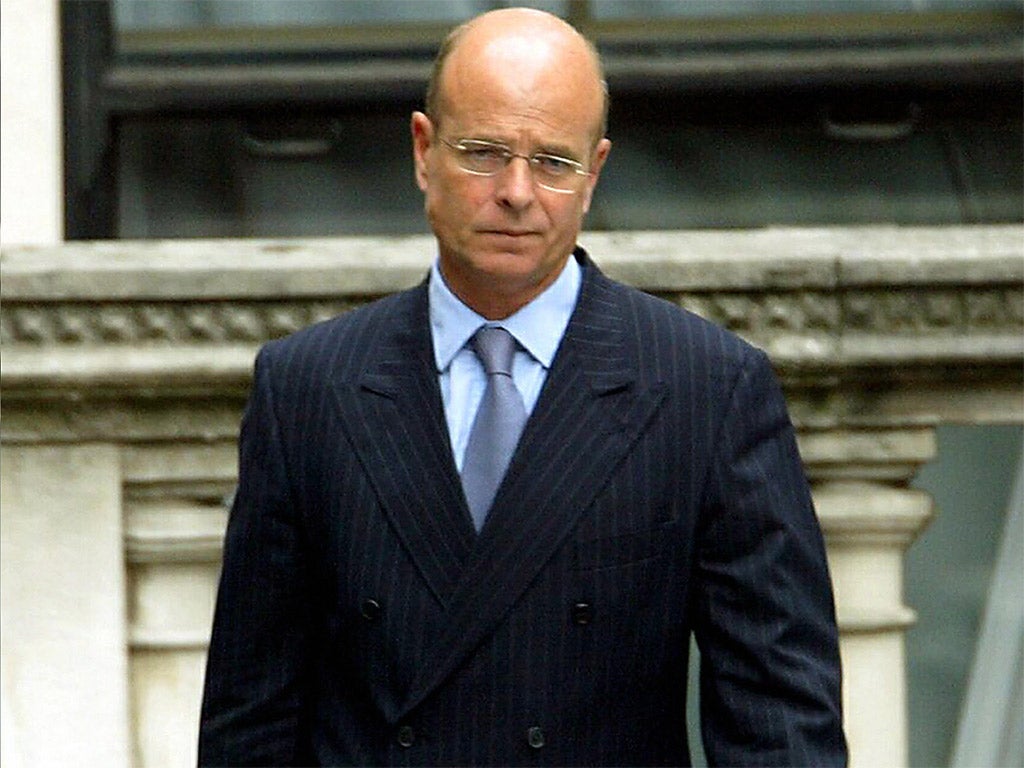

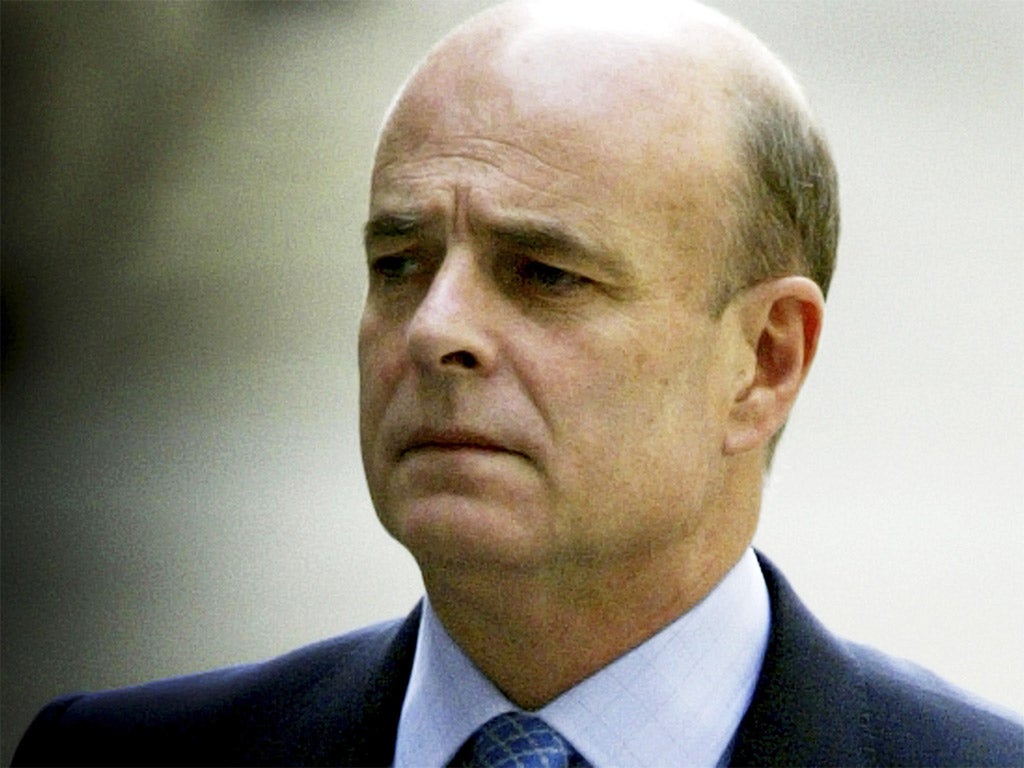

Sir John Scarlett: From WMD to Wonga, how the former MI6 chief has cashed in

The former MI6 chief, whose 'evidence' helped take us to war in Iraq, has latterly proved to be better at making money than standing up to Tony Blair

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Middle East desk at the Secret Intelligence Service MI6 is not a quiet place. Over three days in April last year, Israel suspended peace talks with the Palestinian Authority, 25 people were killed in a series of bombs blasts at a Shia rally in Baghdad, and Iraqi helicopters destroyed a convey of Isis fuel tankers inside Syria.

Such events were once the priority of the former SIS chief Sir John Scarlett. But over that 72-hour period, the retired spy boss was engaged in a different sort of business. As a paid senior adviser to US bank, Morgan Stanley, he was in Hawaii at the Ritz-Carlton hotel in Maui, along with 100 of the bank’s top performing brokers.

At the Kapalua resort, Sir John was on a panel of security and intelligence experts offering insight into global affairs for those brokers willing to take time off from their golf and deep-sea fishing. Joining Sir John on the Morgan Stanley panel was General Michael Hayden, a former director of the CIA and the US National Security Agency.

General Hayden, among his other commercial and academic positions, is also a principal of the Chertoff Group, the security and risk management company founded by Michael Chertoff who served as Secretary of the Department of Homeland Security under President George W Bush.

The group’s roster of former US intelligence officials has earned it the nickname of America’s “shadow” homeland security agency. Chertoff describes its board of advisers as “truly exemplary individuals who bring outstanding qualifications in areas of intelligence, foreign policy, international trade and homeland security”. Sir John is one of them.

When Sir John left MI6 in October 2009, Whitehall’s Advisory Committee on Business Appointments (Acoba) – which monitors the revolving door between government and private sector appointments – did not block any of his job applications. Within four months, he had joined the advisory board of accountants PricewaterhouseCoopers. Two months on, the green light was given for the Morgan Stanley and Chertoff jobs.

A position on the board of Times Newspapers was approved inside a year. An advisory role for the Norwegian multinational oil company, Statoil, was given unconditional approval a few months later.

Despite the criticism he received over the compilation of Tony Blair’s “dodgy dossier” on Saddam Hussein’s WMD while he was chairman of the Joint Intelligence Committee (JIC), it seems Sir John’s services are in high demand.

One former MI6 official, who knew Sir John for a large part of his 30-year spy career, said he was just one of many former intelligence chiefs making a killing from the booming private security industry. “After 9/11 there was an intelligence free-for-all in the United States,” the official told The Independent. “The division between state and commercial security got shot to hell, blurred. Booz Allen Hamilton [where whistle-blower Edward Snowden worked], Chertoff, and other connected firms, now pull in billions in state contracts. And as their net and international influence spread, and large corporations place increasing faith in tailored intel, the British CVs of John Scarlett or John Sawers [MI6 chief from 2009-2014] or Mark Allen [a deputy chief at MI6], all look worth shelling out for.”

In January this year, the Foreign Secretary, Philip Hammond, approved the application of Mr Sawers to join the board of BP as a non-executive director. Mr Hammond simply advised him: “You should not draw on privileged information available to you from your time in Crown Service.”

Sir Richard Dearlove, head of SIS between 1999 and 2004, joined the global insurance company, American International Group (AIG), shortly after leaving the service, and has advised other large firms on “global intelligence”.

The days of old-school spy chiefs retiring quietly with their pensions to run a homeless charity or a preservation trust appear long gone.

The Independent contacted Morgan Stanley, and other firms Sir John is, or was, connected with. Swiss Re, the global reinsurance company where Sir John is an adviser, described his function as “exploring emerging issues” and providing “strategic insights, advice and recommendations on the global economic, political, and regulatory environment”.

PwC said he was no longer an adviser. All the firms would not discuss his remuneration. But the private company Sir John Scarlett ran with his wife, Gwenda Stilliard, called J & G Consulting Ltd, had cash assets of £89,573 in 2012. A year later the cash at bank total was £683,625.

And last week it emerged that over the past three years, Sir John shared £800,000 from another private consultancy company, SC Strategy, that he co-owned with the former independent reviewer of terrorism legislation, Lord Carlile. The firm described itself in accounts filed with Companies House as offering clients strategic advice on UK policy and regulation.

Lord Carlile said SC was a small “reasonably successfully” company that provided advice to international clients. However, their only identified client is Qatar’s sovereign wealth fund. Of course, Sir John is not the only member of the British establishment to benefit from their links to the oil-rich Qataris. Tony Blair’s £2.5m-a-year consultancy with the Wall Street bank, JP Morgan, saw him mediate a 2012 deal between the mining giant Glencore and the Qatari Prime Minister, Sheikh Hamad bin Jassim bin Jaber al-Thani. For a three-hour late night in a London hotel, Mr Blair is reported to have picked up a fee of $1m.

Qatar has also donated funds to Ms Blair’s Foundation for Women. In emails recently released by Hillary Clinton, it was revealed she had lobbied Ms Clinton when she was US Secretary of State. In one email she wrote : “As you know I have good links to the Qataris.”

When Sir John left the JIC in 2004, a year after the US-led invasion of Iraq, few in MI6 expected him to return to their fold. Mr Blair thought differently. John Scarlett was promoted to “C” – the chief of the Secret Intelligence Service. His appointment was seen by many as an expression of tacit thanks by the Prime Minister to the man who had stood by him throughout the crisis caused by the WMD expert David Kelly’s suicide. He remained in the post for five years, until 2009, when his new career in the business world commenced.

Although there is no suggestion that any of these people have done anything illegal, transparency campaigners say that the “revolving door” between Whitehall, Westminster and the private sector needs addressing.

Robert Barrington, the executive director of Transparency International, the campaign group that monitors abuse of government rules, said : “Currently individuals in key positions only need the approval of Acoba, the appointments committee. And as there is a merger between the public and private sectors, the lines of compromise are far more blurred than they used to be. There is a hole in the current system. The rules, as they stand, are really not fit for purpose.”

Next month, Sir John will be back again at a Ritz-Carlton, not in Hawaii but in Doha. Alongside Qatari government ministers and bankers, he will be a keynote speaker at the Euromoney conference. Individual speakers of “world renown” covering events of “substance and importance” are promised.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments