Thousands sign petition to scrap Tories' child benefit 'rape clause'

Scottish National Party MP Alison Thewliss is leading the Scrap the Rape Clause campaign

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Women who will have to tell the Government they have been raped in order to continue to receive some tax credits are being treated “abhorrently” by the Government, campaigners have said.

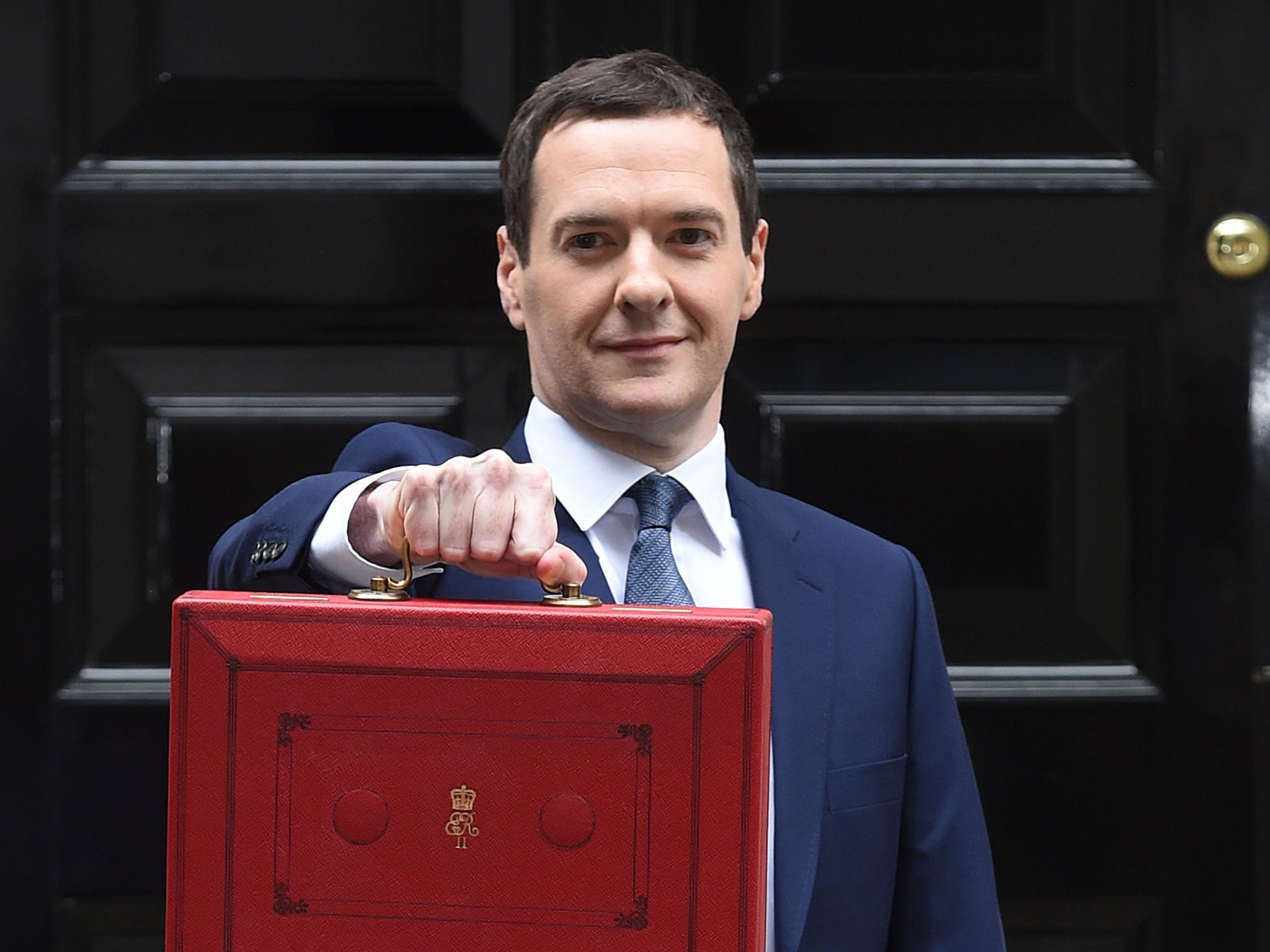

In the Summer Budget, George Osborne announced that Universal Credit, tax credits and housing benefit will only be awarded for two children per household.

“The Department for Work and Pensions and HMRC will develop protections for women who have a third child as the result of rape, or other exceptional circumstances,” the document reads.

The Scottish National Party (SNP) has dubbed the provision a “rape clause” and launched a campaign to scrap it.

Alison Thewliss, the SNP MP for Glasgow Central, called the measure “draconian” and said she had raised it in the House of Commons nine times.

Launching part of the “Scrap the Rape Clause” campaign on Sunday, she said: “We think the policy on limiting tax credits to the first two children is appalling and tantamount to social engineering, but to put a woman who has been raped in a position where she needs to declare that to a government official is just abhorrent.

“This also stigmatises the child involved, which is surely against the UN convention on the rights of the child.

“This proposal has no place in the twenty-first century and must be dropped immediately.”

More than 5,700 people have signed a petition started by Simon Francis to remove the clause on the Government website.

Petitions are limited to six months and it will run out on 29 January, requiring a minimum 10,000 signatures to force the Government to respond.

Although Mr Osborne reversed some proposed tax credit changes in November, the two child limit remains.

The new rules apply to families claiming for the first time after April next year, or for children born that month or later, and do not apply to disabled children or twins.

Discovery of the rape provision provoked outrage in July, with SNP MP Eilidh Whiteford raising the issue in the House of Commons to ask how the Department for Work and Pensions (DWP) would establish what children were eligible for the exception

“Will there be a box to tick on the form? Will a criminal conviction against a perpetrator be required?” she asked.

“We know rape is one of the most unreported and poorly prosecuted serious crimes in the UK – most surveys suggest that 85 per cent of women who are raped just don’t report it for a whole variety of reasons.”

Angela Devine, manager of Glasgow Women’s Aid, said the charity was supporting the campaign to scrap it.

“As an organisation offering refuge and support to some of the most vulnerable women and children in our city, we know the damaging effect this clause could have on women who have already endured trauma,” she said.

“It is not uncommon for children to be the product of rape or coercive control and women should never be placed in the humiliating position of appealing to the DWP for benefits...we reject these changes as untenable and discriminatory.”

She questioned whether DWP staff would be given training to deal with sensitive disclosures and support the victims coming forward.

A Government spokesperson told The Independent the methods of implementation were still being discussed.

“We are currently working through the detail of this policy, and as part of that we will ensure women who have a child as the result of rape are not impacted," she said. "We will be working with stakeholders to ensure that this exemption is delivered in the best way possible.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments