Conservative MP warns future tax cuts ‘will come too late’

Conservative MP Richard Drax urged the Treasury to ‘go further’, as ‘lower taxes generate more cash’.

Your support helps us to tell the story

This election is still a dead heat, according to most polls. In a fight with such wafer-thin margins, we need reporters on the ground talking to the people Trump and Harris are courting. Your support allows us to keep sending journalists to the story.

The Independent is trusted by 27 million Americans from across the entire political spectrum every month. Unlike many other quality news outlets, we choose not to lock you out of our reporting and analysis with paywalls. But quality journalism must still be paid for.

Help us keep bring these critical stories to light. Your support makes all the difference.

A Conservative MP has warned future tax cuts “will come too late”.

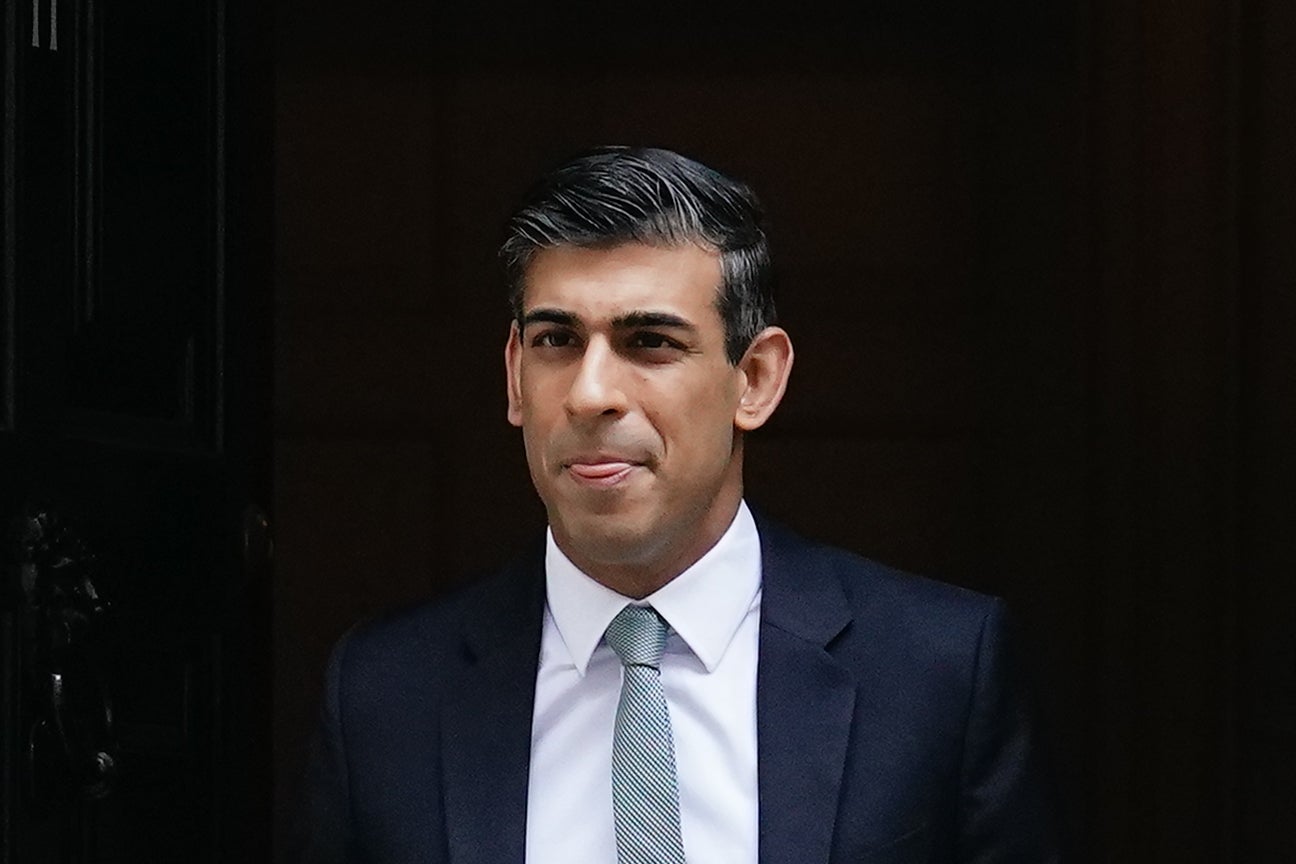

Despite Chancellor Rishi Sunak announcing he intends to lower the basic rate of income tax to 19% by May 2024, forecasts show the UK is still heading for its highest tax burden since the late 1940s.

The Office for Budget Responsibility has warned living standards face their biggest fall in a single year since records began in the mid-1950s.

Conservative MP Richard Drax urged the Treasury to “go further”, as “lower taxes generate more cash”.

Low taxes are a force for good for the individual who is far better placed to decide where to spend their money

The MP for South Dorset was speaking as the Commons debated the National Insurance Contributions (Increase of Thresholds) Bill.

The Bill will change the thresholds at which UK workers will pay national insurance. The starting thresholds will rise to £12,570 from July, aligning income tax and national insurance in a tax cut worth more than £6 billion, according to the Treasury.

The Government previously announced that a UK-wide 1.25 percentage point health and social care levy based on national insurance contributions will be introduced from April 6, ring-fenced for health and social care.

Speaking about the spring statement when the threshold increase was announced, Mr Drax said: “I applaud the Chancellor for going as far as he went, and that’s what I said in my statement yesterday. But many of my constituents in South Dorset are impoverished already.

“We have deep pockets of deprivation and poverty, and I fear that despite the generous moves by the Chancellor and the tinkering that he has done haven’t gone far enough.”

Mr Drax added: “I just want to say to the Treasury bench, with the cost of living spiralling and taxes at the highest for 70 years, can I urge them to go further? As they know full well, lower taxes generate more cash.

“It is a proven point. And something that Conservatives on this side of the house have fervently followed for as long as I can recall.”

He said: “Low taxes are a force for good both for the individual who is far better placed to decide where to spend their money, and for the private sector, which can better invest in their businesses, employ more staff and sustain a profit… and let’s not forget it is the tax from these profits, which pay for the public sector.”

“I welcome the Chancellor’s talk of more tax cuts to come, but in my humble opinion, and certainly for my constituents for the reasons I’ve stated, they will come too late,” he said.

Mr Drax also suggested he wants to see reductions in some areas of public expenditure, such as the NHS.

He said: “In the Chancellor’s statement yesterday what I didn’t hear was the good Conservative word savings. The opposition call it cuts, I call it savings. We appear to acquiesce to every demand for more money. This is taxpayers’ money and surely now it is time to review, for example, the big spenders, like the NHS and welfare.

“Of course they are both needed, but surely it is time to review both to make sure that we are getting value for money.”

He said he disagrees with the national insurance rise which would “see billions of pounds disappearing into a blackhole, followed very soon afterwards by demands for more”.

“I don’t believe, for the sake of the public finances, this can go on,” he said.

Rishi Sunak said his tax plan “delivers the biggest net cut to personal taxes in over a quarter of a century”.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.