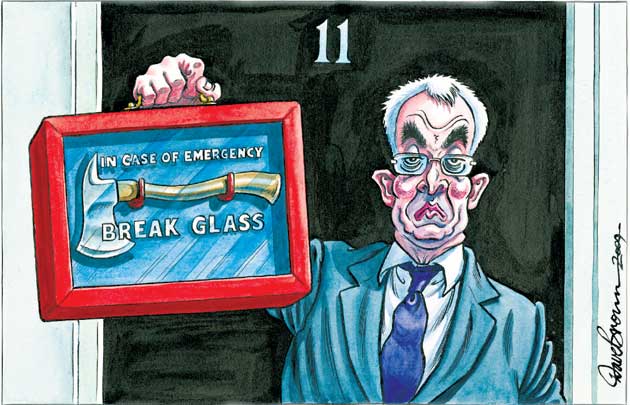

It's worse than we thought, admits Darling

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Chancellor admitted today the recession was far deeper than he had predicted as he announced a public sector pay squeeze to help curb soaring national debt.

Alistair Darling laid out plans to slash public spending in real terms from 2011 - after the General Election - as he revealed the economy would shrink by 4.75 per cent in 2009 compared to his April Budget estimate of 3.5 per cent.

He also said the public finances were deeper in the red with a deficit of £178 billion this year compared to the £175 billion he had predicted.

And he announced a tax rise in the pipeline for anyone in work with a further 0.5 per cent increase national insurance rates from April 2011 for all employers, employees and the self-employed.

But Mr Darling insisted in his Pre-Budget Report that the economy would start growing by the end of the year and next year would grow by between 1 per cent and 1.5 per cent.

Shadow chancellor George Osborne immediately accused Mr Darling of having "ducked" crucial decisions to get public finances back on track.

He said Labour had put electioneering ahead of fixing the economy, putting off tough spending decisions until after Britain goes to the polls.

And he described the decision to increase National Insurance rates as a "tax on jobs".

Mr Osborne told MPs: "They have lost all moral authority to govern today."

"Every family in the country is going to be forced to pay for years for this Prime Minister's mistakes.

He added: "No one will ever believe a word they say on the economy again."

The Chancellor predicted that British business would benefit as global demand picked up.

He declared: "So I am confident that the UK economy will start growing by the turn of the year."

But, justifying his decision to postpone some major cutbacks, he went on: "Recent market reaction to financial problems in Dubai highlights just how fragile world confidence remains.

"So while I am confident that the UK economy is on the road to recovery, we can't be complacent.

"And we must continue to support the economy until recovery is established.

"To cut support now could wreck the recovery - that's a risk I am not prepared to take."

He announced that overall public spending would be held to an average increase of just 0.8 per cent a year - but only from 2011.

He said: "That will mean cuts to some budgets, as programmes come to an end or resources are switched to new priorities. And some programmes will need to be stopped altogether."

Despite increasing his deficit estimate he pledged to reduce it as the economy recovers, predicting it would fall to £96 billion in 2013-14, slightly lower than forecast in April, and £82 billion in 2014-15.

But there were widespread jeers from Opposition MPs when the Chancellor said his announcements were being made "from a position of strength".

The Chancellor angered unions by announcing plans to cap public sector pay rises to 1 per cent for two years from 2011.

He said that contributions from the state to the pensions of teachers, local government and health workers and civil servants would be also capped, saving £1 billion a year.

The Government said the senior civil service pay bill would be cut by up to £100 million over three years and any new government appointment over £150,000 and all bonuses over £50,000 would require Treasury approval.

Mr Darling gave a boost to pensioners announcing a 2.5 per cent increase in the state pension next year.

And there was laughter from MPs when he announced a cut in bingo duty.

He confirmed that VAT will return to 17.5 per cent on January 1 but added: "I have no other changes in VAT to announce."

As expected Mr Darling announced a levy on big bank bonuses.

Banks face a special one-off levy of 50 per cent on any individual discretionary bonus above £25,000.

He said: "This will be paid by the bank not the bank employee.

"Anti-avoidance measures will be introduced with immediate effect.

"High-paid bank staff will of course also have to pay, as usual, income tax at their top rate on any bonus they receive.

"On a cautious assumption, which includes our expectation that some banks will rein back bonuses, this one-off levy is expected to yield £550 million.

"This additional money will be used to pay for the extra measures, already announced, like help for the young and older unemployed to get back into work."

He also announced a freeze in the £325,000 inheritance tax allowance.

Mr Darling also confirmed a raft of heavily trailed green measures including a scrappage scheme for inefficient boilers.

From April, people with a home wind turbine or solar panels who plug their excess power into the national grid, will receive on average £900 a year, tax free, he said.

And electric company cars will be exempt from company car tax for five years, the Chancellor announced.

CBI director general Richard Lambert said: "The Chancellor has made a serious mistake imposing an extra jobs tax at a time when the economic recovery will still be fragile. Increasing the national insurance contribution will hold back job creation and growth.

"He has also missed the opportunity to increase the UK's credibility by reducing the public deficit earlier. We are no clearer today as to how the Government plans to reduce public expenditure.

"We applaud the Government's courage in beginning to tackle the thorny issues of public sector pay and pensions. There is also an encouraging package to support companies as they seek to exploit new low-carbon opportunities.

"A headline-grabbing tax on bankers' bonuses may have populist appeal, but the Government needs to take care not to put the UK's financial services sector at a comparative disadvantage internationally. The threat of an exodus of talent is real."

TUC general secretary Brendan Barber said: "The Chancellor had to maximise the chances of recovery, help the unemployed and make sure that when the time is right to close the deficit, those who did most to cause the crash and did best from the boom make their proper contribution through a fair tax system.

"On the biggest decision he is right. The Chancellor has ruled out big cuts in the near future. To have cut spending so soon after a serious recession would be gross economic irresponsibility. Instead he has concentrated on helping the unemployed and given a welcome boost to investment in the green technologies of the future. This is not just good for jobs, but helps rebalance the economy away from our over-reliance on finance.

David Frost, director general of the British Chambers of Commerce, said: "The Chancellor's Pre-Budget Report sets out some good schemes to support businesses - like the extension to the Enterprise Finance Guarantee - but these have been undermined by the announcement of an additional hike to National Insurance Contributions in 2011.

"It's clear that NIC rises mean a brake on employment growth. While everyone understands the importance of restoring the public finances to a sustainable path, a tax on jobs is not the way to do it."

"The Chancellor's medium-term growth predictions are optimistic, and we would still like to know where this growth is going to come from if taxes, like National Insurance, go up and directly impact on business."

"Businesses across the country still want to see the detail of how the Chancellor intends to cut the public sector deficit, and ensure more sustainable levels of public spending. Investor confidence depends on it."

Colin Stanbridge, chief executive of the London Chamber of Commerce said: "The super tax on bankers' bonuses, coupled with the Chancellor's refusal to scrap the 50p tax on high income earners will undoubtedly damage London's standing as a financial centre.

"These tax rises were made for political, rather than economic reasons, and will raise little money for the Government while sending the wrong signals to the rest of the world about the competitiveness of our capital."

Steve Radley, director of policy at the Engineering Employers Federation said: "The job of today's statement was to outline how the structural shortfall in the public finances was going to be tackled. Instead it went for the easy targets and fudged the tough decisions necessary to achieve this.

"We also needed to see tangible action to begin re-balancing our economy. However there were only limited measures which are unlikely to drive broad-based growth.

"Whilst there are some helpful measures such as deferring the increase in corporation tax for small firms, the failure to extend capital allowances for investment removes support at just the time in the cycle when firms could most benefit.

"Business will now be faced with a further six months of uncertainty as to how the Chancellor plans to tackle the deficit."

David Coats, associate director at the Work Foundation said: "This was a statement focused on growth and jobs. I particularly welcome the Chancellor's commitment to maintaining public spending until the recovery has been secured. Alistair Darling is moving in step with the other G20 economies by putting the highest priority on the reduction of unemployment, with help for both younger and older workers.

"Of course the Chancellor had a difficult balancing act to perform - continuing to support economic recovery while making credible commitments to reduce the deficit. This is a good, measured package that offers hope to both business and the unemployed. If the world economy stays on course then the UK can look forward to a slow but steady recovery in 2010."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments