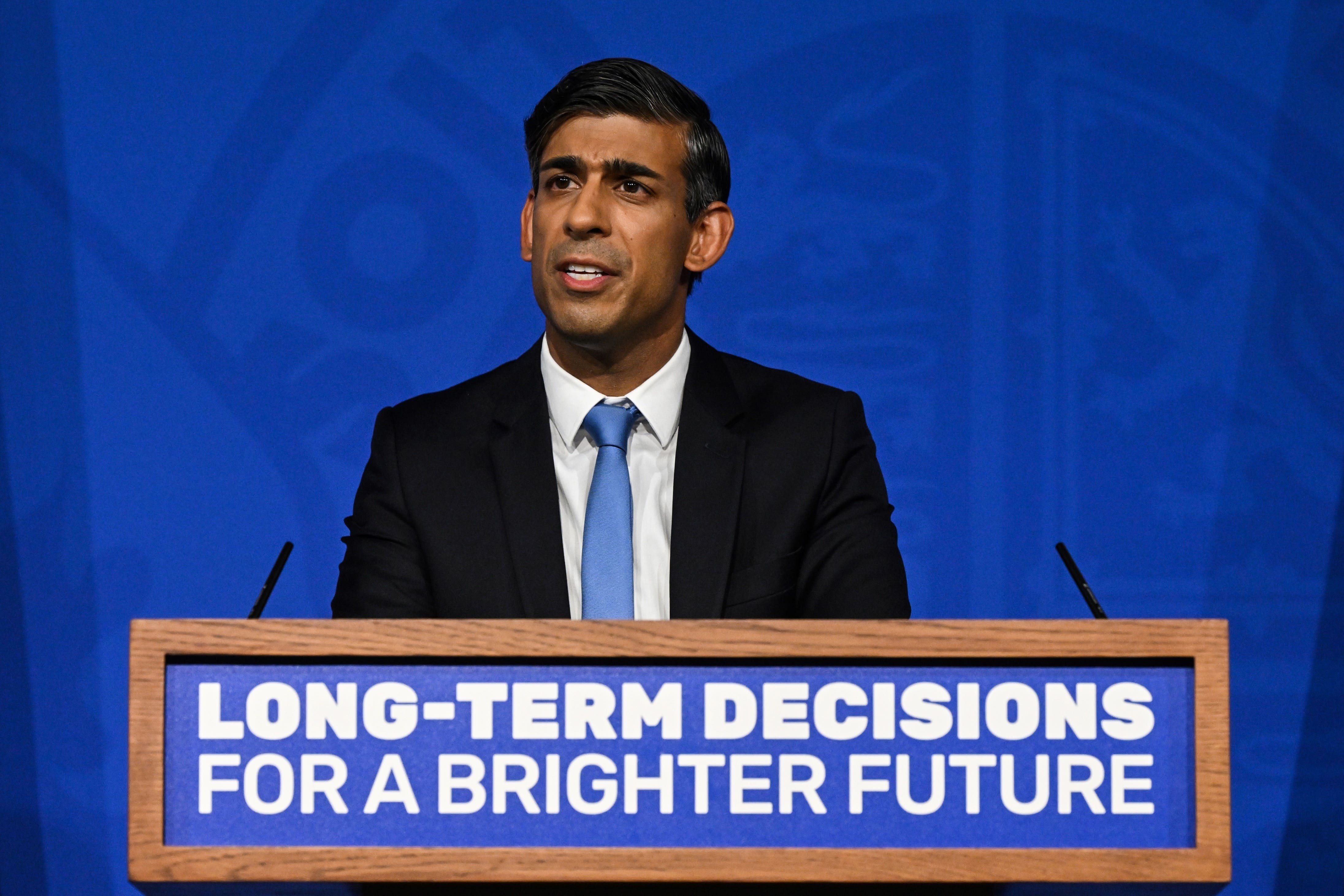

Sunak ‘to cut inheritance tax’ in boon for Britain’s wealthiest – and wants to abolish it altogether

The state of the nation’s finances mean there is little prospect of a change in the near future.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Rishi Sunak is understood to be considering a cut to inheritance tax as he seeks to woo voters ahead of the general election.

Downing Street sought to play down speculation in the Sunday Times that the prime minister was drawing up plans to slash the tax.

But the newspaper reported there were live discussions at the highest level of government about reforming the tax.

One proposal being considered is for Mr Sunak to announce his intention to phase out the levy by reducing the 40 per cent inheritance tax rate in the budget in March, while setting out a pathway to abolish it completely in future years, the newspaper said.

Downing Street sources insisted that formal plans were not being drawn up and pointed to chancellor Jeremy Hunt’s insistence that tax cuts are “virtually impossible” given the state of the public finances.

But a senior government source told the Sunday Times: “No 10 political advisers have been looking at abolishing inheritance tax as something that might go in the manifesto.

“It’s not something we can afford to do yet.”

Inheritance tax is levied at 40 per cent, but the vast majority of estates fall below the threshold – which can be up to £1 million for a couple – to incur the charge.

The latest figures, for the tax year 2020 to 2021, showed just 3.73 per cent of UK deaths resulted in an inheritance tax (IHT) charge.

There has been pressure within the Tory party to change or scrap IHT, with former prime minister Liz Truss among those calling for it to be axed.

Labour’s shadow Treasury chief secretary Darren Jones said: “A year ago Liz Truss trashed the economy with unfunded tax cuts.

“Now Rishi Sunak is doing what Liz Truss wants.

“Abolishing inheritance tax – which 96 per cent of people never pay – is an unfunded tax cut of £7.2 billion per year.

“The biggest threat to the economy is the Conservative Party.”

He wrote to the chancellor demanding answers on how any change might be paid for.

Meanwhile the Mail on Sunday reported that Mr Sunak will fight the election on a promise to keep the triple lock – which guarantees the state pension will increase by the highest of inflation, average earnings or 2.5 per cent – despite concerns about its cost.

Ministers have previously refused to guarantee its continuation beyond the election as inflation and earnings have spiralled, with work and pensions secretary Mel Stride warning it was “not sustainable” in the long term.

Speculation about tax and pension changes comes as Westminster gears up for the general election expected next year.

The Sun on Sunday reported that councils have been told to be prepared for an election in May while Tory campaign chiefs have been preparing local strategies for key seats.

The hope is to replicate the success of the Uxbridge and South Ruislip by-election, where the Tories held the seat vacated by Boris Johnson in a campaign dominated by the row over the ultra low emission zone (Ulez).

But with Labour having a decisive lead in national opinion polls it remains to be seen whether there are enough similarly divisive local issues across the country.