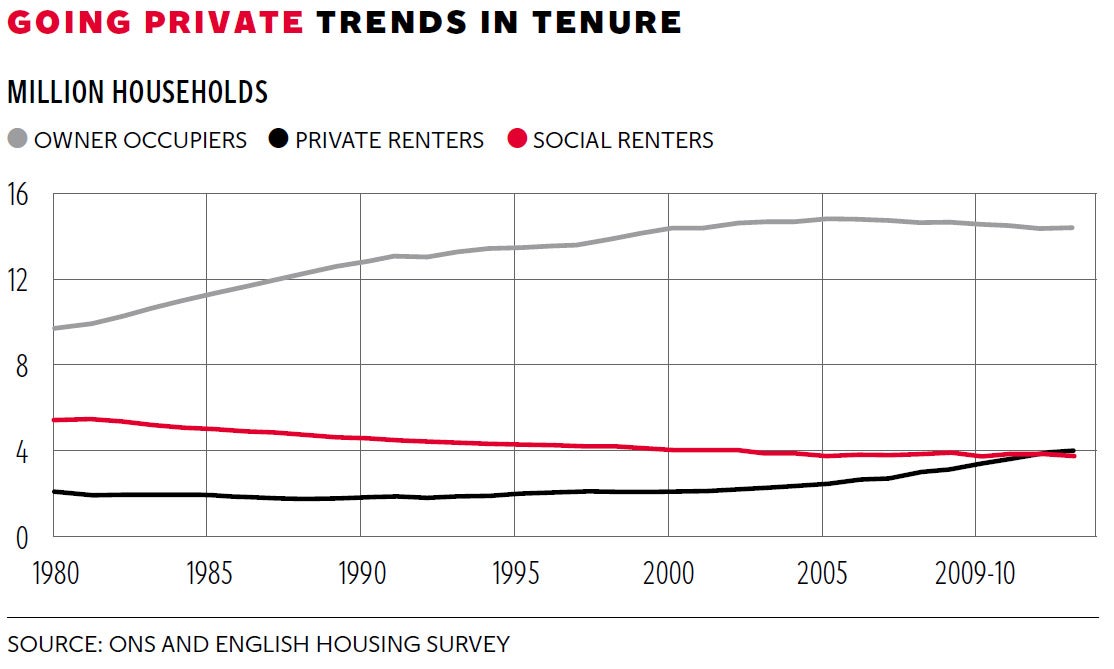

More people now rent privately than from councils or housing associations

Trend driven by soaring house prices, councils selling off properties and a failure to build enough new homes, say campaigners

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.For the first time in a generation, more people are renting from private landlords than local councils or housing associations, according to new government figures.

The historic switch from subsidised social housing to the more expensive alternative has taken little more than 30 years to achieve.

Soaring house prices making buying impossible for first time buyers, councils selling off properties and a failure to build enough new homes, have all driven the trend, say campaigners. With home ownership now at its lowest level since the 1980s and more people renting than paying a mortgage, housing experts are calling on the Government to mount a major house building programme.

“This is a watershed moment for housing in England,” said Rachel Fisher of the National Housing Federation. “With rents soaring and more people priced out of buying a home, renting is no longer an option that everyone can afford. That’s why affordable and social housing is crucial – so that everyone, rich and poor, can have a place to call home.”

The proportion of people in social housing has dropped from almost a third (31.4 per cent) in 1980 to one in seven today (16.8 per cent). By contrast, the percentage renting from private landlords has risen from 11.9 per cent in 1980 to 18 per cent today – the highest in more than 30 years, according to the English Housing Survey for 2012-13.

A growing number of working people also need help to pay their rent. One in three working households (32 per cent) in social housing are on housing benefit, up from one in five in 2010. And 12 per cent of workers renting privately are also on housing benefit, up from 9 per cent in 2010.

The proportion of people who own their own home or have a mortgage has been falling year-on-year since 2005 and is now 65 per cent, the lowest in almost 20 years. There are now four million households renting privately, compared to 3.7m in social housing. Removal of rent controls in the late 1990s and the introduction of buy to let mortgages have driven the change.

Campbell Robb of Shelter said: “These figures confirm the historic shift that people across the country are already feeling: as house prices rise, the dream of a stable home is drifting further out of reach. That leaves families faced with the unsettling reality of bringing up children in a cycle of short-term private lets.”

People renting from private landlords not only pay almost double the rent of those in social housing on average, but are twice as likely to live in what the Government classes as a “non decent” home – one in disrepair and not meeting health and safety standards.

The growth in private renting is not confined to England. In Wales, the private rental sector represents around 14 per cent of the housing stock, with social housing accounting for 16 per cent. In Northern Ireland, private landlords now own more housing than councils and housing associations. And in Scotland, the private rented sector has doubled over the last decade to more than 300,000 households.

Housing Minister Kris Hopkins said the figures were “around a year old”, adding: “Since then we’ve launched the Help to Buy scheme... while thousands of council tenants are taking up the Right to Buy their home.” The Government is boosting the private sector with the £1bn Build to Rent scheme, and “all this is on top of the 420,000 new homes we’ve delivered since 2010”, he added

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments