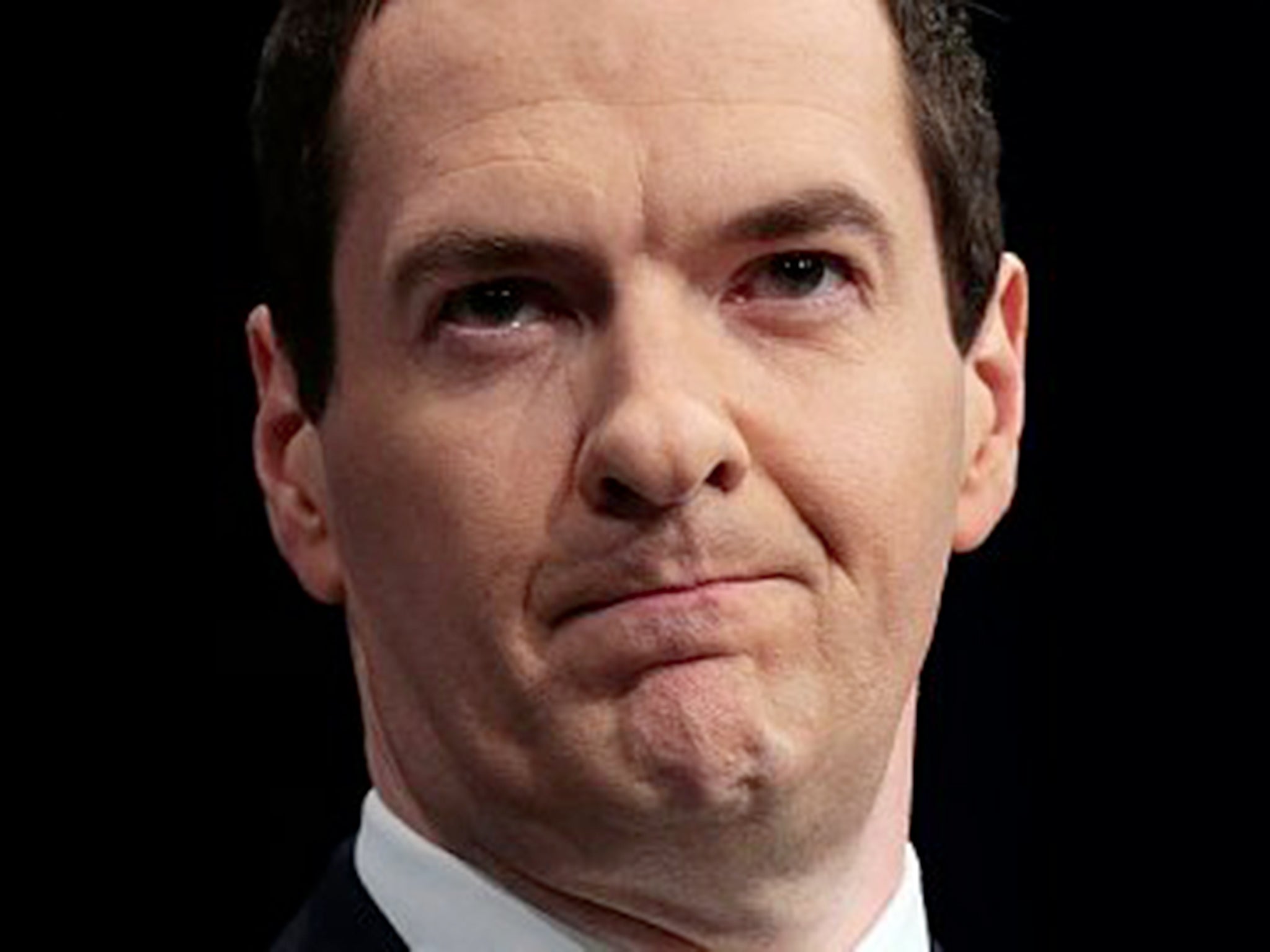

Tax credits Lords defeat Q&A: How did George Osborne get in this mess?

The measures were contained in a statutory instrument, a piece of secondary legislation, which had already been passed by MP

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Q: What did peers vote on?

A: George Osborne’s plans announced in the Budget to reduce the amount which low-paid workers receive in tax credits to top up their pay.

The Commons Library estimated the move would cost 3.3 million working families around £1,300, but the Government insisted most would be compensated by increases to the national minimum wage and tax thresholds.

Q: What form did the vote take?

A: These measures were contained in a statutory instrument, a piece of secondary legislation, which had already been passed by MPs. The tactic provoked criticism that the Government was trying to ram the measure through.

Q: What was the effect of the vote?

A: Peers did not reject the substance of the Chancellor’s proposals, but threw the plans into chaos by demanding a three year delay in implementation for the worst-off.

Q: What happens next?

A: Mr Osborne immediately signalled that transition arrangements for the tax credit cuts would be contained in his Autumn Statement on November 25, while insisting “we can achieve the same goal of reforming tax credits, saving the money we need to save to secure our economy”.

Q: How does he do that?

A: The crucial question. Suggestions include mitigating the cuts by speeding up his planned rise in the tax-free allowance or increasing the level at which employees pay national insurance. He could also adjust the detail of the tax credit cuts to shift the losses to slightly better-off workers, although this would simply shift the pain between two groups of “strivers”.

Q: So he’s got a bit of breathing space?

A: Not really. Mr Osborne appears before MPs on Tuesday, when he will face challenges on how he gets out of this mess. And on Thursday the Commons will hold a backbench debate on tax credits where a new approach will be backed by growing numbers of Tories. Losing support on his own side could be as damaging to Mr Osborne as the plans’ rejection in the Lords.

Q: Where does this leave the Lords?

A: On a collision course with the Chancellor and Prime Minister, who both pledged after the votes to act on the “constitutional issue”.

It has been suggested the Prime Minister could pack the Lords with ranks of newly-appointed Tory peers, to secure a majority, although that would make a mockery of his promise to cut the cost of politics.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments