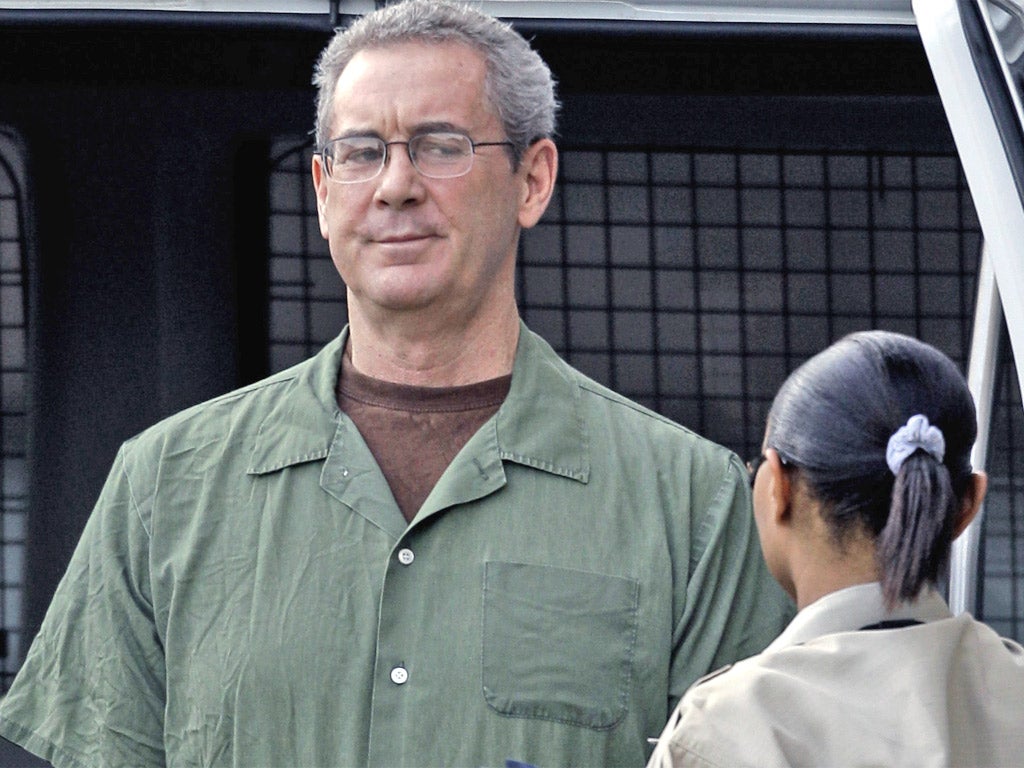

Allen Stanford had been lying to investors for 25 years, court told

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Allen Stanford was lying to employees and cheating investors as far back as 1987, a court was told yesterday.

The Texan financier produced fake deposit insurance at his Caribbean bank in order to lure investors using a London-based "shell company", the first day of his fraud trial in Houston heard.

One of the people employed to sell financial products for his first bank in Montserrat said Mr Stanford came up with a way to soothe the doubts of potential depositors who were otherwise wary about investing offshore.

The former billionaire, 61, denies 14 counts of fraud, conspiracy and obstructing regulators, and insists that the banking empire he used to sponsor Twenty20 cricket competitions was always a legitimate business.

Because offshore banks are not typically covered by government insurance that guarantees depositors' money, many potential clients refused to put their savings with Mr Stanford's Guardian Bank when it was set up in the late 1980s, said Michelle Chambliess, a former sales representative for the company. That changed when Mr Stanford returned from a trip to London with an insurance certificate from something called "British Insurance Fund Ltd", with an address in Piccadilly.

Brandishing a copy of the certificate, Ms Chambliess said: "If I went +to meet you in Mexico City, I could show you this and say, look, we have insurance."

But the US assistant attorney Gregg Costa, for the prosecution, told the court: "It's a fake insurance policy." He asked if Ms Chambliess would have used it to reassure depositors if she knew that Mr Stanford had personally set up British Insurance Fund as a shell company. "Then it wouldn't have been insurance," she said.

Ms Chambliess was the first of what is expected to be more than a dozen witnesses for the prosecution in a trial scheduled to last six weeks. Mr Stanford, who has been held in custody since 2009, faces up to 20 years in prison if convicted. The trial continues.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments