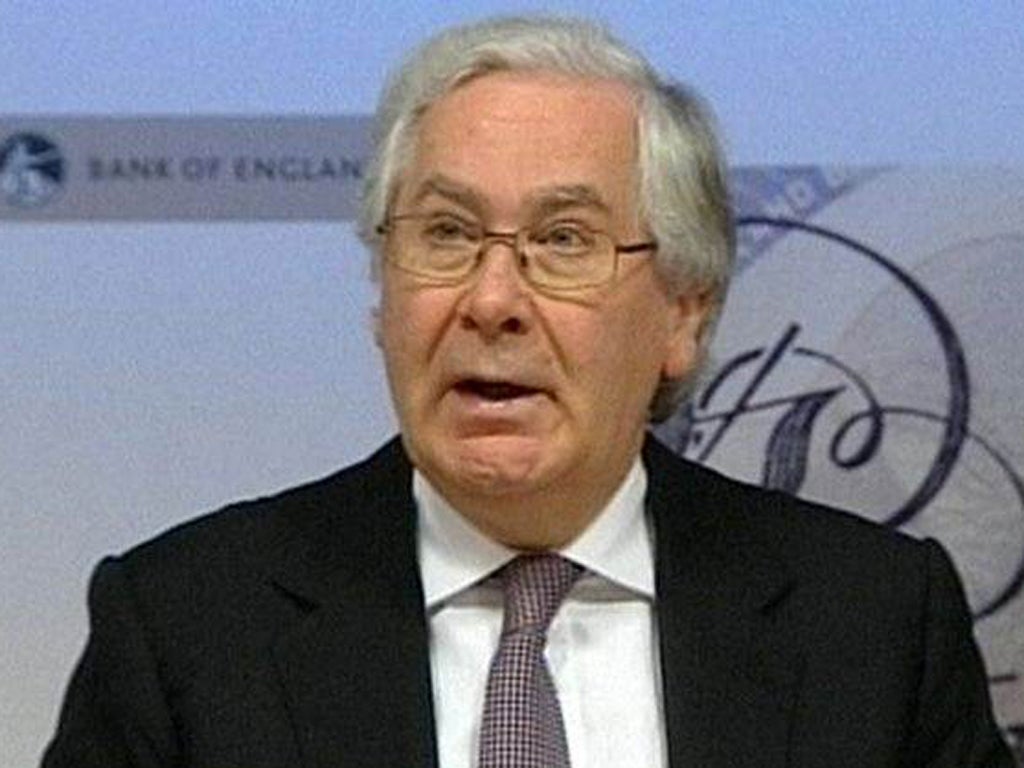

Sir Mervyn King tells George Osborne: you must act now to tame the City

'Vested interests' are trying to kill reforms, warns Governor of the Bank of England

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Governor of the Bank of England, Sir Mervyn King, has demanded that the Government speed up its reform of Britain's financial sector. He also attacked bankers for resisting new financial regulation in order to protect their large bonuses.

Sir Mervyn warned last night that "vested interests" in the City of London were trying to scupper reforms meant to prevent another crisis.

The Chancellor, George Osborne, met the bosses of Barclays, the Royal Bank of Scotland and Lloyds in the days before the Vickers report on reforming the banking sector was published in September 2011. Last December, The Independent revealed that senior bank executives met or called Treasury ministers nine times in the weeks after the report's release.

"Already we see vested interests rise up to defend their bonuses and profits," the Governor said during the 2012 BBC Today Programme lecture.

The Governor's call for reforms of the banking sector to be speeded up is likely to meet a hostile reception in the Square Mile. Sir Mervyn praised the Vickers commission – which has recommended that the Government compel Britain's largest banks to ring-fence their high-street lending operations from their high-risk investment banking arms and hold significantly larger capital buffers. "It's vital that Parliament legislates to enact these proposals sooner rather than later," he said.

Some regulators have suggested the present deadline for the implementation of the ring-fence – 2019 – will provide the banking lobby with enough time to ensure it is watered down.

The Government has said it will pass legislation on the ring-fence before the end of the present parliament, but some regulators fear Vickers could still end up diluted. Last November, Bob Jenkins, a member of the incoming financial super-regulator, the Financial Policy Committee, said: "Their deadline is 2019 – a date so distant as to be irrelevant to their careers; a gap so long as to allow lobbyists to chip away until the proposal becomes both unrecognisable and ineffective. Why wait?"

The Governor said the Bank, which is to be given far-reaching regulatory powers from next year, would not be swayed by the financial sector's lobbying. "As an independent central bank with over three centuries of history, we can resist those short-term pressures and take the longer view needed to prevent another crisis" he said.

Speaking about the roots of the 2008 financial crisis, the Governor put the blame on the excesses of the banking sector. "In a nutshell, our banking and financial system over-extended itself" he said. "Banks made increasingly risky investments [and] to make matters worse they started making huge bets with each other on whether loans that had already been made would be repaid."

He also defended the Bank of England's conduct in the run-up to the crisis, saying it had warned of the dangerous build-up of risk in the financial system, but was powerless to do anything about its concerns, having been stripped of its regulatory powers after being granted independence in 1997.

But he added that the Bank of England should have been more vocal about its concerns regarding the banking sector. "With the benefit of hindsight, we should have shouted from the rooftops that a system had been built in which banks were too important to fail, that banks had grown too quickly and borrowed too much, and that so-called 'light-touch' regulation hadn't prevented any of this," Mr King said.

"And in the crisis, we tried, but should have tried harder, to persuade everyone of the need to recapitalise the banks sooner and by more."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments