Disgraced crypto boss Sam Bankman-Fried faces up to 110 years in prison at sentencing on fraud charges today

Former FTX head was found guilty on seven charges that carry maximum sentencing of 110 years

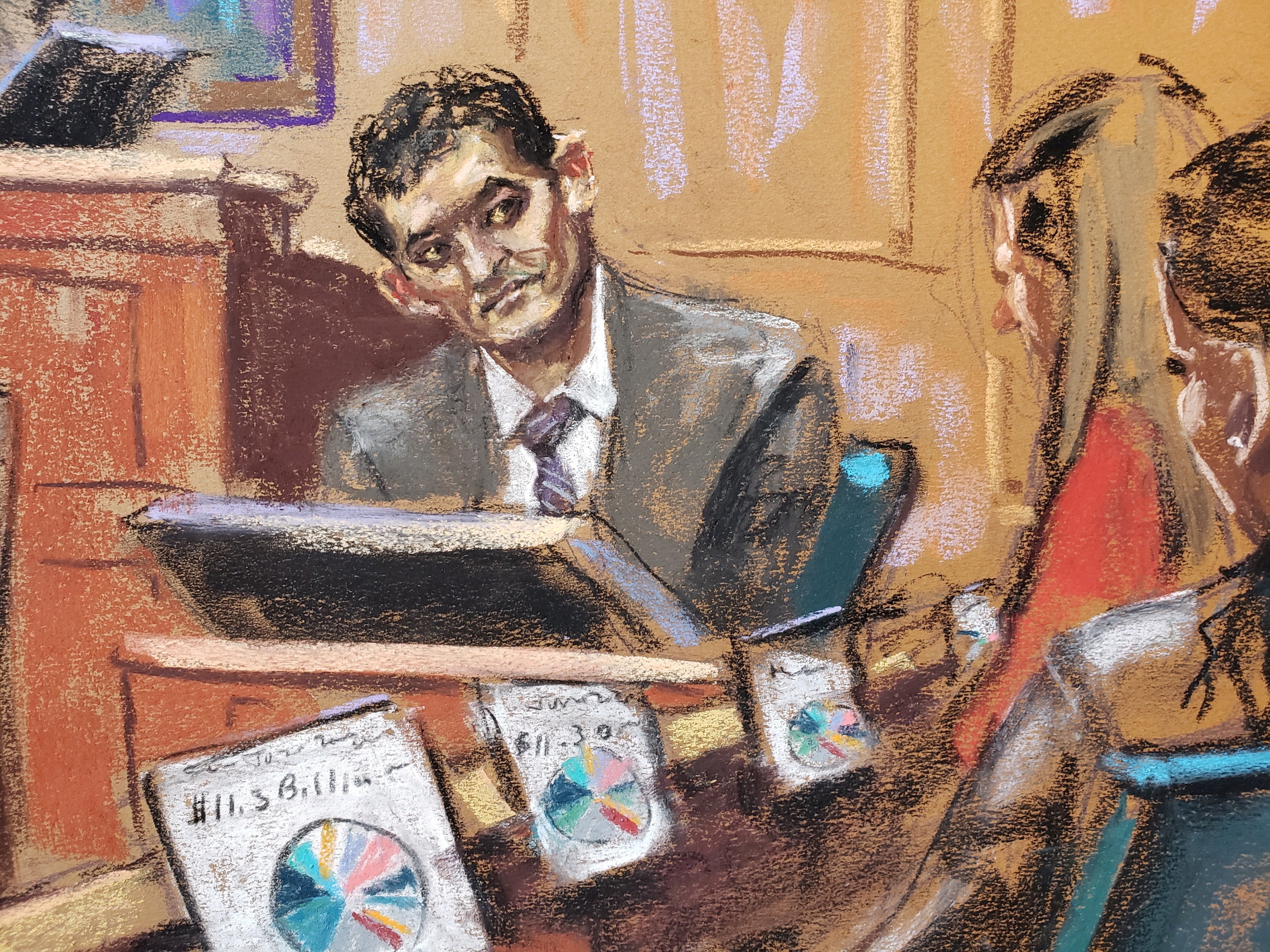

Sam Bankman-Fried, the former billionaire entrepreneur who founded the now-bankrupt cryptocurrency company FTX, will appear in a Manhattan federal court today to be sentenced on a slew of fraud and conspiracy charges.

Just four months ago, a jury determined that Bankman-Fried, 32, had lied to FTX investors, lenders and customers and used their money to build himself up as the “King of Crypto”.

He was convicted on a total of seven charges: two counts of fraud and five counts of conspiracy.

On Thursday, Bankman-Fried will return to court where District Judge Lewis Kaplan will hand down a sentence of up to 110 years in prison,

Federal prosecutors have asked Judge Kaplan to sentence him to between 40 and 50 years. Bankman-Fried’s lawyers meanwhile have pushed back on that, saying no more than 6.5 years is appropriate given he is a non-violent first offender.

Judge Kaplan will weigh each side’s opinion as well as any supplemental letters or statements from victims of Bankman-Fried’s crimes or from people who know Bankman-Fried personally. Other factors such as the likelihood Bankman-Fried would reoffend, his current health and mental wellness as well as his age will come into play.

Less than two years ago, Bankman-Fried was on top of the cryptocurrency world as the young but inspiring leader of FTX, the crypto exchange and hedge fund with more than one million users – including a slew of famous faces.

At its peak, FTX was worth $32bn.

But everything came tumbling down, essentially overnight, in November 2022 after a concerning report by CoinDesk revealed that a majority of FTX’s assets were held by a quantitive trading company that Bankman-Fried also ran called Alameda Research.

The report led to a massive rush of customers looking to withdraw their funds from FTX, causing another problem: an $8bn hole in the company.

Bankman-Fried’s personal wealth, which he often touted as being used for altruistic matters, sharply fell and he was soon arrested.

Throughout his trial last year, federal prosecutors provided a jury with a mountain of evidence that revealed that, behind-the-scenes, Bankman-Fried had bad intentions in purposefully swindling investors, customers and lenders to grow FTX and his wealth.

Former executives attested to the horrible mismanagement of the company and testified that Bankman-Fried hatched plans to lie to investors and customers.

Meanwhile, Bankman-Fried’s lawyers set out to make the former crypto head appear unintentionally misguided in managing the company.

Following the jury’s decision in November, Bankman-Fried appealed the decision. The appeal is still ongoing.