Stamp duty: Estate agents voice fears as plug is pulled on the rock star's property trick

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Buyers of homes worth more than £2m are going to be hit with a massive stamp duty rise from today, with a new 7 per cent stamp duty land tax charged. Until yesterday, only a 5 per cent charge was levied on homes sold for overa £1m.

The charge on a £2m property will rise from £100,000 to £140,000. But the hike – which is supposed to help pay for higher income tax personal allowances – was quickly condemned by estate agents as putting the recent tentative recovery in house prices at risk and disproportionately hitting London and the South-east.

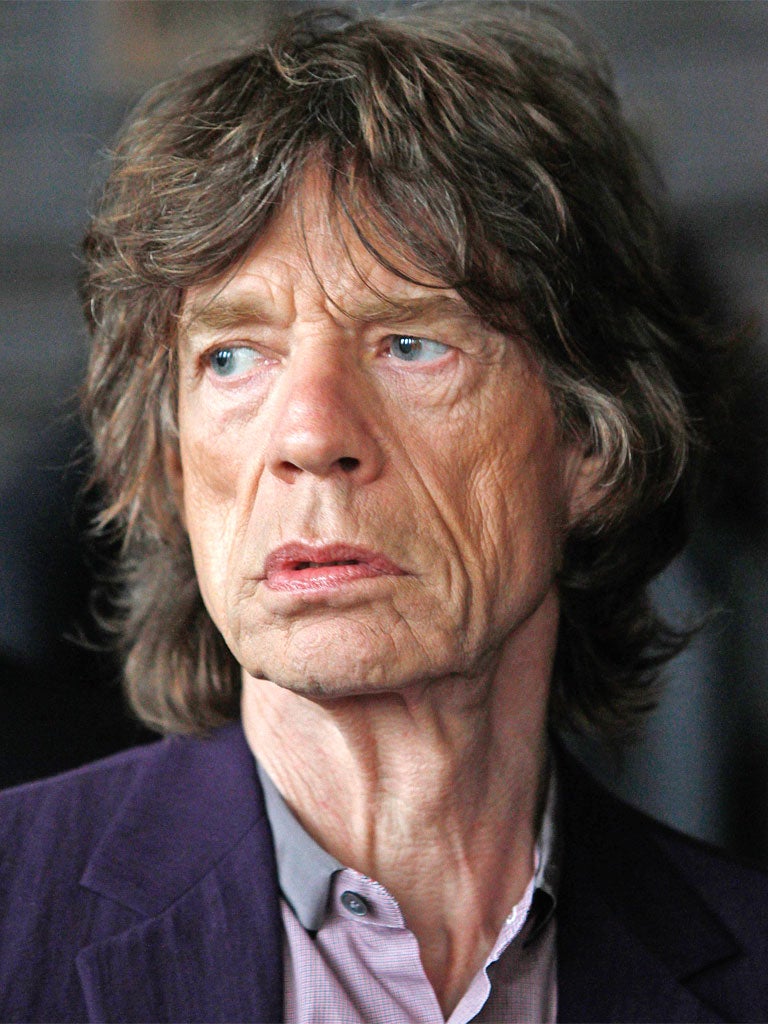

In addition, the Chancellor moved to close a major stamp duty loophole which allows individuals to pay a much-reduced rate of tax by using an offshore company to buy property rather than doing it in their own name. The rock stars and Sir Bob Geldof and Sir Mick Jagger and the businessman Lakshmi Mittal have been some of the more high-profile names to use these tax avoidance schemes, but hundreds of Britain's most expensive properties have been sold this way.

In future, anyone looking to buy a residential property through an offshore company will face a one-off tax charge of 15 per cent – more than twice the level of the new higher-rate stamp duty. Paul Emery, tax director at PricewaterhouseCoopers, said that the Chancellor was "throwing the book at avoidance" and a "strong signal that residential property sales cannot escape tax".

Those that have already benefited face a retrospective tax charge, the Chancellor warned, a move already being dubbed the "Geldof tax".

"The hundreds of UK and foreign buyers who have avoided stamp duty this way face a massive bill from next April, with capital gains tax being charged when they sell and the possibility of an annual levy," said Toby Ryland, partner at the accountancy firm Blick Rothenberg. "The only option they will have is to unwind these schemes and pay the stamp dutythey owe."

Peter Rollings, chief executive of the estate agent Marsh and Parsons, said: "This stamp duty rise risks deterring prime property transactions, thereby undermining the Government's stamp duty tax take – as well as limiting London's appeal. With the property market still far from healthy, we need to see the Government supporting activity at all levels, rather adding yet another tax burden."

Other agents warned that the new higher stamp duty will hit not just the rich but all those currently in a chain.

"Every homeowner will feel this, not just the wealthy," said Trevor Kent, former head of the National Association of Estate Agents. "Seventy per cent of first-time buyers rely on the successful progression of 'chains' of sales. If someone at the top of the chain sees they are getting clobbered they may not complete and the house of cards collapses."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments