Companies are avoiding tax by putting staff on less secure contracts, Government tsar warns

Matthew Taylor said firms can reduce their tax burden by classing staff as ‘self-employed’

The man reforming UK employment rules has signalled a possible future crackdown on firms trying to minimise their taxes by manipulating the official status of staff.

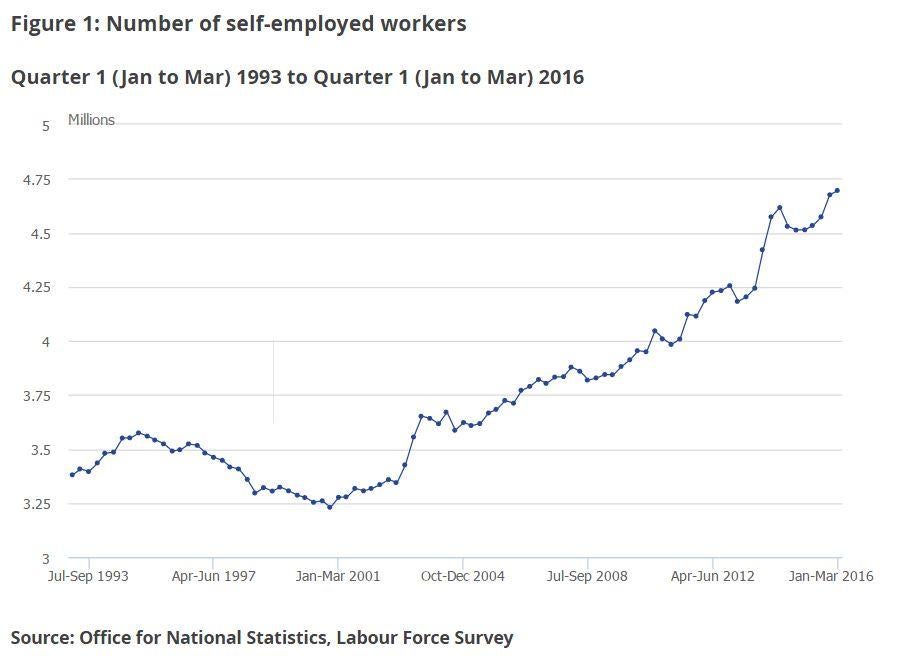

Matthew Taylor suggested lower tax rates that firms can lock in by re-classifying people as “self-employed”, had led to a rise in the number of jobs undertaken without the rights a full employee has.

It comes after a union study claimed increasing self-employment and the use of zero-hours contracts is costing the UK £4bn a year in lost tax, and ahead of data on Wednesday expected to show a continuing trend of high UK employment, pumped up by a rise in part-time jobs.

Theresa May asked RSA chief executive Mr Taylor to lead an independent review into how employment practices should change to keep pace with modern business models.

Speaking to BBC Radio 4’s Today programme, Mr Taylor said: “I think all businesses will try to minimise their tax burden.

“But because we have ambiguity over whether people are self-employed or workers … some businesses have designed themselves in order to try to make sure people are defined as self-employed because there is a lower tax burden.

“That’s one of the incentives driving the pattern of employment that we have.”

Research into the “gig-economy” by the Trades Union Congress found a rise in less secure work in the UK could be costing the Government almost £4bn a year in lost tax income and benefit pay-outs.

Increasing numbers of self-employed workers and those on zero-hours contracts earn less than regular employees, pay less tax and national insurance and mean a lower tax burden for firms using them.

The TUC study said their relatively low earnings also make them more likely to need in-work benefits, with the accumulated cost of £75m a week for the exchequer.

Mr Taylor said: “You can never be absolutely sure of how much it is costing because you then have to have an alternative of how much it would cost if you were to close down that activity, but there is certainly an impact and the public finances.”

Official employment figures out last month showed there were 8.55 million people working part-time between September and November, 86,000 more than for a year earlier.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments