Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Keir Starmer is facing criticism from Labour's left wing for supporting the government's planned income tax hike for lower-paid workers – fresh from taking a stand opposing rises on corporate profits.

Chancellor Rishi Sunak announced on Wednesday that he would freeze the tax-free personal allowance at £12,570 from next year until 2026, along with the threshold for the higher rate.

The move, described by the Institute for Fiscal Studies as "the least progressive way of raising income tax", amounts to a tax rise on lower-paid workers because the allowance would normally be uprated by inflation.

Labour's front bench on Wednesday night indicated it supported the measure "in principle" – but the stance drew criticism from some in the party who said the leadership was giving the impression it had the wrong priorities.

A spokesperson for left-wing campaign group Momentum said Labour should be fighting "for a redistribution of wealth and power away from the elite and towards ordinary people".

They added: "That means borrowing to invest and supporting increases in the rates of tax paid by both profitable corporations and the mega-rich. Our party has to be crystal clear about who's side we're on - and equally, who's side we're not on. Key workers need a pay rise, not a tax rise.

"Any changes to the tax system must shift the burden upwards, onto those who can afford to pay, and leave working people better off overall."

The party's front bench spent the last week insisting that corporation tax should not go up immediately, and that to raise it would be a form of austerity – though it ultimately backed the government's decision to bring in a rise later by 2023.

Commenting on the approach, Matt Zarb-Cousin, a former spokesperson for Jeremy Corbyn, said: "So now we support taxing nurses and other key workers more following a pandemic, having just resisted increasing tax for the corporations who have done well out of the pandemic. The optics are s***, the politics is s***, the values are s***. A hat-trick of utter s***."

In 2017 and 2019 Labour pledged headline corporation tax rises roughly of the magnitude introduced by Mr Sunak. But the party explicitly opposed tax rises on the bottom 95 per cent of workers, saying only that it would increase income tax for those earning more than £80,000 – the top 5 per cent of salaries.

The opposition's response to Wednesday's budget criticised the government for some of the tax rises confirmed by Mr Sunak, notably his ending of the freeze on council tax, which the opposition says will hit families hard.

But shadow chancellor Anneliese Dodds indicated that the party would support the four-year freeze on income tax thresholds, stating: “In principle we are not against the freeze.”

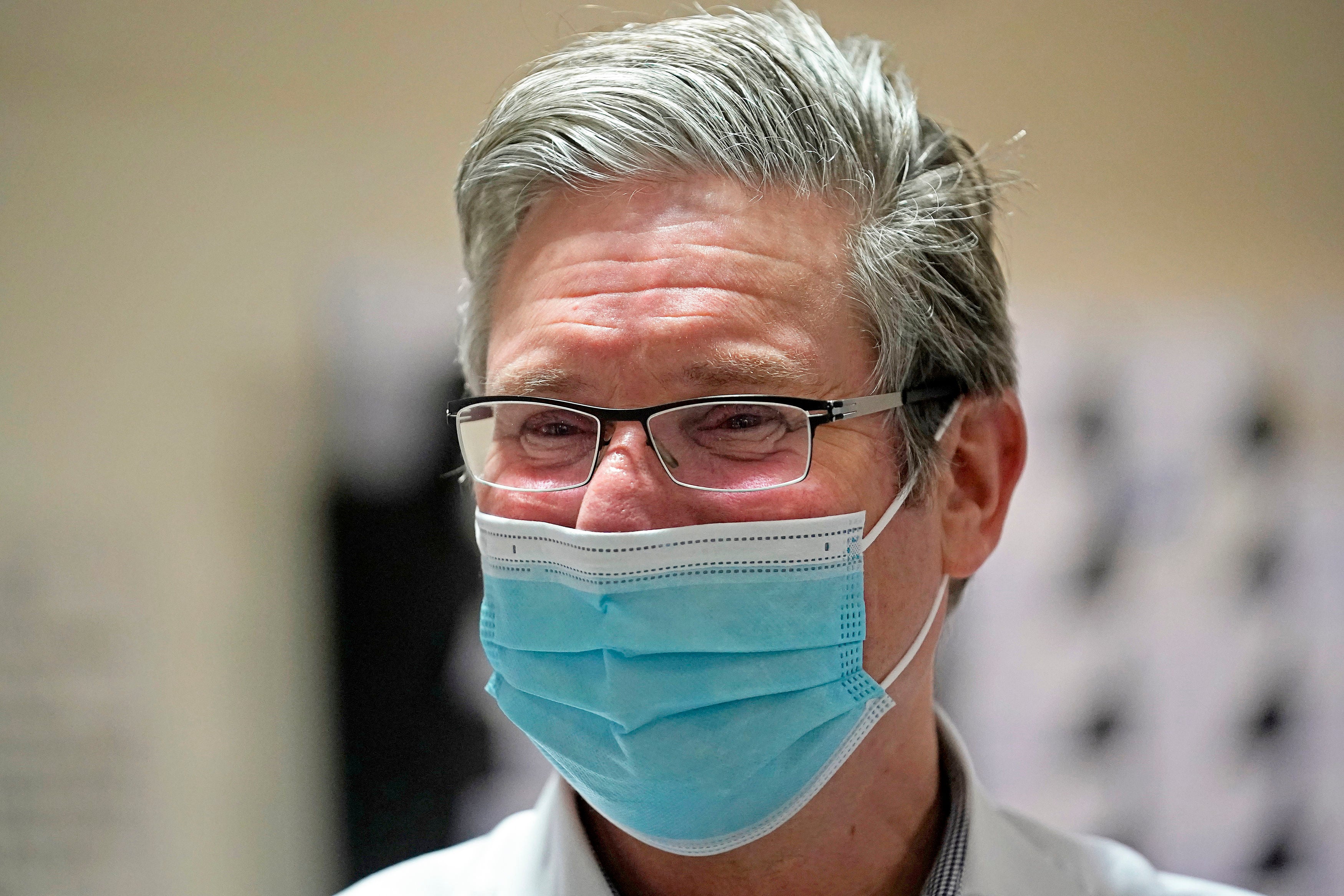

Asked on Thursday about Labour backing parts of the budget that would hit lower earners with tax changes, Keir Starmer told reporters:

"We've been critical of the government's budget, and the impact on those on lower incomes and you could see it in a number of different areas.

"There's the council tax hike that's coming, that'll hit families across the country. Universal Credit coming to an end in six months, six million families will lose £1,000 a year as a result of that.

"So we're very concerned; and of course a pay freeze for key workers, including all the staff in this hospital that I've just been talking to, so this budget is hitting those lower incomes, very very hard."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments