Environment secretary insists ‘tractor tax’ will only impact minority as farmers say they’ve been lied to

It comes after the PM was accused of lying to farmers after the government extended inheritance tax to family farms for the first time in history

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

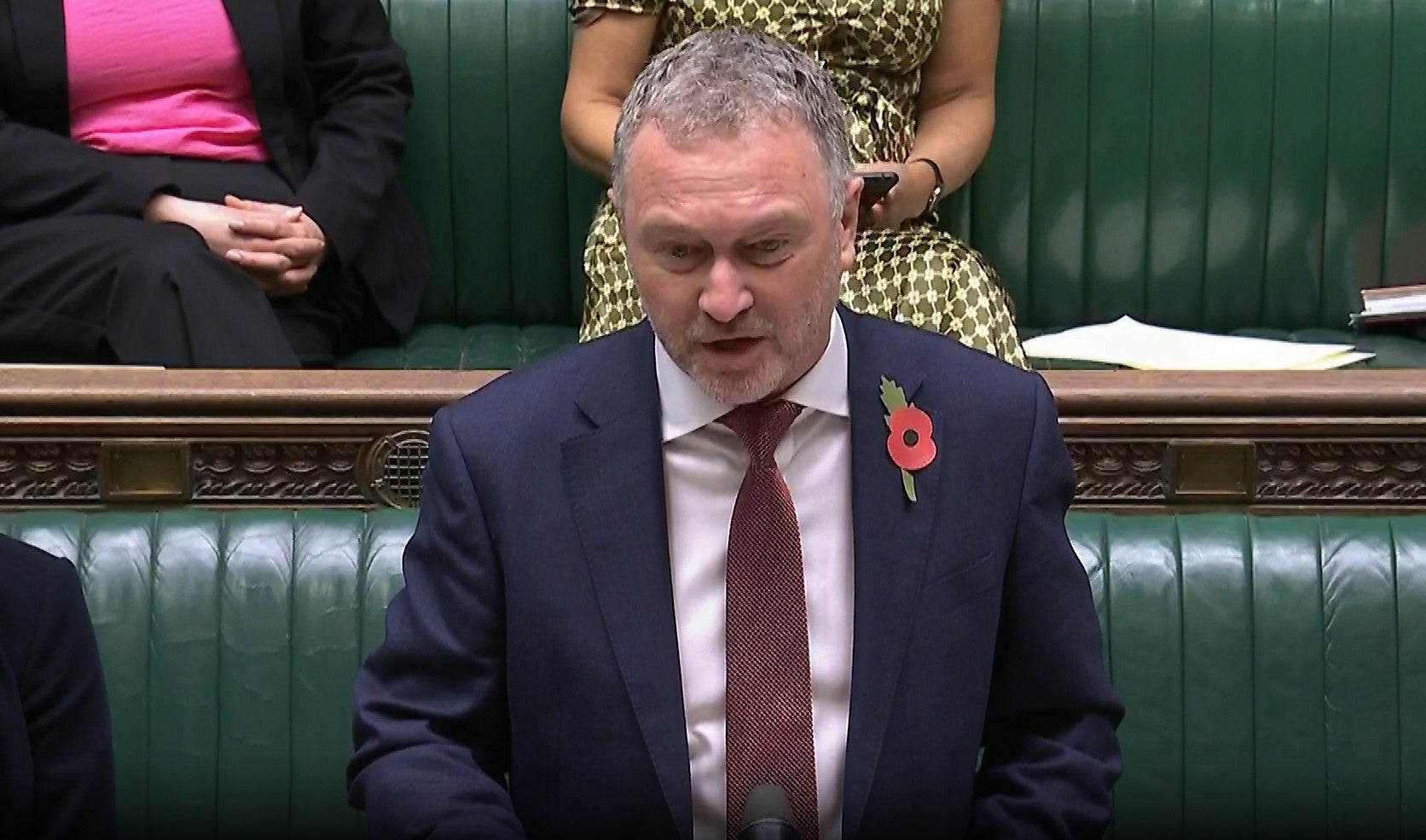

Your support makes all the difference.Environment secretary Steve Reed has hit back following a storm of criticism over the government’s plans to extend inheritance tax to family farms, claiming the “vast majority of farmers will not be affected at all”.

He blamed “misleading headlines” for the backlash to the tax, saying “only the richest estates” will be affected.

It comes just days after Sir Keir Starmer was accused of lying to farmers about wanting “a new relationship” with them after the Budget extended the tax to family farms for the first time in history.

The move, which has already been dubbed the “tractor tax”, means farms worth more than £1m are now subject to 20 per cent inheritance tax.

Writing in The Daily Telegraph, Mr Reed said the government has taken a “fair and balanced approach that protects family farms while also fixing the public services those same families rely on”.

“I completely understand farmers’ anxiety at any changes. But rural communities need a better NHS, affordable housing and public transport that we can provide if we make the system fairer,” he said.

Mr Reed continued: “Only the richest estates will be asked to pay – not small, family farms as some misleading headlines have claimed.

“Look at the detail and you’ll see that the vast majority of farmers will not be affected at all. They will be able to pass the family farm down to their children just as previous generations have always done.

“That is how we boost our food security and speed up nature’s recovery.”

Farmers from across the UK are set to descend on London next week for a rally against the government’s agricultural policies, which they argue put the future of family farms at risk.

The rally, organised by the National Farmers Union (NFU), will take place on Tuesday in Westminster.

The row over the tax has been fuelled by memories of Sir Keir’s 2023 speech to the NFU when he pledged to have “a new relationship with the countryside and farmers”.

The prime minister claimed to be concerned that “each day brings a new existential risk” to British farming. He added: “Losing a farm is not like losing any other business, it can’t come back.”

Baroness Batters, the former president of the NFU who introduced Sir Keir at the conference last year, said the £1m threshold will easily be reached when land value is added to the value of machinery and buildings on farms, meaning most family farms will be subject to the new tax.

She said: “There was already a challenge in farming because of the move away from CAP [common agricultural policy] and the new subsidy system not really working.

“The problem is that farmers are asset rich but cash poor. So this will have an impact.”

Her successor, Tom Bradshaw, described the new tax as “disastrous”.

“This Budget not only threatens family farms but will also make producing food more expensive. This means more cost for farmers who simply cannot absorb it, and it will have to be borne by someone. Farmers are down to the bone and gristle,” he said. “Who is going to carry these costs?”

Meanwhile, Gareth Wyn Jones, a farmer in north Wales, told The Independent: “We were lied to by Keir Starmer. There is no doubt.

“The vast majority of farms in this country are family farms and now they are going to be broken up or people will not be able to afford to stay in farming.”

Speaking on Thursday, Sir Ed Davey, leader of the Liberal Democrats, said his party would “absolutely” reverse the policy if they were in power.

Speaking to journalists at the press gallery lunch in parliament, Sir Ed said the policy “shows a huge lack of understanding of rural communities and farmers”.

He warned that “farmers are struggling” in the wake of Brexit and years of volatile weather conditions, describing the past few years as having already been a “rough run” for British farms.

“Farms tend to go down generation to generation. It’s how they work and it’s really important.

“Fifty per cent of farms are worth at least £1.5m, so it’s more than one or two farms. Just think of the impact that’s going to have on communities”, he added.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments