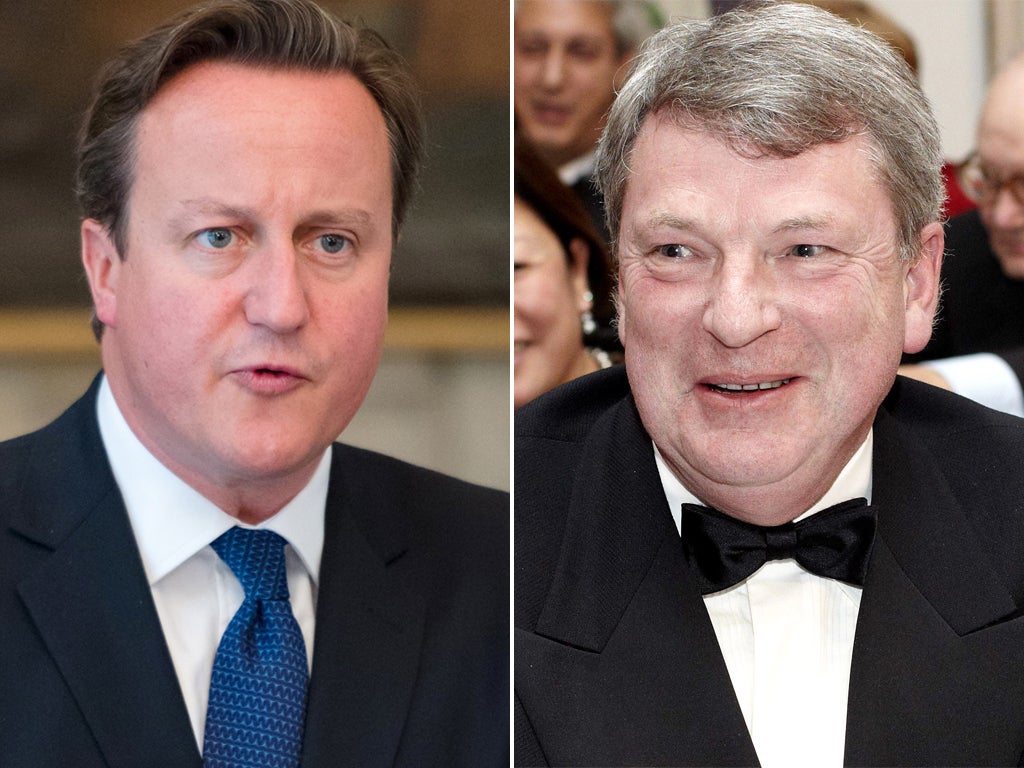

The seven questions David Cameron's election guru needs to answer about his tax affairs and his influence on Tory policy

Margaret Hodge, the woman who took Amazon, Google and Starbucks to task over tax avoidance, demands answers from the PM and Lynton Crosby

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Last week the anti-tax avoidance champion Margaret Hodge demanded David Cameron "come clean" over whether his election strategist Lynton Crosby had gained personally from his "complex" tax affairs and his non-dom status.

Having heard nothing from Mr Crosby or the Tories Ms Hodge, who challenged Amazon, Starbucks and Google over tax avoidance in her role as chair of the Public Accounts Committee, has laid out in clear terms the seven questions that the pair must answer to dispel growing concerns that the Australian's personal tax affairs have had an influence on Conservative party policy on tax avoidance and non-doms.

Mr Crosby’s financial affairs came under the spotlight after it emerged that he is a director and a shareholder of firms based in the tax haven of Malta.

Ms Hodge's questions come as The Independent revealed that Crosby Textor Ltd - a firm owned by Mr Crosby and his business partner Mark Textor - made losses of £1 million in two years.

The seven questions for Lynton Crosby needs to answer:

1. Lynton Crosby is a Director of one company and shareholder of another in the known tax haven of Malta. He has never explained why he has this arrangement. Why does Lynton Crosby have companies in Malta?

2. Rutland Ltd, the Maltese company of which Lynton Crosby is Director, has accounts which show significant amounts held as “deposits in foreign banks”. This was €326,011 in 2013, €449,999 in 2012 and €2,457,115 in 2011. We also know that 90% of Rutland Ltd’s interests lie outside Malta. What does Rutland Ltd invest in?

3. The same company, Rutland Ltd, has not filed accounts for 2014. Indeed, on 12th February 2015, Rutland Ltd filed for an eighteen month “extension of period allowed for laying accounts”. Will Rutland Ltd now release its accounts for 2014 so the public can see what its activity is?

4. If Lynton Crosby were to be paid via either of his Maltese companies for any of his work around the world, his status as a non dom would mean he would pay a Maltese tax rate. To know whether he has taken advantage of this, has Lynton Crosby ever been paid via his Maltese companies, Rutland Holdings or Rutland Ltd?

5. The Tories have failed to back Labour's policy proposals to crack down on tax avoidance and abolish non dom status. It is a matter of public interest, in light of his tax status and offshore interests, whether Lynton Crosby has influenced the Tories' policy positions. What discussions has Mr Crosby had with David Cameron about policy surrounding tax avoidance and non-dom status?

6. In light of the public policy implications, it is important to know whether David Cameron is aware, and is comfortable with, his campaign manager's personal tax arrangements. So, is David Cameron aware of Lynton Crosby's personal finance arrangements?

7. Lynton Crosby has previously confirmed that he is a non dom. The Labour Party has said that it will abolish non dom status, which the Conservatives oppose. We should know why. Lynton Crosby’s non-dom status could allow him to keep his worldwide income and gains out of UK tax by keeping them offshore. Does Lynton Crosby’s non-dom status allow him to keep income and gains in Rutland Ltd or Rutland Holdings without paying UK tax on them?

Mr Crosby’s spokesman told The Independent in a statement that he had never avoided or attempted to avoid paying his full tax obligations in the UK.

It stated: "It has been a matter of public record since 2013… that Lynton Crosby pays tax in the UK, on his UK earnings, at exactly the same rate as any UK citizen. There is no public interest in publishing false allegations about the financial affairs of a private individual.

"There is nothing new in this. It is simply a gratuitous attempt to re-publish year-and-a-half-old, unfounded allegations. This information has been public for years, even before it was reported back in 2013,” the spokesman added.

"Rutland is a perfectly legitimate Malta-based company that fulfils all of its tax obligations in Malta and its fully audited accounts and directorships have been public for years.

"Rutland has never done any business in the UK, nor paid wages nor dividends to anyone in the UK. It has not received fees from any UK company, body, entity or individual.

“Any claim, or attempt to claim, that Mr Crosby avoids, or attempts to avoid, paying anything but his full tax obligations is categorically wrong and defamatory and will rightly be treated as such. Further, any claim, or attempt to claim, that Rutland was set up, or is used, to avoid paying UK tax is also categorically wrong and defamatory."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments