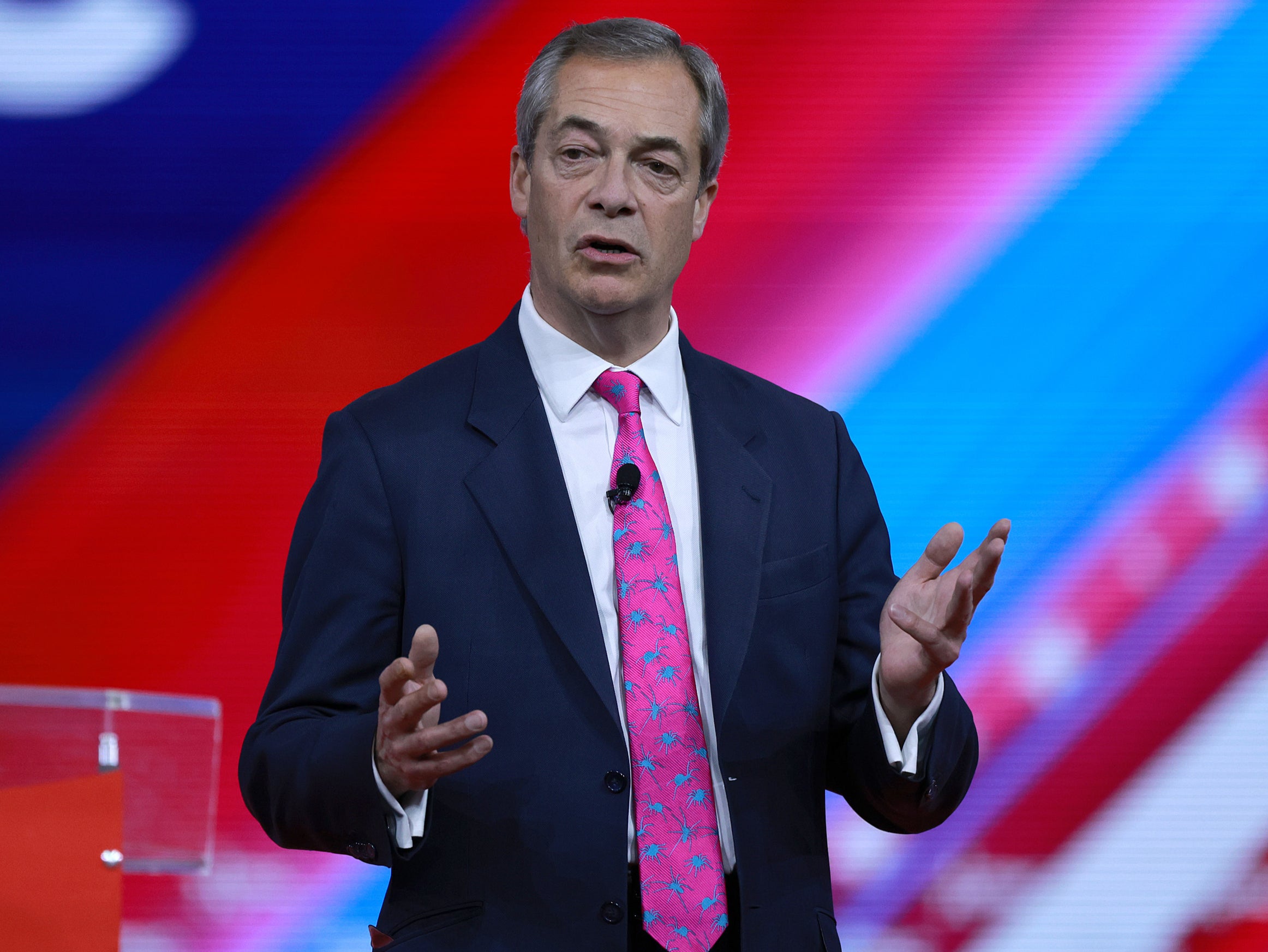

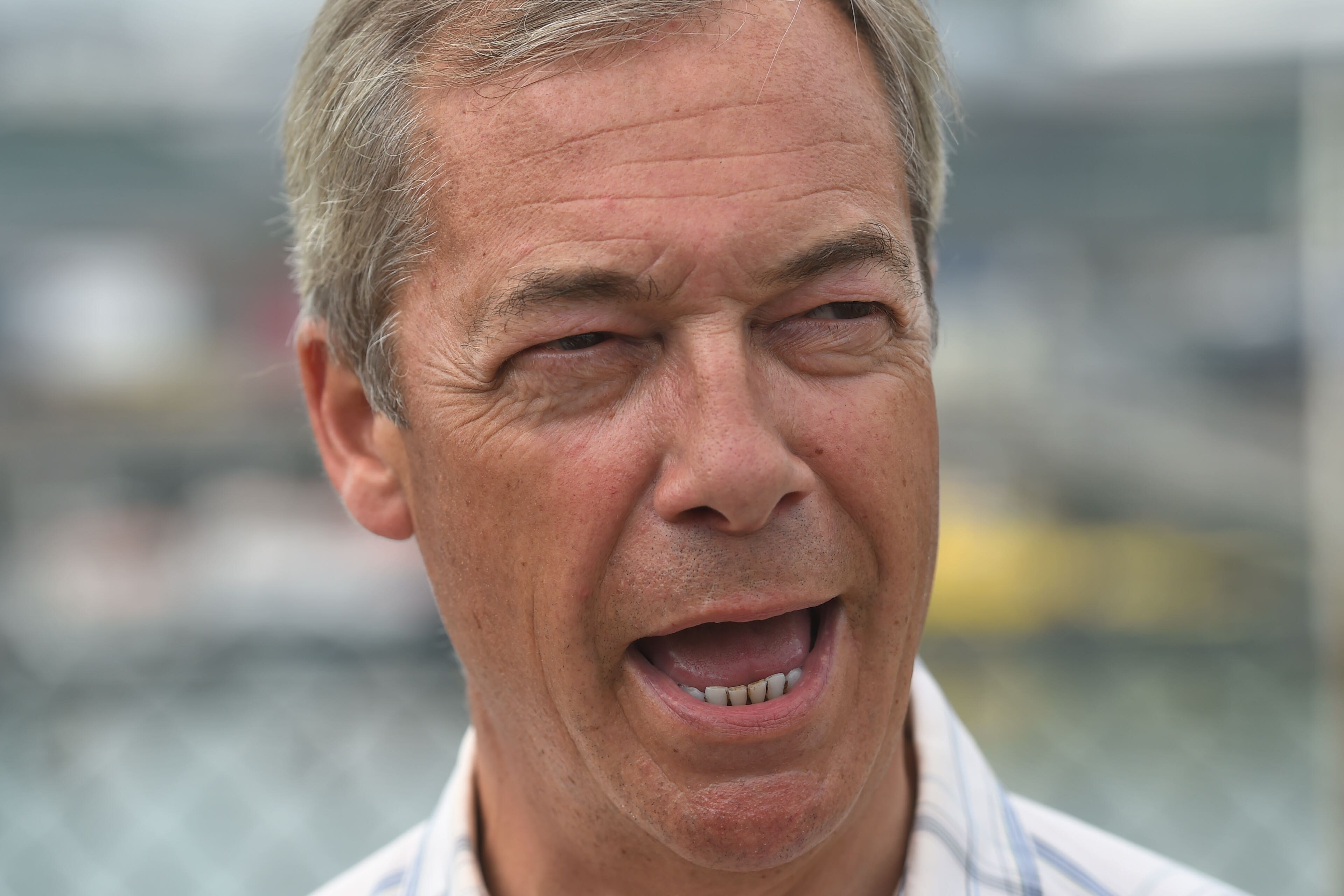

Nigel Farage: EU to blame for my bank account woes

Former Brexit Party leader claims he has fallen foul of over-zealous anti-money laundering regulations

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Arch-Brexiteer Nigel Farage has blamed EU rules “madly adopted” by the UK for being denied accounts with several banks.

The former Brexit Party and Ukip leader sparked a major row last month after claiming his account with Coutts was shut down because he was a ‘politically exposed person’ (PEP).

It followed suggestions made in the Commons that Mr Farage, who has appeared on Russia Today in the past, had received more than half a million pounds from the Kremlin-backed broadcaster.

Coutts, a private bank servicing high net-worth individuals, was understood to have closed Mr Farage’s account due to a lack of funds.

Writing in The Sunday Telegraph, Mr Farage, who said several other banks had denied him accounts, claimed he was the victim of over-zealous anti-money laundering regulations.

“Anti-money laundering rules appear to have been wildly over-interpreted by the compliance departments of banks in the UK,” he wrote in the Brexit-supporting newspaper.

“Nobody can deny that money laundering is a problem, he said. “Yet a series of agreements, EU directives and UK rules established to confront this menace have almost entirely failed to do so.

“Banks now live in fear of receiving huge fines. Their default setting seems to be to close down the business and personal accounts of anybody who is deemed to require extra due diligence – be they the owner of a window cleaning firm or a pawnbroker.”

He added: “Those who are paid in cash are no longer welcome; the compliance costs of servicing these accounts makes them unprofitable.”

Mr Farage initially claimed that his account with Coutts, which acts on behalf of the royal family, had been closed in an “establishment”-orchestrated revenge mission for Brexit, sparking a free speech row.

Andrew Griffith, the city minister, wrote to the UK’s financial watchdog urging it to prioritise an “important” review into whether people are being denied bank accounts due to their political views.

Mr Griffith, in a letter to Nikhil Rathi, chief executive of the Financial Conduct Authority (FCA), said the “strength of concern” on the issue meant it needed to be prioritised by the watchdog.

No 10 also waded into the row, with a spokesperson saying there had been “concerns” at the highest level of government and that the Treasury was looking at whether banks were overstepping the mark by closing some accounts.

But sources at Coutts insisted Mr Farage’s accounts were closed because he fell below the financial threshold Coutts requires.

They told the BBC he was even offered a regular account at NatWest – which owns Coutts – which Mr Farage confirmed to The Independent.

Coutts requires clients to maintain at least £1m in investments or borrowing, or hold £3m in savings, to be eligible for an account, the BBC reported.

Mr Farage, who says he has been with the bank since 1980, suggested another reason his accounts may have been cancelled was his status as a so-called politically exposed person (PEP), which carries extra costs for banks.

But sources familiar with the bank’s thinking told the BBC this was not the reason his accounts were closed and that it was a “commercial” move.

Coutts said it would not comment on individual clients.

Mr Farage, first announced that his account had been in a video on Twitter, said that the “only explanation” he could think of for his bank’s decision was a claim made by senior Labour MP Chris Bryant in the Commons that the former Brexit Party leader had received almost £550,000 from the television network Russia Today.

“I simply point out that Nigel Farage received from Russia Today £548,573 in 2018 alone – from the Russian state,” said the MP.

But Mr Farage said Mr Bryant’s claim was “completely false”. He said: “I did not receive a penny from any source with even a link to Russia.”

Two former Brexit Party MEPs, Christina Jordan and Henrik Overgaard-Nielsen, have also claimed that their bank accounts have been shut down without explanation in recent years.

According to the House of Commons Library, PEPs are individuals around the world with “prominent public functions”.

The law recognises the risk of PEPs abusing their positions for private gain and using the financial system to launder the proceeds of this abuse, it says.

PEPs, as well as their families and close associates, must therefore go through enhanced scrutiny when using the services of certain firms that act as ‘gatekeepers’ to the financial system, such as banks.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments