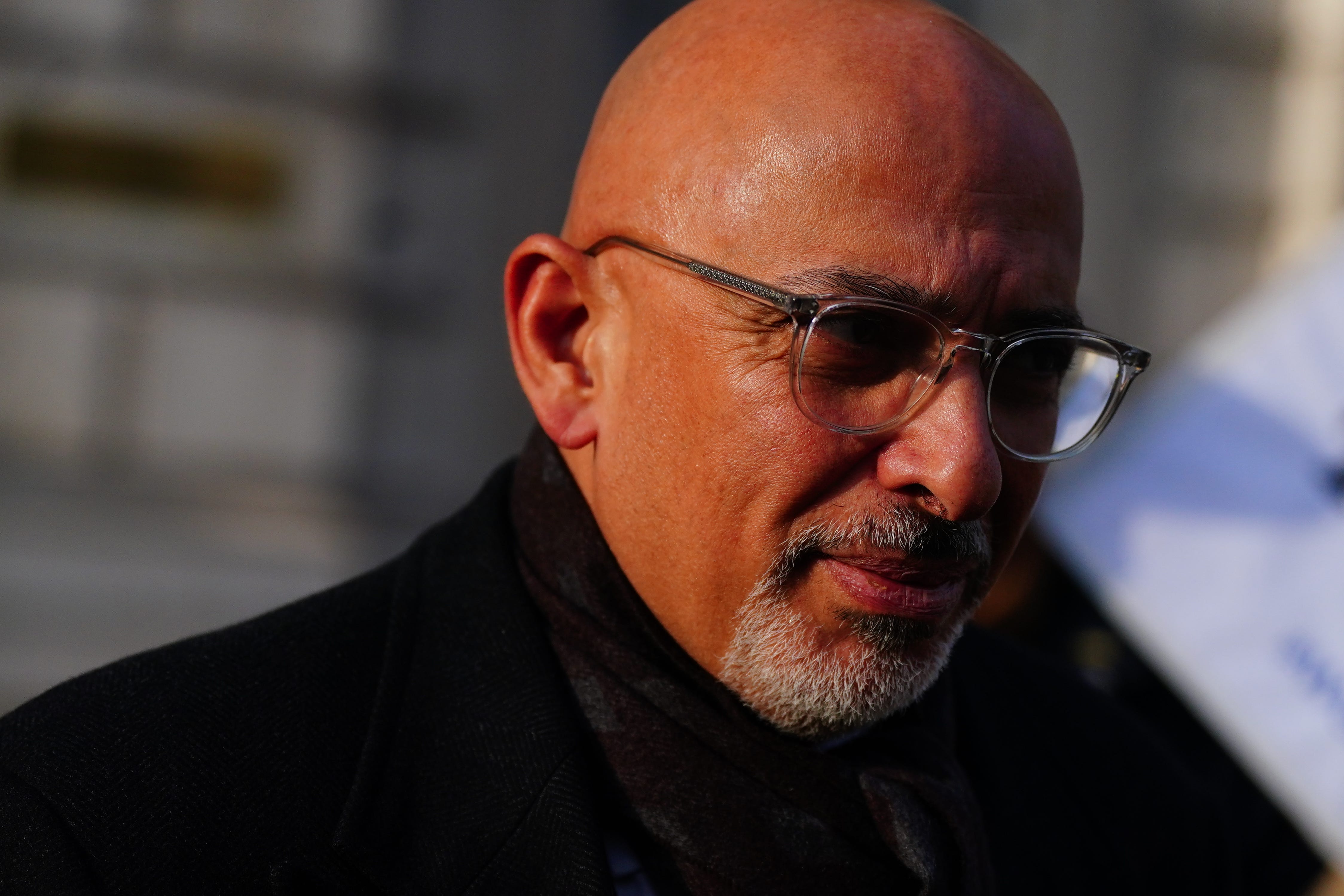

Nadhim Zahawi’s position ‘untenable’ after tax penalty reports, says Labour

Reports suggest the Conservative Party chairman has paid seven-figure sum to settle a tax dispute with HMRC

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Tory party chairman Nadhim Zahawi’s position is “untenable”, Labour has said after reports that he paid a penalty as part of a multimillion-pound tax settlement.

The former chancellor, who attends Rishi Sunak’s Cabinet, has been under pressure since it was reported that he paid HM Revenue & Customs a seven-figure sum to end a dispute.

Deputy Prime Minister Dominic Raab defended his colleague, saying Mr Zahawi “has been very clear that he’s paid all the tax that he’s owed” and “if there’s further questions… I’m sure there’ll be the proper transparency”.

Labour called for an explanation after The Guardian reported that Mr Zahawi paid a 30% penalty, taking the estimated total tax bill to more than £4.8 million.

Mr Zahawi’s team has been contacted for comment on the latest allegation.

Labour deputy leader Angela Rayner told BBC Breakfast: “The fact that Nadhim hasn’t been out on the airwaves explaining himself, to me, adds insult to injury, especially given that he called this smears at the time and sent legal letters to those that asked questions legitimately about it.

“And when you’re the chancellor, who is in charge of the tax affairs of the UK, and you’ve got a wealth of that nature, you would be expected to know about your tax affairs or to seek that advice at the time, as opposed to not paying those taxes and having to pay a penalty notice.

“I believe his position is untenable. If he’s lied and misled the public and HMRC regarding his tax affairs then I think his position is untenable.”

Mr Raab told Sky News: “I can’t speak for the personal tax affairs of a colleague, but what I would say is that Nadhim has been very clear that he’s paid all the tax that he’s owed, that he’s paid it on time, that there’s nothing outstanding due, and I think that’s of course right and proper.

“If there’s further questions, of course, I’m sure there’ll be the proper transparency.”

Asked if Mr Zahawi will still be in his post in a month, Mr Raab said: “A month’s a long time in politics. I certainly hope so.”

Mr Zahawi allegedly avoided tax by using an offshore company registered in Gibraltar to hold shares in the polling company he co-founded, YouGov.

YouGov’s 2009 annual report showed a more than 10% shareholding by Gibraltar-registered Balshore Investments.

The report described the company as the “family trust of Nadhim Zahawi”, then an executive director of the polling firm.

Tax lawyer Dan Neidle has estimated that Mr Zahawi owed £3.7 million, and said that with interest that could be due on top of the reported 30% penalty, the total could be more than £4.8 million.

Mr Neidle, of the Tax Policy Associates think tank, said: “You don’t pay a 30% penalty if your tax affairs are in order.

“You do it, at best, if you’ve been careless if you haven’t paid tax that’s due.”

The Government website says a penalty of up to 30% is due if it arises because of a lack of reasonable care. A deliberate error can incur a penalty of between 20% and 70%.

A spokesman for Mr Zahawi previously said his taxes were “properly declared and paid in the UK” and the minister had “never had to instruct any lawyers to deal with HMRC on his behalf”.

Mr Sunak has defended him, telling Prime Minister’s Questions on Wednesday that Mr Zahawi “has already addressed this matter in full and there’s nothing more that I can add”.

Questions about Mr Zahawi’s tax affairs have added to a series of challenges this week for the Prime Minister, who was fined by police for not wearing a seatbelt in the back of a moving car.