Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

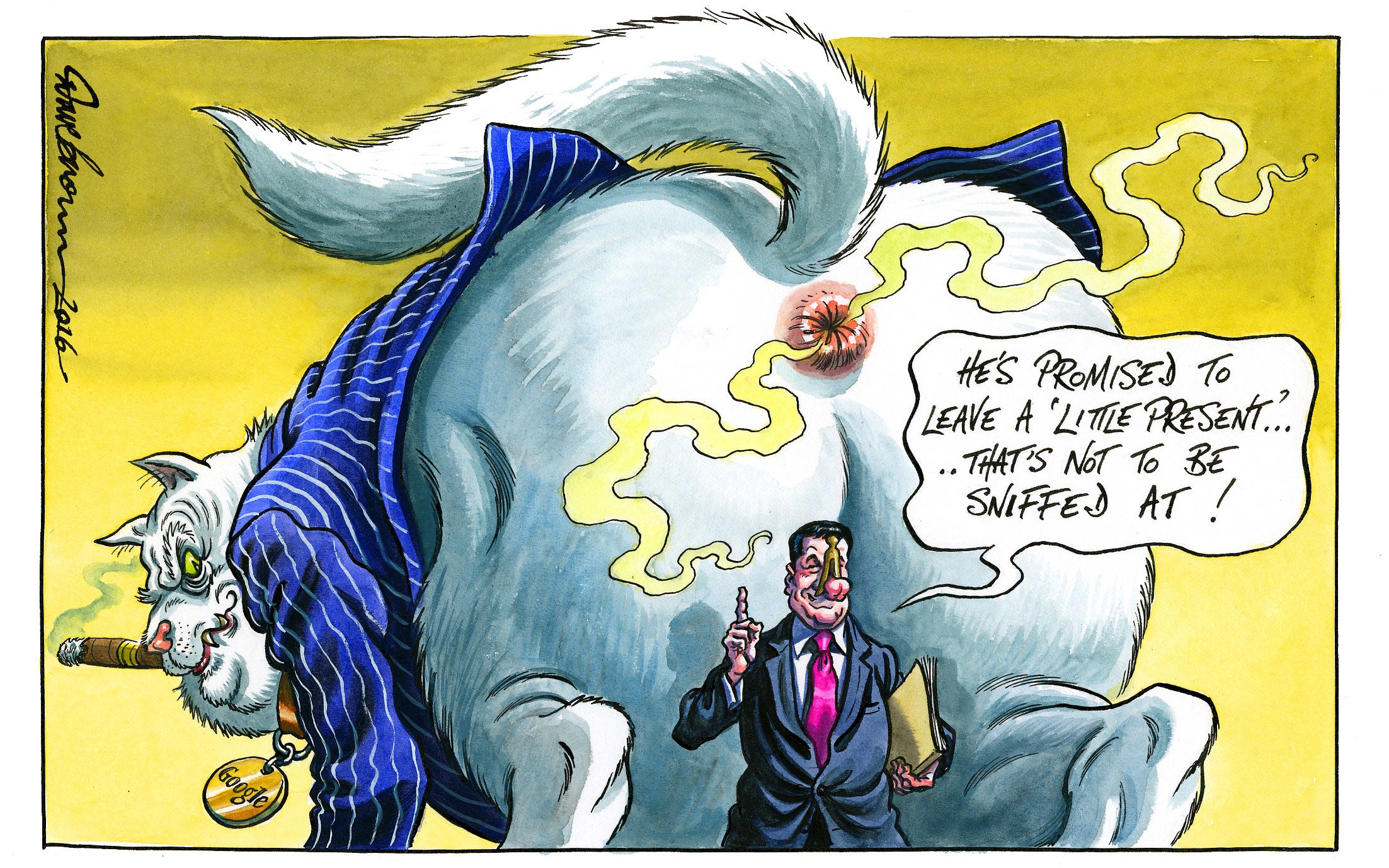

Your support makes all the difference.It is “absurd” to blame Google and other multinational corporations for “not paying their taxes”, Boris Johnson has said.

The search giant reached a settlement with the tax authority to pay £130m in so-called “back taxes” after an open audit of its accounts.

The deal was criticised as “derisory” by Labour, whose shadow chancellor John McDonnell said the deal should be investigated by the Government’s public spending watchdog.

Mr Johnson however defended the actions of Google and other multinationals, who have been accused of seeking to minimise the amount of tax they pay.

He claimed that it was company directors’ jobs to pay as little tax as possible within the law and that they should not be expected to do otherwise.

“Everyone is complaining that it isn’t enough, that it still amounts to a tax rate of only about 2 per cent on earnings,” he wrote in his column for the Daily Telegraph newspaper.

“It is absurd to blame the company for ‘not paying their taxes’. You might as well blame a shark for eating seals. It is the nature of the beast; and not only is it the nature of the beast – it is the law it is the fiduciary duty of their finance directors to minimise tax exposure.”

He also argued that EU member states should be in “competition “with each other to offer firms the lowest corporate tax rates.

Mr Johnson said it would be a “good thing” if companies paid more tax but blamed the Government for structuring the tax system as it had done.

He said he did not want tax rates to go up or for European Union countries to do this in concert, however.

Last last year it was reported that George Osborne's tax avoidance crackdown had missed its targets by hundreds of millions of pounds, according to data released by the Office for Budget Responsibility.

One of the possible successors to David Cameron as Prime Minister, Mr Johnson’s views on corporation tax could be of significant consequence were he to come to lead his party.

Google’s tax deal, agreed on Friday night, covers money owed by the company since 2005 and was the result of a six-year inquiry by HMRC.

Meg Hillier, chair of the Commons Public Accounts Committee, said at the weekend that the amount of money raised was “a small amount” for the corporation.

Matt Brittin, head of Google Europe, told BBC News: “Today we announced that we are going to be paying more tax in the UK.

“The rules are changing internationally and the UK government is taking the lead in applying those rules so we'll be changing what we are doing here. We want to ensure that we pay the right amount of tax.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments