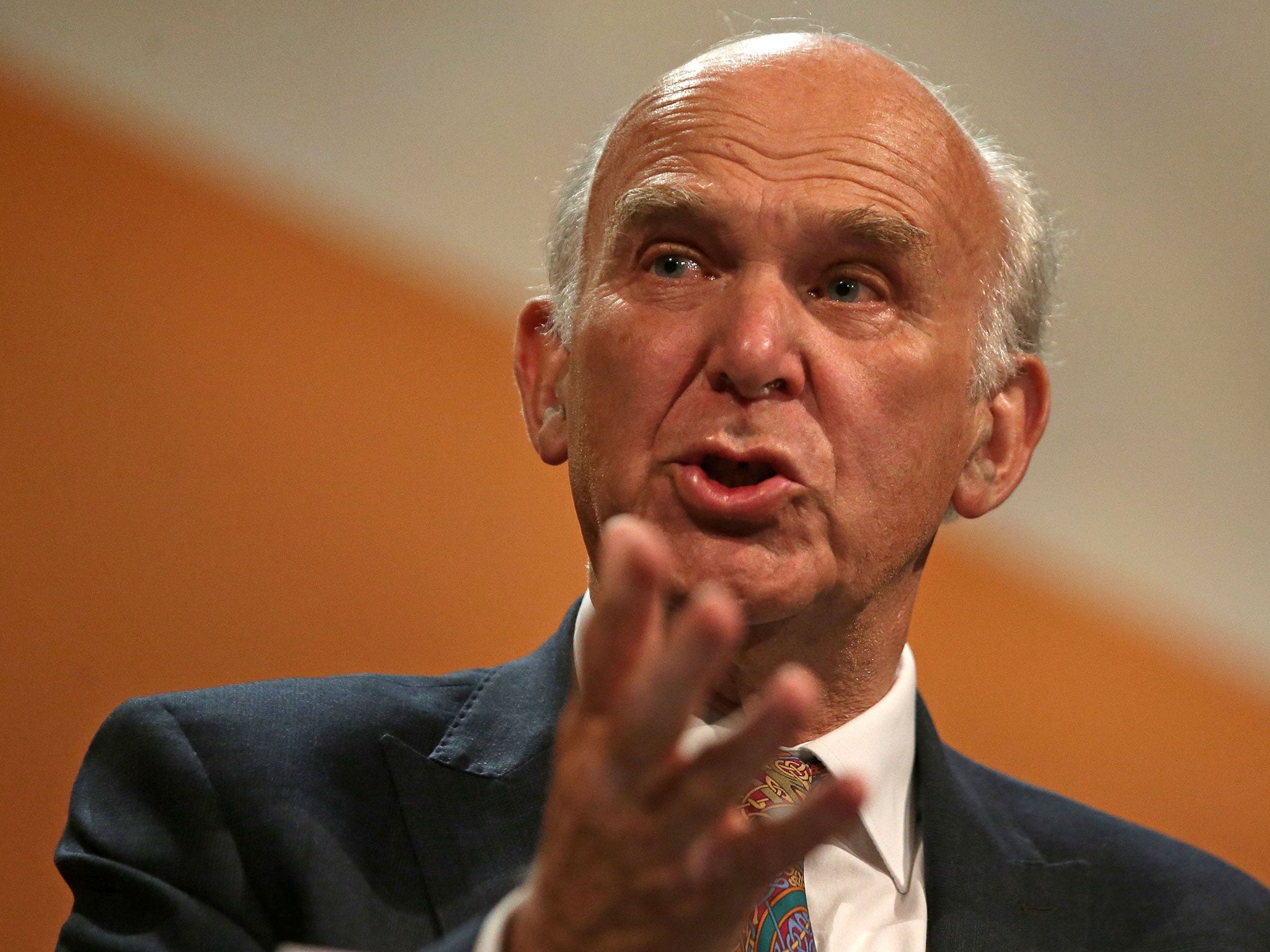

Vince Cable says direct rule should be imposed if British overseas territories fail to tackle 'unacceptable' tax practices

Liberal Democrat leader calls on the Government to restore 'integrity' of tax policy following Paradise Papers leak

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Government should impose direct rule over British overseas territories if they continue to allow "unacceptable" tax practices in the wake of the Paradise Papers leak, Sir Vince Cable has said.

The Liberal Democrat leader mooted restoring a colonial-style government in crown dependencies such as Bermuda and the British Virgin Islands if the territories fail to measure up to basic tax standards followed by the UK.

The former business secretary also called for a general crackdown on "aggressive tax avoidance" and suggested blacklisting guilty firms from applying for public sector contracts.

It comes after millions of leaked documents - dubbed the Paradise Papers - shone a light on the extent of secretive overseas investments in off-shore tax havens from high-profile figures ranging from Bono to The Queen.

Delivering a pre-Budget speech in London, Mr Cable said: "What I would recommend is that the territories that depend on British protection should be required to observe basic standards. Those that don't - and there are clear violations of this within the OECD - should be blacklisted.

"They should be given a timetable to phase out unacceptable practices under the anti avoidance rule and also to introduce a fully open transparent register.

"If they don't comply then sanctions should kick in and we do have a fairly straightforward sanction which is the imposition of direct rule."

Direct rule was imposed in the Turks and Caicos islands in 2009 after the territory was judged to be rife with corruption by an independent probe.

Sir Vince added: "If our dependent territories and crown colonies will not uphold basic standards on tax then that should be the remedy and in that way we restore some of the integrity and eliminate some of the cynicism which exists around tax policy."

Meanwhile, Sir Vince used the speech in the City to lay out his party's stall ahead of the Budget, including proposals to woo younger voters by giving every young person £18,000 to spend on skills or training after turning 18.

The idea would do more for intergenerational equity than "populist gestures" from Labour to cut tuition fees, which would benefit well-off graduates, he said.

Among those named in the explosive leak of papers include former Tory treasurer Lord Ashcroft and US president Donald Trump's commerce secretary, Wilbur Ross, who is reportedly linked to a Russian firm.

The Queen's private estate, Duchy of Lancaster, was also found to have millions of pounds invested in offshore arrangements.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments