Public purse losing £29m a week as a result of tax breaks for banks – TUC

The Treasury will lose at least £1.5 billion a year over the next four years, report claims.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Government’s decision to cut the banking surcharge is costing the public purse £29 million a week, unions are claiming.

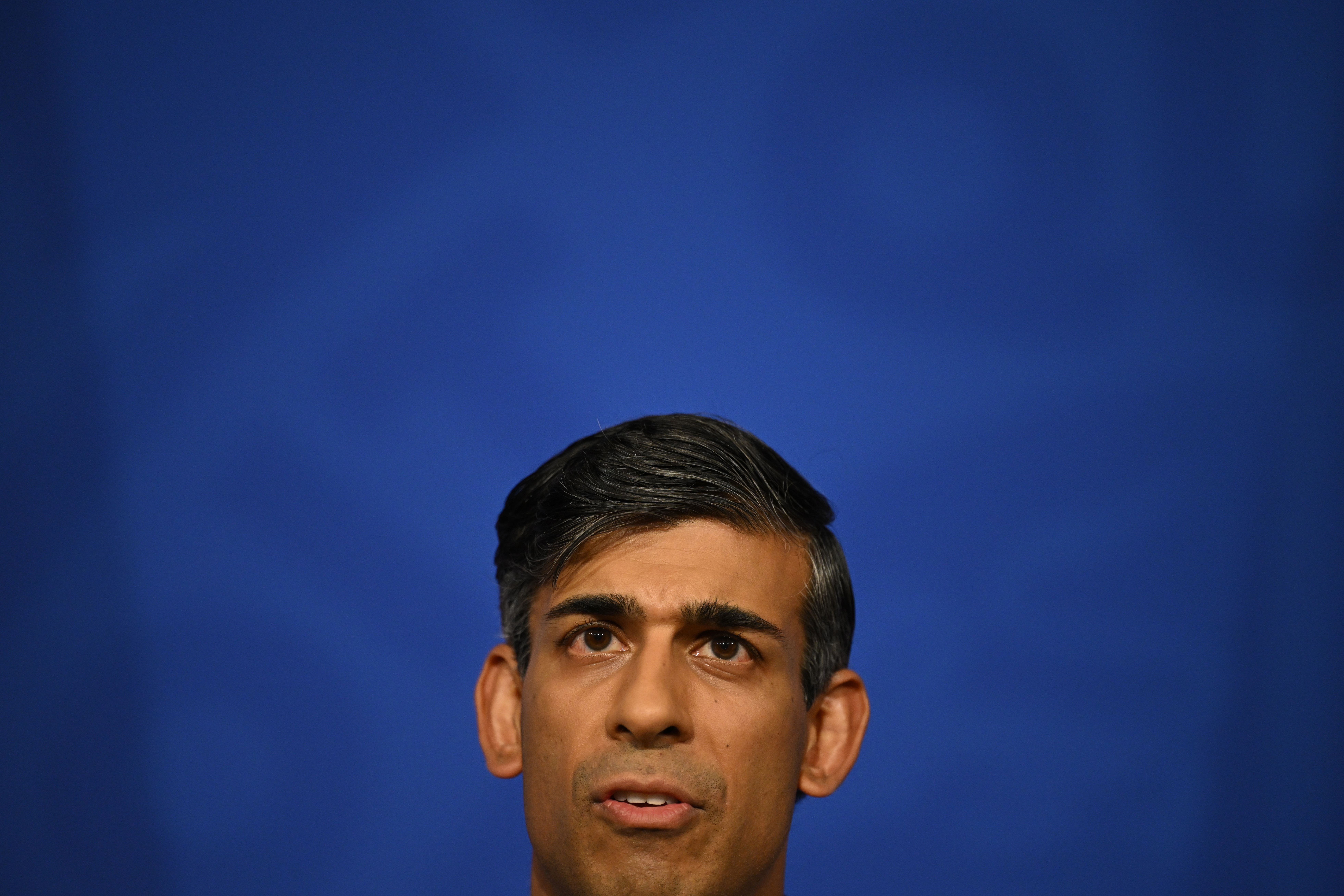

The TUC said its research estimated that the Treasury will lose at least £1.5 billion a year over the next four years as result of the change introduced by Rishi Sunak when he was chancellor.

The Prime Minister’s decision to reduce the surcharge has starved our public finances and our public services of much-needed funds at the worst possible time

The surcharge has been cut from 8% to 3%, allowing banks to make “huge profits” from rising interest rates, said the union organisation.

TUC general secretary Paul Nowak said: “At a time when our schools and hospitals are crumbling, Rishi Sunak has given a huge tax break to banks.

“Banks have enjoyed eye-watering profits over the last year and this tax cut means they have cashed in on soaring interest rates and families’ mortgage misery.

“The Prime Minister’s decision to reduce the surcharge has starved our public finances and our public services of much-needed funds at the worst possible time.”