Rachel Reeves gambles on £40bn tax rise in her first Budget

With a £40bn hike, Rachel Reeves delivered the highest level of tax increases ever announced in a Budget, but questions remain as to whether her measures will deliver the economic growth she hopes for

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Rachel Reeves gambled on a £40bn tax rise in Wednesday’s historic Budget in a bid to boost public services and grow the economy.

She told the House of Commons that the increase – a record sum, equalled only by Norman Lamont in 1993 – coupled with a massive £32bn in extra borrowing was vital to “fix broken Britain”.

Ms Reeves, the first woman in the 803-year existence of the office of chancellor of the Exchequer, delivered the first Labour Budget in 14 years to cheers from her own benches, as she blamed a “toxic Tory legacy” for the measures she was forced to take.

A confident-looking Reeves mocked opponents during a 77-minute speech that included swipes at Rishi Sunak’s fondness for private jets and at her predecessor Kwasi Kwarteng describing his notorious mini-Budget as “not perfect”.

But on the serious detail, she said: “I have made my choices. The responsible choices. To restore stability to our country. To protect working people.”

She announced a string of measures targeting the wealthy and the middle class, including:

- Employers’ national insurance contributions to rise from 13.8 per cent to 15 per cent

- Capital gains tax increased from 10 per cent to 18 per cent

- Non-dom status abolished and replaced with a residency tax

- Inheritance tax expanded to include pensions and farms

- Stamp duty raised to 5 per cent for existing homeowners

Ms Reeves said the tax rises will help to pay for an extra £25bn cash injection for the NHS, part of an overall spending increase of £70bn.

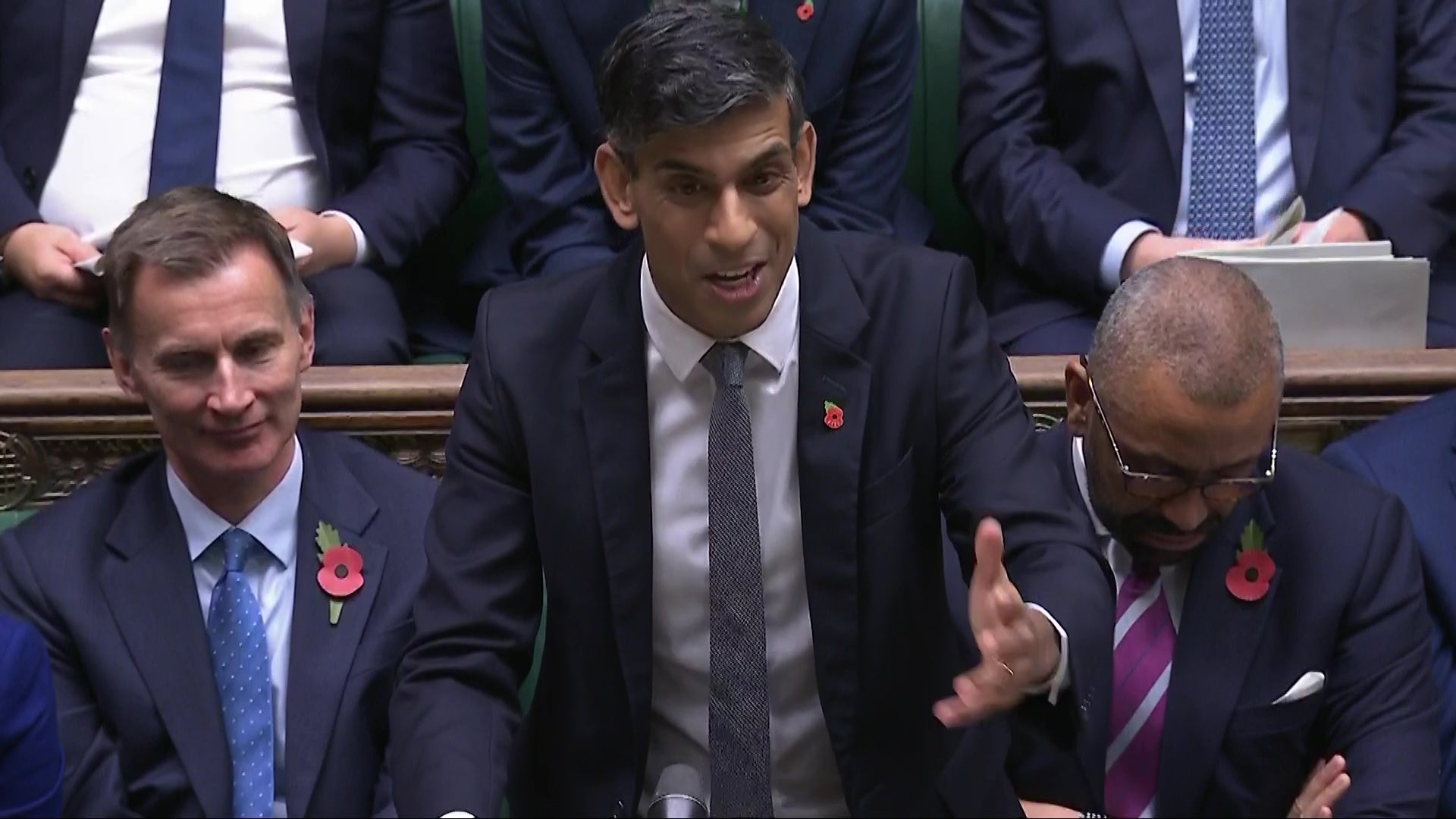

Rishi Sunak used his last Commons outing as opposition leader to accuse the chancellor of “fiddling the figures”. In his official Budget reply, he said she had “totally failed to grip public spending” and made “broken promise after broken promise”.

Outside the chamber, Tories reminded voters of Mr Sunak’s pre-election warning from 1 July: “Keir Starmer will put up your taxes. Bookmark this tweet.”

More unsettling for Ms Reeves, the Office for Budget Responsibility (OBR) suggested that her measures would not boost economic growth, which would be lower than previously estimated.

The OBR also failed to confirm her claim to have been left with a £22bn black hole by the Tories, noting that it had only found a £9.5bn shortfall.

Paul Johnson, of the Institute for Fiscal Studies, said Ms Reeves had taken a “huge gamble”.

“Tax is now on a path to 38.2 per cent of GDP, its highest level ever in the UK, as the chancellor seeks to shore up public services,” he said. “But the chancellor wanted to go further on spending, and so she’s also topping up public service budgets through borrowing in the next couple of years.”

He added: “In broad brush strokes, that was the Budget we had been led to expect: big tax rises, more cash for public services, more borrowing and more investment. Look beyond the headline numbers and there are two big judgements – one could say gambles – that the chancellor seems to be making.”

The OBR gave a measured response, refusing to say whether supply-side reforms such as loosening planning rules would boost growth. Instead, it predicted that growth would dip, despite upgrading its estimates for the first two years, from 0.8 per cent to 1.1 per cent in 2024 and from 1.9 per cent to 2 per cent in 2025.

There are downgrades for subsequent years: it expects to see 1.8 per cent in 2026 (down from 2 per cent), 1.5 per cent in 2027 (down from 1.8 per cent), and 1.5 per cent in 2028 (down from 1.7).

With the cost of living a persistent concern, the OBR also warned that inflation would remain higher than hoped for, expecting it to hit 2.3 per cent in 2026, 2.1 per cent in 2027, and 2.1 per cent in 2028.

Former chancellor Jeremy Hunt said Ms Reeves’s growth plan would fail because “she has given us German levels of tax, and French labour laws”.

Christopher Hayward, policy chair of the Corporation of the City of London, told The Independent that Ms Reeves will have to improve on the growth expectations in the OBR forecasts.

“We have to do much, much better than that if we’re going to actually drive growth,” he said. “Growth has been this government’s buzzword, and the projections they’ve given are disappointing, and we will have to beat those.”

He went on: “Nobody welcomes tax increases, and I certainly don’t welcome [the rise in capital gains and employer NICs]. From the City’s point of view, that is a serious problem. But I think that it was inevitable that these tax rises were going to come up. So the worst of the news – let’s put it that way – is out of the way in this Budget, and we can now focus on improving Budgets in subsequent years.”

A source close to Ms Reeves admitted: “Is there more to do on growth? Yes. But this is our first Budget.”

While most departmental budgets increased, the biggest loser was the Home Office, with a 3.2 per cent revenue loss – based on hopes that the backlog in asylum claims will be cleared.

Aside from the NHS, one of the biggest winners was the Department for Transport, where Ms Reeves’s vow to “invest, invest, invest” saw her commit to a number of projects including a £500m boost to fix local roads and potholes, £1bn for better buses, investment in the Transpennine Route Upgrade, and public funding for fully completing HS2 into London Euston.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments