Africa's illicit money sent to Western banks

Some of the continent's leaders used the US financial system to protect millions of dollars

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Several African leaders, their relatives and associates used Western banks, including British ones, to move hundreds of millions of dollars out of their countries and into accounts and companies they controlled, according to a US Senate report released late last week.

It says that, in 2007, President Omar Bongo of Gabon brought $1m in shrink-wrapped $100 notes into the US in a suitcase; that Teodoro Obiang, son of Equatorial Guinea's president, moved "more than $100m in suspect funds through US bank accounts, including $30m to purchase a residence in Malibu"; and that, between 2000 and 2008, Jennifer Douglas, fourth wife of a former Nigerian vice-president, "helped her husband bring more than $40m in suspect funds into the US".

The banks through which these funds were channelled include Bank of America, Citibank Private Bank and HSBC. Although a number of cases are cited where banks – including HSBC – flagged up concerns about the movement of such large amounts and closed the accounts, the report also points to instances where the checks on identity and the source of the funds were less rigorous than many of us face when trading in two-figure sums at high street branches.

The report also says that a number of US professionals – lawyers, lobbyists, and estate agents – were used "to funnel millions of dollars in illicit money into the United States". It adds, in remarkably forthright language for an official report, that "politically powerful foreign officials, and those close to them, have found ways to use the US financial system to protect and enhance their ill-gotten gains".

One of the report's most startling examples is that of Teodoro Obiang, 40, now the subject of a US criminal investigation. His salary, as minister of agriculture and forestry, is $60,000 a year. Yet, between 2004 and 2008, according to the senate report, he moved "more than $100m in suspect funds through US bank accounts, including $30m to purchase a residence in Malibu and $38.5m to purchase an aircraft". The home was the sixth most expensive home bought in the US that year, and Mr Obiang's spending did not stop there.

Two US lawyers set up shell companies for Mr Obiang, and the report lists some transactions through an account for one of them, called Beautiful Vision, at Bank of America. In one four-week period in late 2004, cheques made out included: $82,900 to Naurelle Furniture; $137,312 to Ferrari of Beverly Hills; a further $332,243 to Ferrari; $80,287 to Gucci; $59,850 to "Soofer Gallery Rugs"; and a total of $338, 523 to Lamborghini Beverly Hills. Further cheques in the first half of 2005 were: $55,193 to Dolce & Gabbana, and $58,500 for the installation of a Bang & Olufsen home cinema system.

Back in West Africa, many of his countrymen have rather more pressing concerns than which home entertainment system to choose. Despite Equatorial Guinea being sub-Saharan Africa's third biggest oil producer, life expectancy for men is only a fraction more than 50 years, and the infant mortality rate is 12 times worse than in the US. Political arrangements in the country make it unlikely that Mr Obiang or his father will suffer electorally for the contrast between their lifestyles and that of their people. At the last election, President Obiang achieved 95 per cent of the vote.

And then there is President Bongo of Gabon, the man with $1m in his suitcase. Once on US soil, the cash was deposited by his daughter, Yamilee Bongo-Astier, in a safe deposit box at a New York bank. The bank closed her account soon afterwards. But, the report says, between 2000 and 2007, other accounts controlled by this unemployed student were the conduit for considerable sums of money.

Omar Bongo died in 2009 and his place was taken by his son, Ali. Both men, says the report, "amassed substantial wealth while in office, amid the extreme poverty of its citizens". US investigators discovered that Ali Bongo's wife, Inge Lynn Collins Bongo, formed a US trust in her maiden name, opened accounts in its name in California and used them to receive "multiple large offshore wire transfers... and used the funds to support a lavish lifestyle and move money along a network of bank and securities accounts benefiting her and her husband".

The report also names Jennifer Douglas, a US citizen and fourth wife of Atiku Abubakar, former Nigerian vice-president, who "helped her husband bring more than $40m in suspect funds into the United States from 2000 to 2008". In 2008, the US Securities and Exchange Commission claimed that she received bribes of more than $2m from the German company Siemens AG. She denies this, but Siemens has pleaded guilty to criminal charges relating to the payments, which it said were sent to one of her US accounts.

And the report says that Pierre Falcone, an Angolan arms dealer now serving a six-year sentence in a French jail for charges arising out of illegal arms dealing, money laundering and tax fraud, "had open access to more than 30 US bank accounts in Arizona for 18 years". Mr Falcone's home in Paradise Valley, Arizona, is now for sale with an asking price of $14.5m. The reports says that Bank of America kept 30 accounts for him and his relatives, and did not consider these to be high risk "even after learning in 2005 that he was an arms dealer and had been imprisoned in the past". Two years later, the bank closed his accounts, and "expressed regret for providing him with banking services".

The leaders involved...

Teodoro Obiang

The son of the President of Equatorial Guinea is alleged by the report to have received $110m of suspect funds, transferred illicitly through the US banking system. Mr Obiang reportedly used US proxies acting as escrow agents to buy a US-manufactured Gulfstream Jet costing $38.5m. The report identified deficiencies in US law which exempt escrow agents from money-laundering controls. The Equatorial Guinea embassy in London could not be reached for comment.

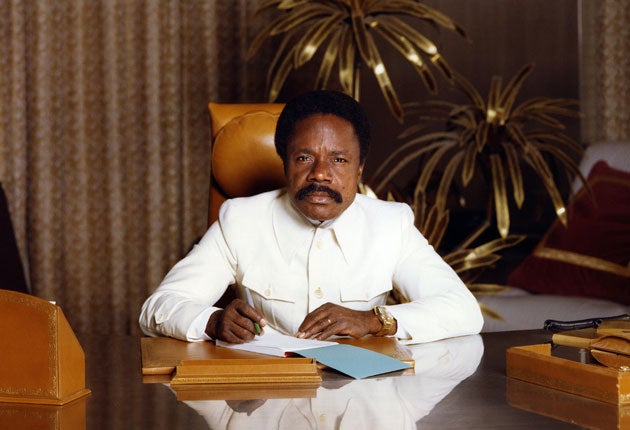

Omar Bongo

The late president of Gabon is alleged to have wired $18m to a trust controlled by his insider lobbyist as part of the effort to acquire military hardware. The report suggests that Bongo used his daughter, Yamilee Bongo-Astier, to receive millions of dollars in illicit funds. She had bank accounts closed twice, once after she received a $183,500 wire from Gabon and the other after her bank found that she had $1m in her safe deposit box. Gabon's ambassador could not be reached for comment.

Pierre Falcone

Convicted arms dealer Pierre Falcone was found by the Senate to have used family and shell accounts to import millions of dollars in illicit funds into the US. Bank of America allegedly held about 30 accounts for Falcone between 1989 and 2007 but failed to recognise him as a "politically exposed person", meaning that he was not subjected to the correct controls. BoA continued to deal with him until a Senate inquiry in 2007 and his accounts were finally suspended.

HSBC

HSBC's US operation is identified by the Senate report as having failed to spot and report some suspicious transactions and customer profiles. While the report acknowledges that some of the suspect accounts were "inherited" from legacy banks taken over by the London-based giant, certain HSBC compliance practices are singled out for criticism. HSBC is rebuked for continuing to provide services for the African Investment Bank and offshore accounts to the Angolan Central Bank.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments