UK facing longest fall in living standards for over 60 years, finds think tank

The Resolution Foundation has said the British economy will be £42bn smaller by 2022 than we thought in March

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The UK is on course for the longest period of falling living standards since records began, according to a leading think tank.

The Resolution Foundation said data released in the Budget showed British are families suffering the biggest squeeze in their finances since the 1950s.

It explained in a report published this morning that the UK economy will be £42bn smaller in 2022 than we thought it would be in March after official data indicated dismal growth forecasts in coming years.

The data was released by the Office for Budget Responsibility alongside Chancellor Philip Hammond’s Budget statement in the Commons, which saw him announce £25bn in extra spending to prop up the economy.

Director of the Resolution Foundation Torsten Bell, said: “Following years of incremental changes, yesterday the OBR handed down the mother of all economic downgrades pushing up borrowing for the Treasury.

“While Philip Hammond chose to take a relaxed approach to additional borrowing, families are unlikely to do so when it comes to the deeply troubling outlook for their living standards that the Budget numbers set out.

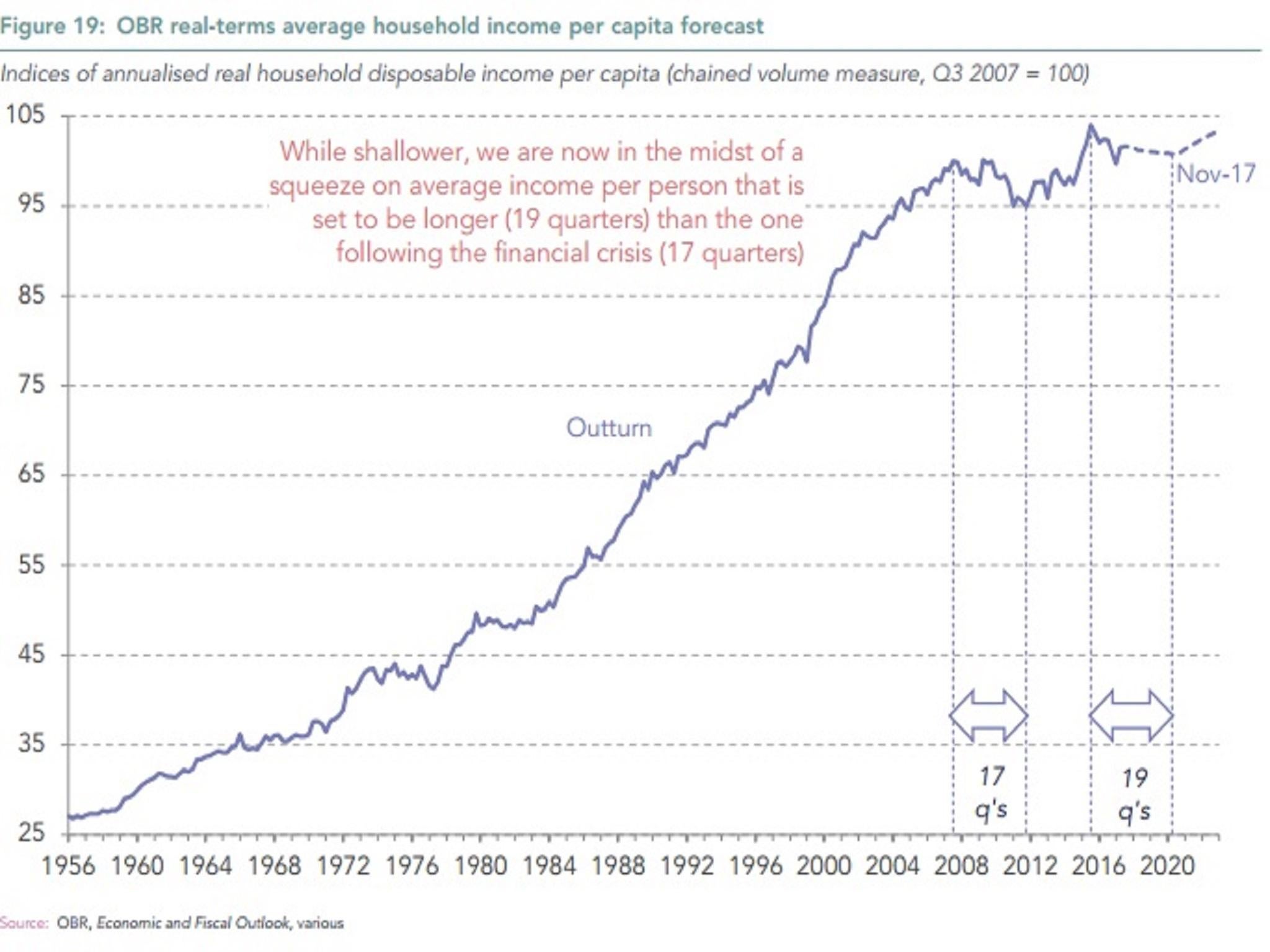

“Families are now projected to be in the early stages of the longest period of continuous falls in disposable incomes in over 60 years – longer even than that following the financial crisis.”

The Foundation said that the current income squeeze is set to be longer, albeit shallower, than the post-crash squeeze, with real household disposable incomes set to fall for an unprecedented 19 successive quarters between 2015 and 2020.

It went on to say that despite the Chancellor's small changes to improve universal credit, tax and benefit policies announced since 2015 will push living standards down and increase inequality.

It added that the poorest third of households are set for an average loss of £715 a year by the end of the parliament, while the richest third gain an average of £185.

Mr Bell added: "Faced with a grim economic backdrop the Chancellor will see this Budget as a political success. But that would be cold comfort for Britain’s families given the bleak outlook it paints for their living standards.

"Hopefully the OBR’s forecasts will prove to be wrong because, while the first sentence of the Budget document reads ‘the United Kingdom has a bright future’, the brutal truth is: not on these forecasts it doesn’t."

The Foundation also took a dim view of the Chancellor's plan to offer a stamp duty cut to young people trying to get on the housing ladder, which he argued could help a million people save on average more than a thousand pounds when buying a home.

The OBR said on Wednesday that it believed the number helped by the scheme would be closer to 3,500, and that it may have an upwards pressure on house prices, meaning the real beneficiaries of the policy would be existing homeowners.

Longer incomes squeeze than financial crisis

The Resolution Foundation branded the move which was met with loud cheers in the Commons, "a very poor way to boost home ownership".

It said said the cumulative £3bn cost of the abolition of stamp duty for first time buyers could instead have supported the building of 40,000 social rented properties or around 140,000 homes through the government’s own Housing Infrastructure Fund.

Mr Hammond hailed some £15bn in money for new housing, which as well as the stamp duty cut, included a fund to free up land for development, investment in council housebuilding, “right to buy” for housing association tenants and allowing local authorities to apply a 100 per cent council tax premium on empty properties.

The Chancellor also addressed criticism that benefit claimants were suffering hardship waiting for the new universal credit payment, by reducing the wait to five weeks, costing £1.5bn.

He also announced £2.5bn of investment to kickstart the UK’s lacklustre productivity and invest over £500m in a range of initiatives from artificial intelligence, to 5G and full-fibre broadband.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments