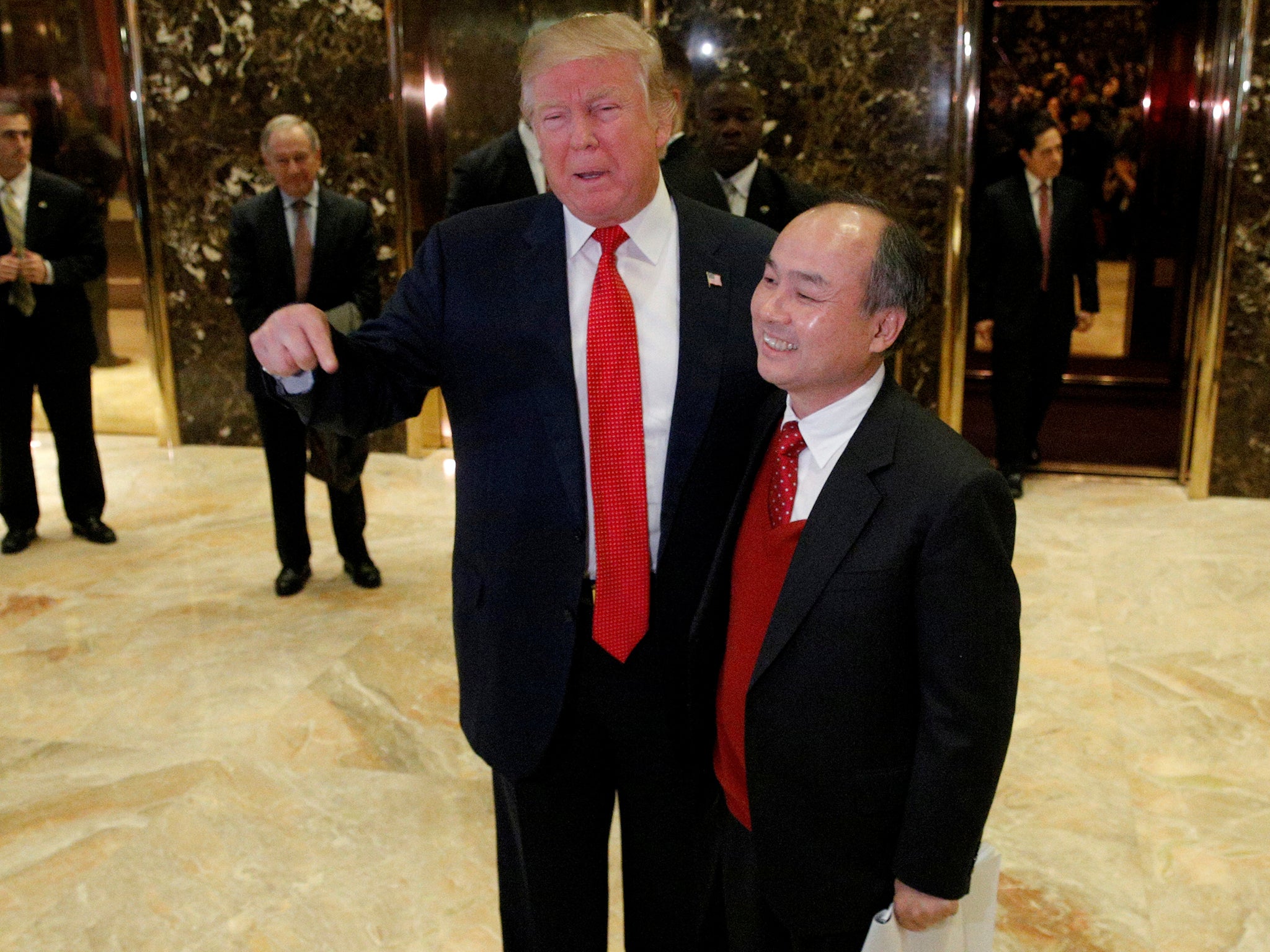

Your support makes all the difference.When President-elect Donald Trump announced Tuesday that Japanese corporate giant SoftBank had agreed to invest $50 billion in the United States and create 50,000 new jobs, he presented it as a triumph for American workers. But economists and analysts who have been scrutinising the announcement suggest it might be a bigger win for the Japanese telecom and Internet conglomerate, SoftBank, and its billionaire founder, Masayoshi Son.

Analysts said the Japanese company could be angling for lucrative benefits, including the regulatory approval to carry out one of the largest telecom mergers in recent history, between Sprint, which SoftBank owns, and rival carrier T-Mobile. It could also be cultivating a friendly environment for further technology investments Son is seeking to make in the United States.

“I think Son must have thought how to use Trump and this opportunity” for his business, said Mana Nakazora, chief credit analyst at BNP Paribas Securities.

Shares of SoftBank Group rose 6.2 percent on the Tokyo Stock Exchange on Wednesday to close at their highest level in more than a year. Shares of Sprint Corp. rose nearly 9 percent on Wednesday, while T-Mobile’s stock climbed more than 4 percent. Collectively, the companies added billions of dollars in market value after the announcement.

Trump said Tuesday on Twitter that Son said he would not have made the investment if Trump had not won the election.

But analysts said the $50 billion investment would probably come from a $100 billion fund created by SoftBank and the Saudi government - Son said as much to the Wall Street Journal - and that much of the fund might have been destined for the United States anyway.

SoftBank announced in October that it would dedicate at least $25 billion toward the $100 billion “SoftBank Vision Fund” to invest in global technology companies in the next five years. Saudi Arabia's public investment fund pledged to invest up to $45 billion in the same time period, with the additional $30 billion coming from outside investors.

“Son must have intended as much as half of the Vision Fund to go to the US, as he's aware that there are great companies in Silicon Valley. But he chose this time to announce it as Trump is now going to be the next president,” said Jun Tanabe, a SoftBank analyst at JPMorgan Securities in Tokyo.

“Mr. Son already created the $100 billion fund and chose to invest $50 billion into the US. I suspect he would have done this whether the winner was Trump or Hillary,” Suzuki Kazuto, a professor of international political economy at Japan's Hokkaido University, tweeted Wednesday.

A SoftBank spokesman declined to comment on whether the funds would be coming from the SoftBank Vision Fund or give further information regarding the investment. A Trump spokesman did not respond to requests for comment.

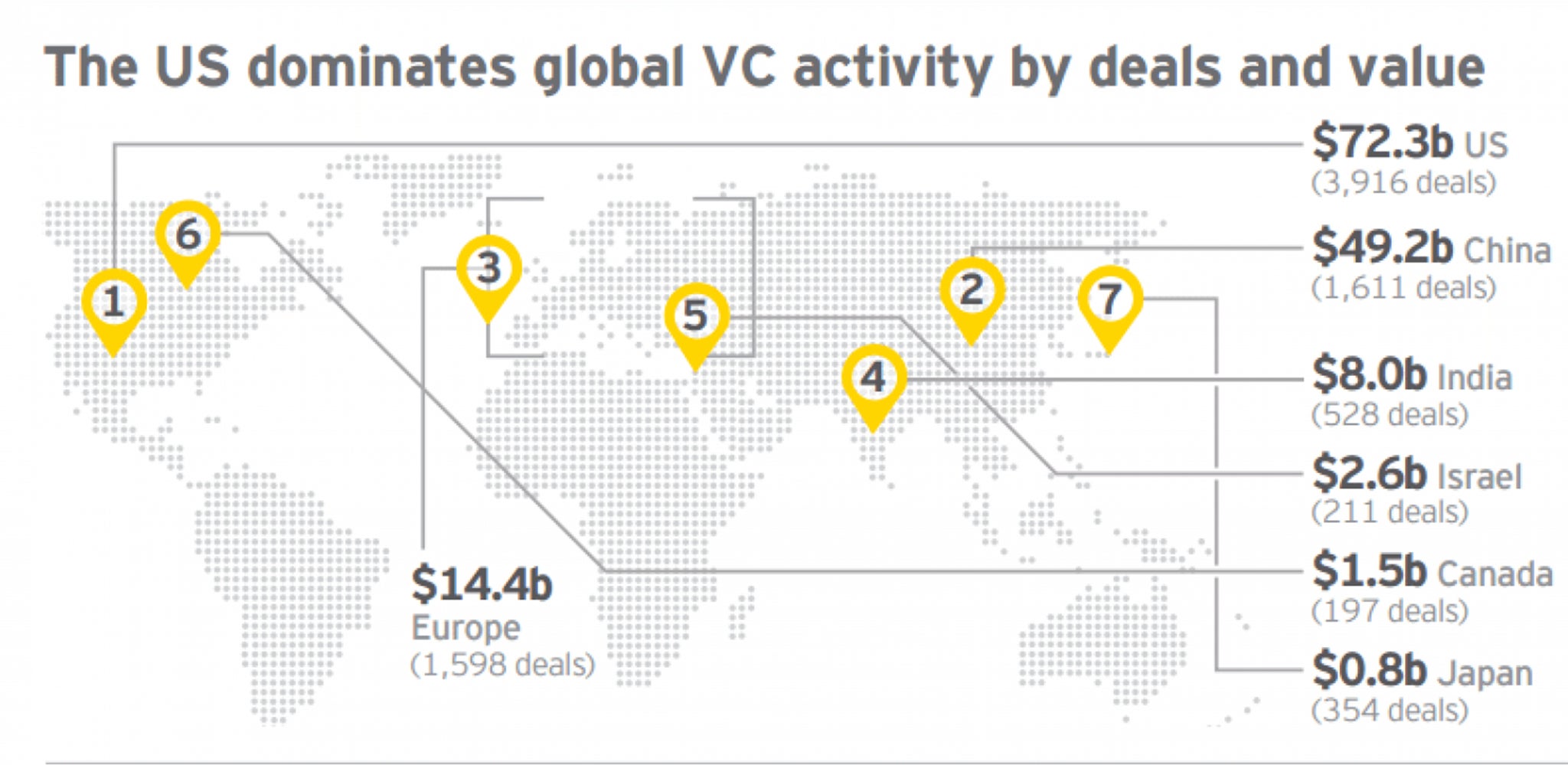

Analysts suggested it would be difficult to deploy $100 billion in investment in global technology without looking largely to the United States and Silicon Valley. In 2015, for example, venture capitalists invested $148 billion worldwide in 8,381 deals, according to consulting firm EY. The United States accounted for about half of that investment.

“In 2016 so far, about 60 percent of all venture capital in the world has gone to the US,” said Jeff Grabow, US venture capital leader for EY. “The US would be the first place anybody would look.”

Analysts said Son may be seeking to improve the chances of a merger between SoftBank’s Sprint and T-Mobile, a deal that would create a mobile carrier larger than Verizon and almost as big as AT&T. Sprint and SoftBank abandoned an effort to purchase T-Mobile in 2014 - a deal valued at about $32 billion - after the Federal Communications Commission signaled the deal might violate antitrust laws.

Trump will be responsible for appointing the next chairman to the FCC. Speaking from the lobby of Trump Tower on Tuesday, Son said that he wanted to celebrate Trump’s election “because he would do a lot of deregulation.”

“SoftBank’s original plan may come true with the new FCC chairman,” Naoshi Nema, analyst at Cantor Fitzgerald, said in a note.

Analysts also speculated the deal could be an effort to smooth the way for other investments in the United States in the future, and specifically ward off the suspicion that sometimes surrounds foreign investment.

“It's possible that the SoftBank Vision Fund, the money coming from overseas, will start investing in American companies one after another, so there's a risk that Trump might criticise the move,” said Hideaki Tanaka, senior analyst at Mitsubishi UFJ Morgan Stanley Securities.

Instead, Son first paid his respects to Trump by showing that SoftBank would be investing in American start-ups and hiring locals, Tanaka said: “This could help SoftBank do its business in the US more smoothly. It could give an impression that his company is friendly to the US.”

In the past two months, Trump has taken an unusual new approach toward companies, negotiating with the air conditioner and furnace manufacturer Carrier to keep more than 1,000 jobs at an Indiana furnace factory from moving to Mexico, and singling out gear-maker Rexnord on Twitter for plans to move to offshore facilities. He has threatened US firms that outsource jobs with “retribution,” and proposed a 35 percent tariff against those that do take jobs offshore.

Some lawmakers and Trump allies have celebrated the deal with Carrier. Peter Wallison, former White House counsel under President Ronald Reagan and a fellow at the American Enterprise Institute, said there isn't enough evidence yet to say that Trump will continue to call out companies. “We haven’t yet seen a real policy that would suggest to me that is the way he is going to conduct his presidency,” he said.

But others have argued that Trump's actions represent the beginning of a policy of negotiating with companies on an individual basis, which in turn will create an incentive for companies to threaten to send jobs overseas in exchange for deals at home. Indiana agreed to $7 million tax subsidies to save the Carrier jobs.

In a Washington Post op-ed last week, former Democratic presidential candidate Senator Bernie Sanders (I-Vt.) criticised Trump for delivering Carrier tax and regulatory favors in return for keeping jobs in the country, arguing that the practice could allow companies to hold Trump “hostage.”

“[Trump] has signaled to every corporation in America that they can threaten to offshore jobs in exchange for business-friendly tax benefits and incentives. Even corporations that weren’t thinking of offshoring jobs will most probably be re-evaluating their stance this morning,” Sanders wrote.

Matthew Mitchell, a senior research fellow at the libertarian Mercatus Center, says it's unclear what direct benefits SoftBank may receive from the Trump administration, if anything. But he added that the president shouldn't be involved in the investment decisions of individual companies, because it risks encouraging inefficient company investments and wasting taxpayer money.

“I think we’re getting into this world now where there’s no longer a taboo about picking winners and losers. And to me, that’s a big concern, because institutionally that’s in some way what has set the US apart from banana republics,” he said.

The Washington Post

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments